Majority of 2025 Tokens Underperform, TGE No Longer Lucrative

- 2025 TGE tokens underperforming; 84.7% below initial valuations.

- Market capitalization for the majority of tokens decreased significantly.

- Ash reports TGEs no longer early investment opportunities.

Ash from the Memento Research team shared data revealing that 84.7% of 118 token generation events (TGEs) in 2025 have fully diluted valuations below their initial figures.

The data underscores challenges in the token issuance market, highlighting limited investment potential as only 15% of projects yield positive returns, impacting market sentiment negatively.

Bitcoin’s Volatility Amidst Underperforming TGE Market

The analysis highlights broader concerns for the cryptocurrency market as valuations drop significantly. Part of the reaction to 2025’s financial landscape, Ash from Memento Research emphasized declining token values among 118 TGE projects. Performance data shows 84.7% with valuations now below their original issuance, with a median drop of 71%. Only 15% of projects have bucked the trend to achieve positive returns. This trend prompts questions about future TGE value as early investment opportunities. With the majority of tokens underperforming, the market might now demand more efficient and innovative projects. Despite initial hopes, investors and analysts question if TGEs still hold viable growth potential.

“TGEs no longer represent early investment opportunities, based on this broad underperformance across sectors.” — Ash, Memento Research team member

“TGEs no longer represent early investment opportunities, based on this broad underperformance across sectors.” — Ash, Memento Research team member

Market Data and Insights

Did you know? In the challenging 2025 crypto landscape, 84.7% of tokens saw valuations fall below initial offerings, demonstrating a stark contrast to prior years often viewed as bullish phases in token markets.

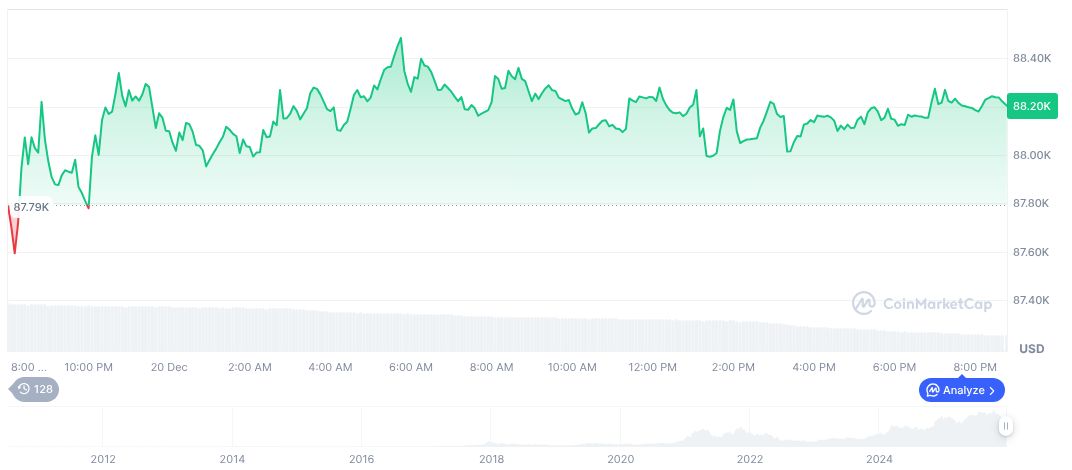

Bitcoin (BTC) priced at $87,860.48, with a market cap of $1.75 trillion and dominance at 58.96%, shows recent volatility. Its 24-hour trading volume is down 44.88%, with prices dipping 0.23% over the same period, per CoinMarketCap data. The Coincu research team notes that broader market conditions and innovations in token technology need reassessment. A consideration of regulatory frameworks might enhance investor security.

Read more about the Federal Reserve developments and their effects on the market.

Stay informed on global policy such as China’s crackdown on stablecoins.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |