Key Insights:

- XRP has hit the 70-day mark under the 50-week SMA—previously a pre-rally signal.

- Binance sees XRP inflows spike to 116M, indicating increased short-term sell pressure.

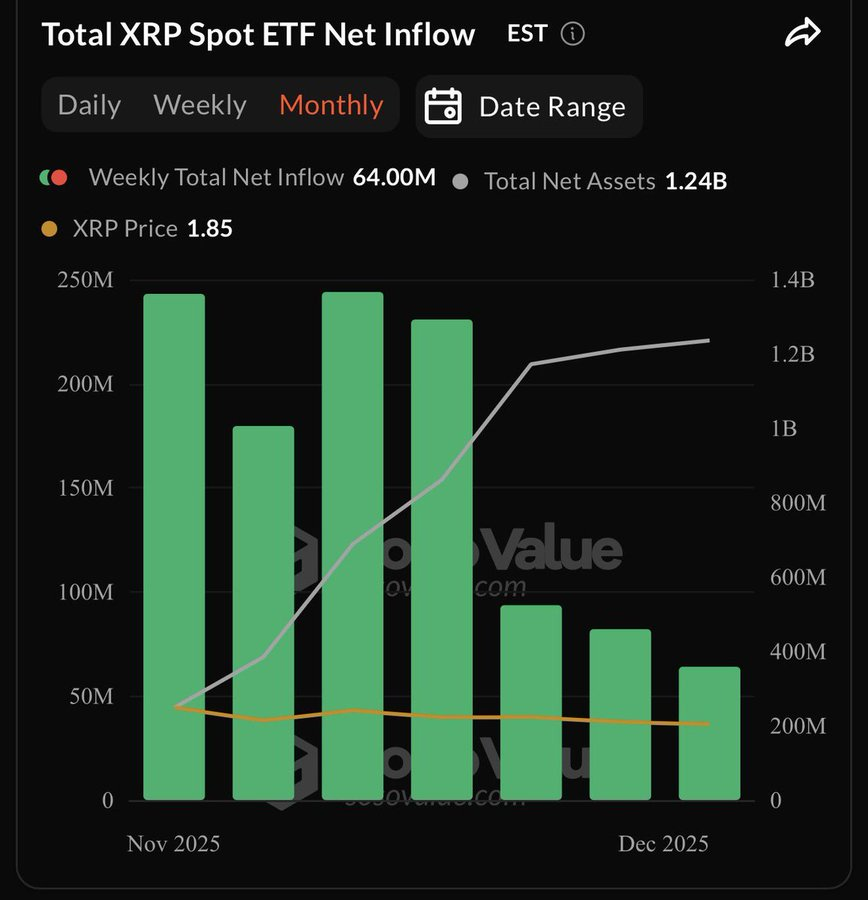

- XRP spot ETFs log seven weeks of inflows, with $64M added and $1.24B in assets.

XRP has spent 70 days under the 50-week simple moving average (SMA), a condition seen before major rallies in past cycles. This same pattern appeared in 2017, 2021, and 2024. Each time, XRP followed with strong gains. In 2017, the price jumped 211%. In 2021, it gained 70%. Most recently, in 2024, the price surged by 850% after 84 days below the SMA.

At that time, price action mirrors those setups. XRP is again at a point where earlier cycles started to move higher. Some traders are tracking this 70-day mark closely. They believe it could lead to another breakout, if price moves back above the SMA.

At the time of writing, XRP trades around $1.86, showing a small drop over the past week. The coin is still under the 50-week SMA, but the historical pattern suggests this level could act as a trigger if broken.

Rising Binance Inflows Point to Short-Term Pressure

Exchange data shows a sharp increase in XRP inflows to Binance since mid-December. On December 15, daily deposits started rising and peaked at 116 million XRP. That’s the highest since October. Moves like this are often seen before large sell-offs.

According to Steph is crypto,

“Rising Binance inflows are adding sell pressure to $XRP.”

The price fell from above $2.40 to below $1.90 during this period, lining up with the surge in exchange activity. These inflows suggest some large holders may be looking to sell or reduce risk.

With more tokens now on exchanges, short-term selling could continue unless strong buying demand steps in. This may weigh on price, even as longer-term signals remain in play.

Spot ETF Demand Grows as Price Holds Steady

XRP spot ETFs have now recorded seven straight weeks of inflows. The most recent week brought in $64 million, pushing total net assets to $1.24 billion. This steady growth shows that demand is still building, even with price stuck near $1.85.

ETF inflows like these are often led by institutions. The fact that flows are rising while the price stays flat suggests quiet accumulation, not short-term trading. This behavior has appeared before in early stages of market moves.

The market hasn’t reacted yet, but continued inflows may build pressure over time. If supply on exchanges begins to thin, prices could start to move in response.

Traders Watch for a Breakout as Signals Line Up

XRP’s setup has caught the attention of traders and holders alike. The 70-day pattern, rising ETF interest, and recent price action all point to a possible breakout window.

Social media is filled with mixed views. Crypto Crib noted,

“$XRP ETF sees 7 WEEKS of straight INFLOWS.”

however, Others are calling back to past predictions, including LeviRietveld, who added, “You have 48 hours,” in response to earlier price debates.

The pattern was familiar. Whether it plays out like before is now the key focus. Traders are watching the 50-week SMA closely, waiting to see if XRP makes its next move.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.