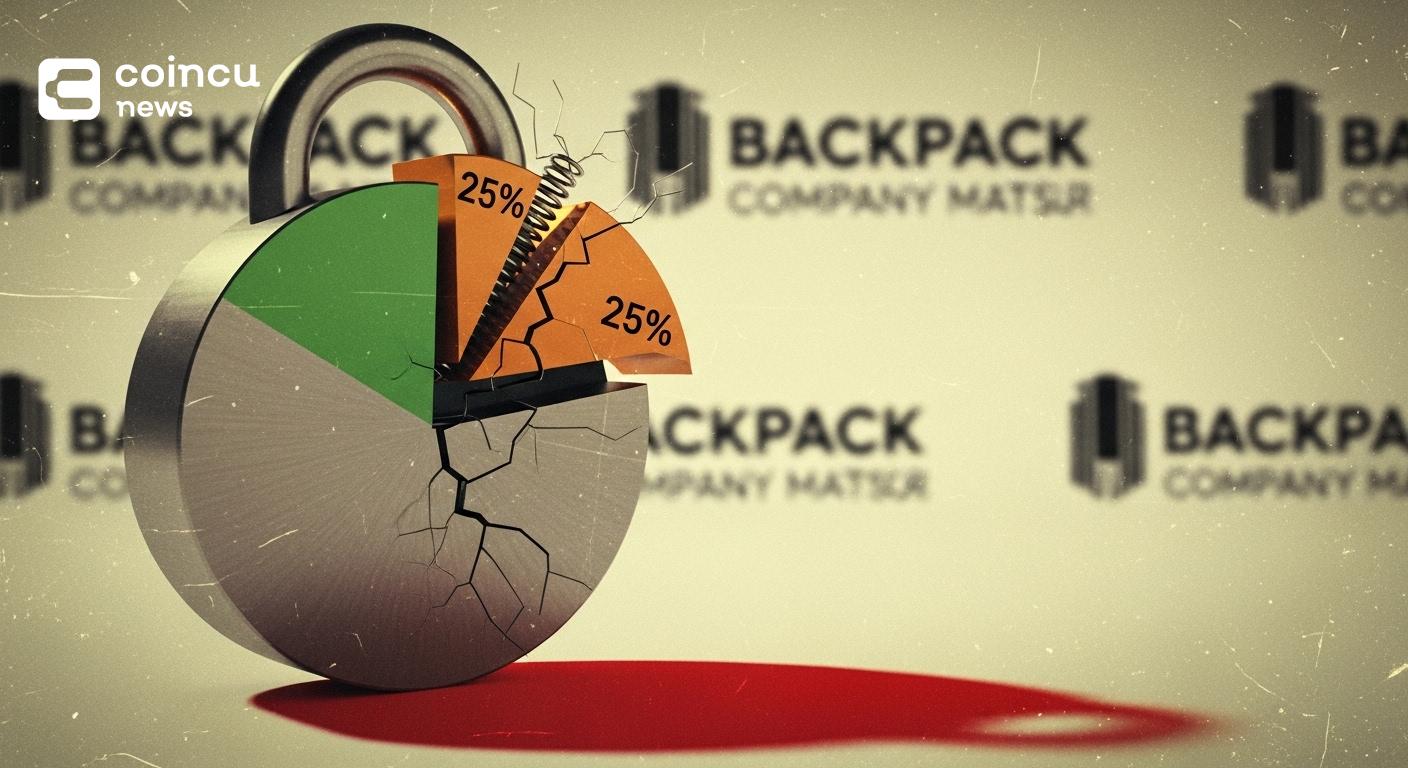

Backpack tokenomics at TGE: 25% unlocked; 24% points, 1% Mad Lads

Backpack will unlock 25% of its token supply at TGE, allocating 24% to points holders and 1% to Mad Lads NFT owners, as reported by CryptoNews.net. This split foregrounds a community-first distribution over immediate institutional allocations.

Backpack tokenomics beyond the day-one float remain limited in public materials. Disclosures reviewed so far do not detail the vesting cadence for the remaining 75%.

Why this high TGE unlock and community-first allocation matters

A 25% TGE unlock can materially increase day-one liquidity and widen initial distribution. By directing most of the unlocked tranche to points holders, the model prioritizes participants who interacted with the ecosystem pre-launch.

Editorially, the approach signals an emphasis on engagement-led distribution and near-term price discovery through a larger circulating float. “Tokenomics details will be disclosed gradually as TGE approaches, emphasizing long-term alignment versus short-term speculation,” said Armani Ferrante, CEO at Backpack.

Immediate impact: liquidity, distribution dynamics, and market-structure considerations

A larger initial float can reduce early slippage and improve order book depth. It may also elevate short-term sell pressure if recipients monetize, so realized liquidity will depend on recipient behavior and any lockups tied to the conversion process.

Concentrating the day-one allocation in points holders and a 1% allocation to Mad Lads can broaden holder dispersion. Actual dispersion will hinge on points-to-token mechanics, which remain undisclosed, and on how actively recipients trade post-listing.

At the time of this writing, broader crypto conditions were mixed; Bitcoin fell below $70,000 with a 3.39% intraday drop, based on data from Yahoo Finance UK. Such conditions could influence initial liquidity, though token-specific flows often dominate at launch.

Key unknowns and risk factors to watch

Points-to-token conversion mechanics remain undisclosed

Without confirmed mechanics, it is unclear whether conversion will be proportional, time-weighted, or tiered. Each path carries different Sybil, concentration, and gaming risks that could affect early trading dynamics.

Vesting and unlock schedule for remaining 75% not detailed

The absence of a published vesting cadence limits visibility into future supply. Large cliffs or rapid emissions could increase dilution and impact pricing, while smoother unlocks could mitigate shocks.

FAQ about Backpack tokenomics

How will Backpack points convert to tokens (proportional, time-weighted, or via tiers/multipliers)?

Not disclosed. The team has not confirmed proportional, time-weighted, or tiered mechanics.

Is there any VC or private sale allocation in Backpack’s tokenomics?

Not specified in available disclosures. Public materials do not detail any VC or private sale allocation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |