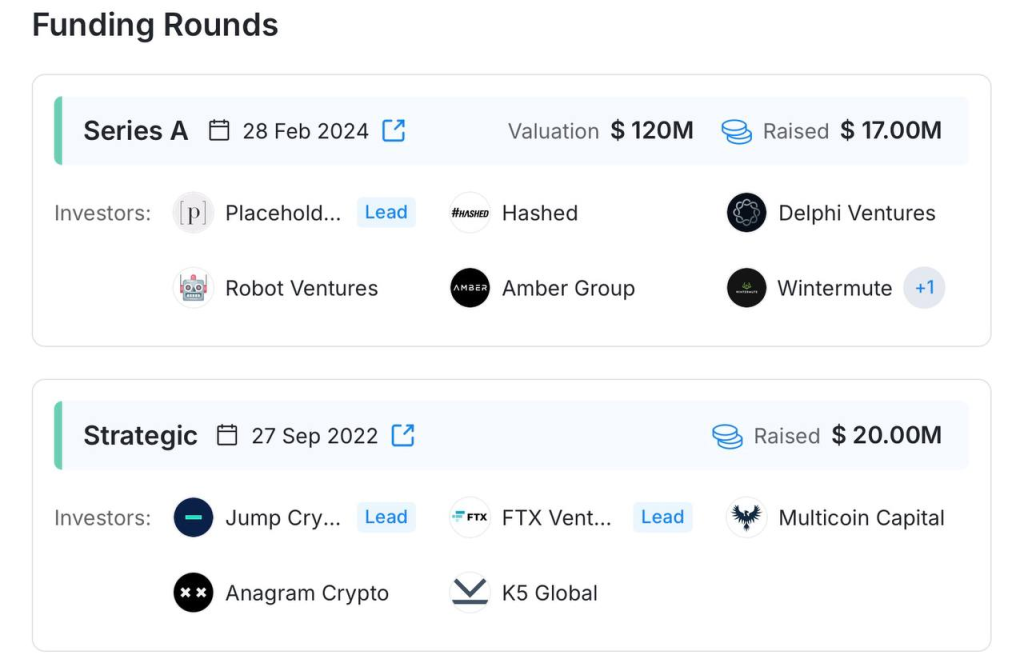

Backpack Exchange is moving to raise $50 million at a $1 billion pre-money valuation, officially entering the crypto unicorn club. Reported on February 9, 2026, the round represents a sharp rise from its $120 million valuation in early 2024.

The valuation is backed by strong revenue and trading momentum. By early 2026, Backpack reportedly generates over $100 million in annual revenue with nearly $400 billion in cumulative volume. The raise supports its tokenomics framework and long-term U.S. IPO plans.

Backpack Exchange’s verified $50M funding and $1B valuation

Backpack Exchange is reportedly raising approximately $50 million at a $1 billion pre-money valuation, officially elevating the platform to crypto “unicorn” status. This valuation matters because it reflects institutional-grade fundamentals, not token speculation:

- Nearly 10× valuation growth from ~$120M in early 2024 to ~$1B in early 2026

- Reported annual revenue exceeding $100M, a key justification for late-stage pricing

- Operational scale: over $60B cumulative trading volume and 500,000+ KYC-verified users by early

For the industry, Backpack’s unicorn status signals that compliance-first exchanges can still scale, even after the collapse of FTX. The funding round also validates the team’s effort to distance the platform from the “ex-FTX” stigma by emphasizing transparency, custody safeguards, and regulated market access.

Use of proceeds: listings, liquidity, market makers, and spot/derivatives products

The expected $50M capital injection is designed to deepen market quality and expand product coverage rather than subsidize short-term growth.

Key capital allocation priorities include:

- Liquidity and market makers: Backpack allocates incentives and equity-linked rewards to professional market makers, improving spreads and reducing slippage across spot and perpetual markets.

- Listings strategy: New assets are added selectively, prioritizing regulatory clarity and sustainable liquidity rather than short-term volume spikes.

- Spot and derivatives integration: The platform already supports regulated spot and perpetual futures, with plans to unify margin and collateral across products.

- Product expansion roadmap: Backpack has publicly stated intentions to expand into prediction markets, lending, and tokenized stocks, positioning itself as a multi-asset trading venue rather than a pure crypto exchange.

This use-of-proceeds strategy reinforces Backpack’s positioning as financial market infrastructure, not a marketing-driven trading app.

Token plans: confirmed vs rumored, eligibility, timelines, and tokenomics

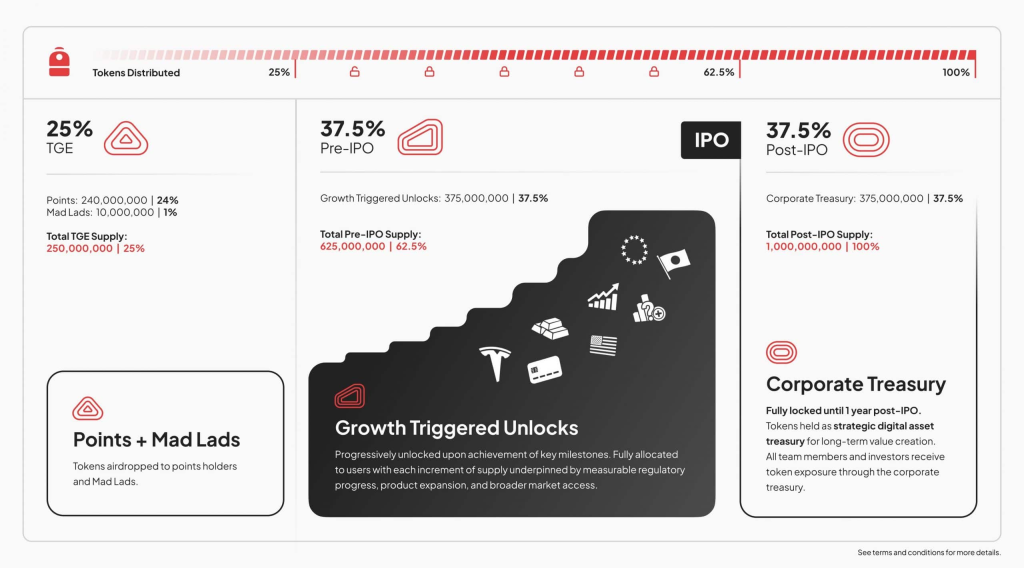

Backpack has confirmed a three-phase token distribution model explicitly designed to prevent insider dumping and align token supply with long-term company growth.

- Total supply: 1,000,000,000 tokens

- Token Generation Event (TGE): 25%

- 24% allocated to Backpack Points participants

- 1% allocated to Mad Lads NFT holders

- Pre-IPO growth unlocks: 37.5%

- Released only after achieving measurable regulatory or product milestones

- Post-IPO treasury lock: 37.5%

- Locked until at least one year after a successful IPO

Crucially, founders, executives, and venture investors do not receive direct token allocations. Their upside is tied to company equity, not token price appreciation.

Rumored or unconfirmed elements include the exact TGE date, initial token utility breadth, and post-TGE fully diluted valuation (FDV), which remains speculative.

Eligibility, timelines, and tokenomics

Eligibility is activity-based, not passive. Users earn Backpack Points through spot and futures trading volume, campaign participation, and ecosystem engagement. A verified Backpack Wallet linked to the exchange account is required to track rankings and claim rewards.

As of early 2026, the TGE timeline remains undisclosed. This delay is intentional, as token issuance is explicitly tied to regulatory readiness and operational maturity rather than market conditions.

Overall, the token functions as a growth-aligned utility layer, reinforcing platform usage instead of acting as an exit vehicle for insiders.

Fees and total cost vs major exchanges (maker/taker and deposits/withdrawals)

Maker/taker schedule, VIP tiers, and hidden costs users actually pay

Backpack’s fee structure is consistently lower than industry averages, particularly for derivatives traders.

At base tiers:

- Spot trading: ~0.08% maker / ~0.10% taker

- Perpetual futures: ~0.02% maker / ~0.05% taker

VIP incentives further reduce costs. Mad Lads NFT holders automatically qualify for VIP Tier 1, lowering futures maker fees to approximately 0.01%. At institutional volumes, maker fees can reach 0.00%, with taker fees around 0.018%.

Hidden costs to consider include:

- Hourly funding rates on perpetual futures (market-driven, not exchange revenue)

- A ~0.85% convenience fee on in-wallet swaps, separate from exchange trading

Deposits, withdrawals, and blockchain network fees vs peers

Backpack minimizes non-trading costs by offering zero-fee fiat rails and near-zero crypto transfer fees.

- Fiat rails: 0% fee USD bank wire deposits and withdrawals

- Crypto deposits: Free

- Crypto withdrawals: Users pay only network fees

- Solana/Tron: typically under $0.01

- Bitcoin and Ethereum: lower than major competitors on average

Compared to Coinbase or Kraken, the total cost of ownership for active traders on Backpack is materially lower, especially for futures users.

Compliance, KYC, security, and proof-of-reserves at a glance

Licensing, KYC/AML requirements, and allowed or restricted jurisdictions

Backpack operates under a jurisdiction-specific, compliance-first regulatory framework.

- European Union: MiFID II license via Backpack EU (CySEC), enabling regulated derivatives

- United Arab Emirates: VARA VASP license in Dubai

- United States: Wallet access nationwide, with exchange access expanding through state-level Money Transmitter Licenses

KYC requirements include government-issued identification, liveness checks, and proof of address. Sanctioned jurisdictions remain restricted.

Custody model, security practices, and proof-of-reserves transparency cadence

Backpack combines institutional-grade custody with daily proof-of-reserves transparency. Security architecture includes:

- Multi-Party Computation (MPC) custody to eliminate single-key risk

- Majority cold storage

- Native hardware wallet support

Proof-of-reserves is implemented using zero-knowledge cryptography, allowing users to verify solvency without revealing individual balances. As of early 2026, reported reserve ratios exceed 100%, with updates published daily rather than quarterly. This structure directly addresses the systemic weaknesses exposed by prior exchange failures.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |