- Tether forecasts $10 billion profit due to USDT and investments.

- Tether’s significant US Treasury holdings strengthen market position.

- Stablecoin issuer reinforces dominance with gold and Bitcoin reserves.

Tether announced a projected net profit exceeding $10 billion for 2025, driven by USDT growth and increased investments in U.S. Treasury bonds and gold.

The forecast highlights Tether’s robust financial position and investment strategy, reinforcing its status as a major global holder of Treasury bonds amidst growing USDT supply.

Tether’s $10 Billion Profit Projection for 2025

Tether has projected a net profit exceeding $10 billion for 2025, leveraging growth of its flagship USDT token and strategic investments. The company’s fourth-quarter report, audited by BDO, revealed a robust financial state with $6.3 billion in excess reserves to offset $186.5 billion in liabilities connected to issued tokens.

The circulating supply of USDT has increased by $50 billion over the past year, surpassing $186 billion, reflecting heightened market demand. Tether’s control over U.S. Treasury bonds has expanded, totaling $141 billion in holdings, including overnight reverse repurchase agreements, making it one of the largest holders globally.

BingX offers exclusive rewards and top-tier security for new and high-volume crypto traders.

Market observers note Tether’s strategy of diversifying assets into gold and Bitcoin with $17.4 billion and $8.4 billion holdings, respectively, as part of its financial resilience plan. However, there has been no significant public commentary from key executives or notable cryptocurrency influencers regarding these developments.

Paolo Ardoino, CEO, Tether, – no direct quotes or statements available from primary sources.

Tether’s Strategic Investments and Market Dominance

Did you know? Tether’s substantial U.S. Treasury holdings make it one of the largest non-government bondholders, illustrating its strategic financial position and influence within global markets.

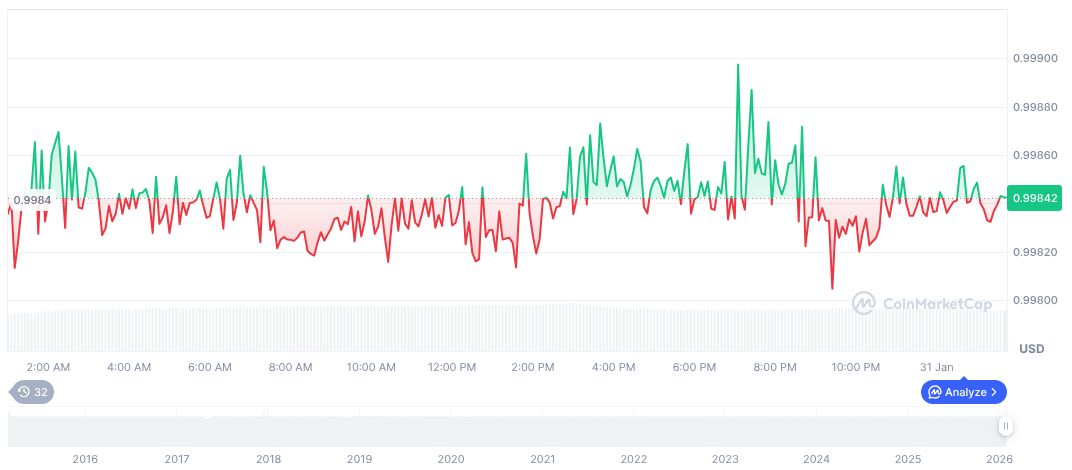

Tether USDt (USDT) maintains a stable price of $0.99 with a reported 24-hour trading volume of $137.77 billion, reflecting an 8.57% change according to CoinMarketCap. The market cap stands at $185.55 billion, holding a 6.54% market dominance, emphasizing its role in the cryptocurrency landscape.

According to the Coincu research team, Tether’s shift towards stable financial instruments like U.S. Treasuries and assets such as gold may mitigate volatility in its reserves. However, regulatory scrutiny could potentially impact its operational landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |