Key Points

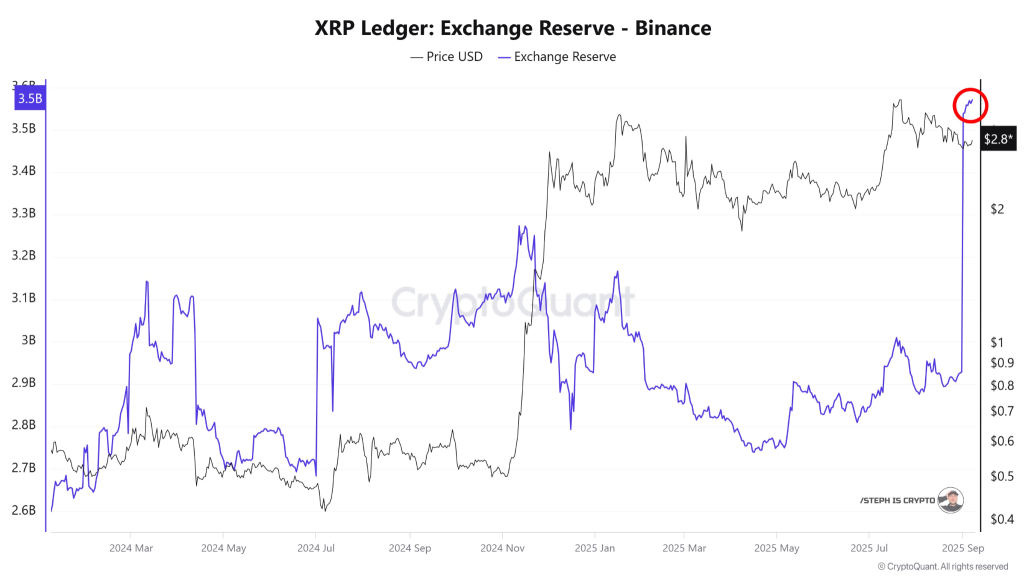

- Binance XRP reserves reach all-time high at 3.57B tokens, signaling possible sell pressure.

- Derivatives volume jumps 34.77%, with long positions dominating across major exchanges.

- XRP trades near $3.01 with bullish momentum, but resistance and volatility remain key risks.

XRP reserves on Binance have surged to a record 3.57 billion tokens, marking the highest level ever recorded. This rise in supply raises caution, as exchange inflows often signal potential selling pressure.

At press time, the token was trading at $3.01, up 3.71% in 24 hours, reflecting market confidence despite growing reserve levels. However, when large holders move funds to exchanges, concerns around future selloffs tend to increase.

Historically, sharp reserve increases have preceded price volatility and short-term corrections, even when overall sentiment remains bullish

Derivatives Data Points to Bullish Yet Risky Conditions

The XRP derivatives market shows growing activity, with trading volume up 34.77% to $7.49 billion and open interest rising to $8.19 billion. Options markets are also heating up, with volume and open interest increasing by over 60% and 47%, respectively.

These spikes signal rising engagement and confidence, yet they also indicate that leveraged positions are building rapidly. Long/short ratios on Binance and OKX favor bulls, ranging from 2.32 to 3.44.

Liquidations totalled $8.61 million in 24 hours, with shorts hit harder, suggesting strong upward pressure and forced exits. However, such imbalances often bring risk, especially if momentum reverses and liquidation cascades begin.

This environment favours bulls but also demands caution, as aggressive positioning can lead to fast moves in both directions.

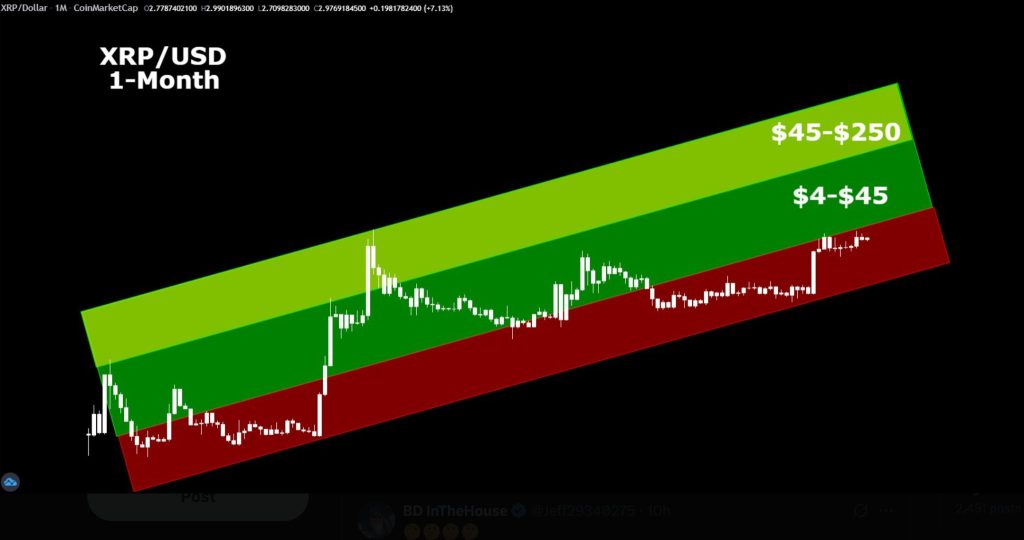

Undervalued Signals and Price Structure Remain in Focus

The XRP/USD chart shows price trading in what analysts consider an undervalued red zone, below projected fair value levels. While the token peaked near $3.80, it remains well below the green valuation zones starting at $4.

Meanwhile, outflows from exchanges have exceeded $100 million frequently, indicating possible accumulation and reduced immediate sell pressure. Meanwhile, occasional $200 million inflows still warn of sudden liquidity shifts.

Elliott Wave models suggest two possible outcomes: a breakout toward $11–$18 or further range-bound movement near $1.70–$2.10. The price holding above $3 supports the bullish case, but resistance remains strong.

XRP’s weekly gain of 7.71% shows strength, but confirmation depends on breaking above resistance and maintaining buyer interest amid volatile flows.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |