- Su Jingliang sentenced for laundering $36.9 million in a fraud scheme.

- Illegal activities uncovered involved USDT conversion in Southeast Asia.

- Regulatory scrutiny on crypto’s role in international fraud intensifies.

Chinese national Su Jingliang was sentenced to 46 months in prison for his role in a “pig butchering” scam laundering over $36.9 million through U.S. shell companies.

The scam’s unraveling highlights the vulnerabilities of crypto platforms to fraudulent activities, emphasizing the need for stronger regulatory oversight and international cooperation in combating financial cybercrime.

Su Jingliang’s Role in $36.9 Million Fraud Scheme

The U.S. Department of Justice charged Su Jingliang for his role in laundering $36.9 million. He managed the scam’s financial operations by converting funds from U.S. shell companies into USDT and transferring them to Southeast Asian accounts. By using encrypted messaging on Telegram, Su coordinated financial transactions pivotal to the fraud scheme. The fraudulent activities led to severe financial repercussions for 174 American victims and a significant reputational blow to cryptocurrency security.

Market reactions have been muted due to the lack of direct impact on USDT’s valuation. Regulatory bodies, however, remain vigilant. The scheme’s exposure highlights the need for enhanced anti-money laundering measures within the crypto industry. Authorities stress the importance of tracking illicit financial flows to prevent similar future incidents.

BingX offers exclusive rewards and top-tier security for new and high-volume crypto traders.

“The scheme demonstrates the lengths to which individuals will go to exploit vulnerabilities in financial systems.” — Jingliang Su, Accountant, Axis Digital

USDT’s Involvement and Regulatory Concerns

Did you know? The use of USDT in the “pig butchering” scam underscores the rise in such tactics, contributing to over $17 billion in crypto scams globally in 2025.

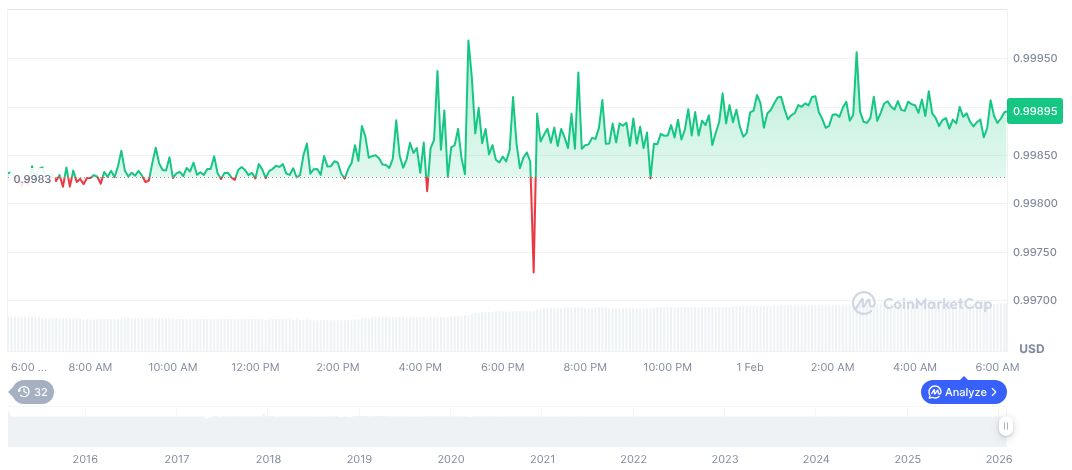

As of February 1, 2026, USDT holds a market cap of $185.17 billion with steady trading activity. The stablecoin maintains a market dominance of 6.97%, with its circulating supply reaching 185.37 billion. Despite minor fluctuations, USDT has sustained a price of $1.00, reflecting its ongoing demand in stablecoin markets, as reported by CoinMarketCap.

Coincu’s research team highlights the essential function that regulatory compliance will play in curbing money laundering through crypto. With past scams influencing stricter measures, the financial landscape continues to adapt, and surveillance technology evolves to counter these challenges effectively.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |