HBAR Approaches Crucial $0.105 Resistance: Breakout or Sharp Rejection Ahead?

Key Insights:

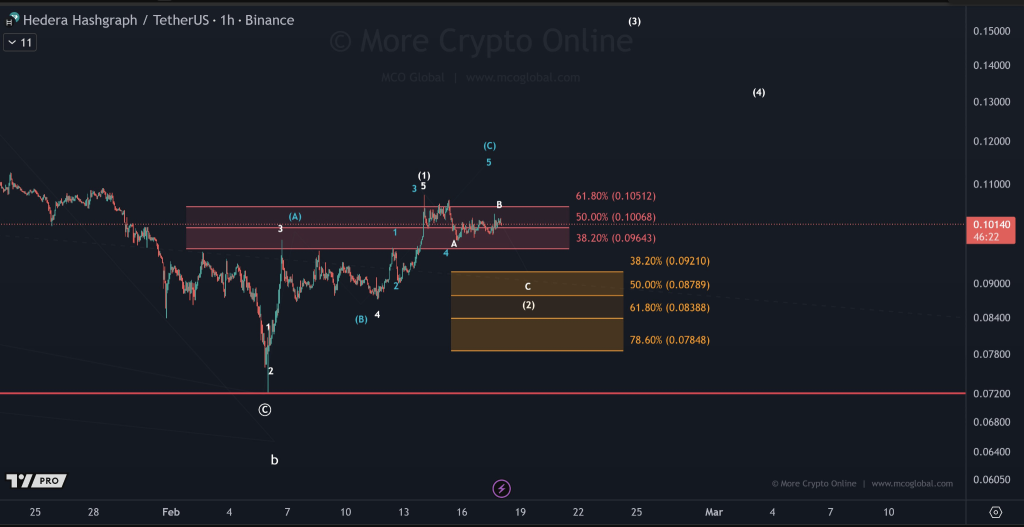

- HBAR approaches $0.105 resistance after forming a five-wave upward pattern from $0.072 low.

- Failure to break $0.105 may trigger a pullback toward support between $0.092 and $0.083.

- Hedera DeFi TVL drops to $58.6 million, signaling lower liquidity and slower market activity.

HBAR trades near a key resistance level as traders watch for the next move. The token approaches a price zone that may decide short-term direction. Market data shows compression below $0.105 as buyers and sellers compete.

HBAR Tests Resistance $0.105 and Showing Support Areas

Hedera (HBAR) is testing a key resistance level near $0.105 as traders watch for the next market move. After reaching a low near $0.072, the token has climbed and formed a five-wave upward pattern. The price now consolidates just below the resistance zone, creating uncertainty about the next direction.

Market observers note that HBAR is at a critical decision point. Buyers remain active, but sellers are defending the 50–61.8% retracement area. Analysts said, “It is unclear if HBAR will break past $0.105 or face a pullback toward support.”

On the 1-hour Binance chart, HBAR faces a strong Fibonacci resistance between $0.100 and $0.105. If the price manages to break above $0.105, momentum could extend to $0.12–$0.13.

However, rejection at the resistance could trigger a pullback toward support between $0.092 and $0.083. Analysts suggest this is consistent with common Wave 2 behavior before a stronger upward trend. Price action around this level will likely define the short-term market trend.

Market Activity Shows Declining Liquidity

Moreover, Hedera’s DeFi total value locked (TVL) is currently around $58.6 million, down from early-2025 highs above $200 million. This shows reduced capital in the token’s DeFi ecosystem and lower trading activity.

DeFiLlama data shows DEX daily totals peaked near $70 million in late 2025, with smaller bursts earlier in the year reaching $40 million. Activity dropped during spring 2025 and partially recovered around July, but the rebound faded toward early 2026. Lower liquidity may affect how quickly HBAR responds to market moves.

Ethereum trades at $1,982.14 with a 24-hour volume of $20.47 billion, down with 0.30% in the last 24 hours. This shows that while the broader market remains active, the token faces specific technical and liquidity challenges as it approaches $0.105.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |