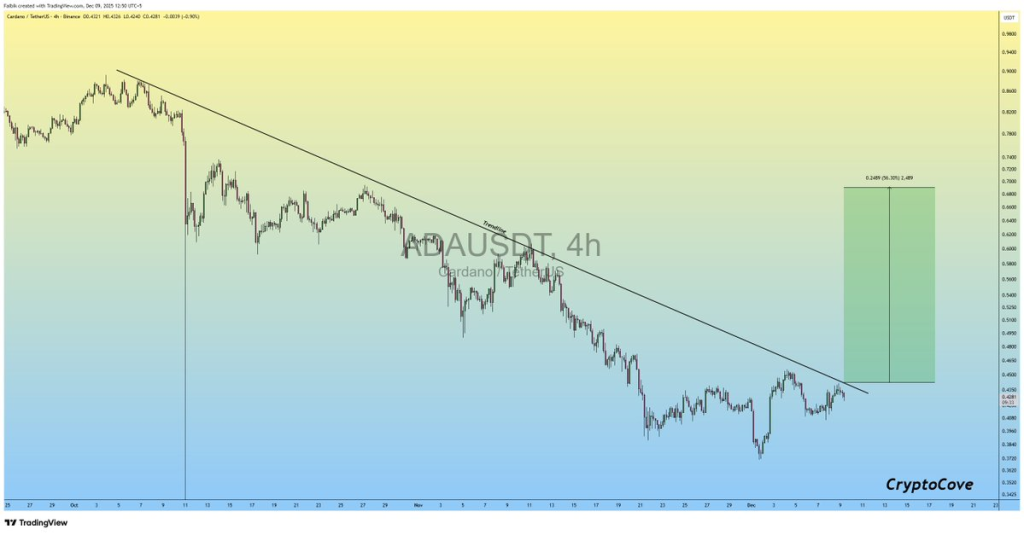

ADA Breaks Trendline as Charts Signal a 40% Bullish Wave Ahead

Key Insights:

- ADA breaks trendline on 4H chart, opening a potential bullish wave toward the $0.60 area.

- Weekly support zone at $0.322–$0.437 holds firm, backed by historical volume and Fibonacci levels.

- Breakout lacks five-wave confirmation, but upside remains valid while price stays above $0.44 support.

Cardano (ADA) has moved above a descending trendline on the 4-hour chart. This line had acted as resistance since early October, with multiple failed attempts to push higher. The breakout took place near the $0.45 to $0.46 level, which was previously capping the price.

A clear bullish candle closed above the trendline, supported by a series of higher lows through early December. This pattern suggests that buying strength is returning after a long period of selling pressure. The trendline, once resistance, now flips into a possible support zone.

Target Range Points to $0.60–$0.62

According to recent chart projections from ZAYK Charts, the breakout opens the door to a move toward $0.60 to $0.62. This range represents a potential gain of about 30% to 40% from the breakout area. The target is based on a measured move shown directly on the chart.

The upside scenario remains valid as long as price stays above $0.44. If the move fails, $0.43 and $0.41 are key support levels to watch. Analysts note that a spike in trading volume could support a faster move toward the upper range.

Long-Term Support Zone Holds on Weekly Chart

On the weekly chart, ADA continues to trade within a broad support area between $0.322 and $0.437. This range includes several overlapping factors: historical price activity, Fibonacci levels, and high-volume nodes. The area has previously served as a base during market pullbacks.

The most recent weekly candle shows a bounce near the $0.38–$0.39 zone. This region aligns with the Point of Control, which marks the price level with the most trading volume in the current range. A market analyst stated, “It is still too early to confirm a sustainable low,” indicating that while price has reacted well to support, confirmation of a reversal is still pending.

Next Focus: Long-Term Trendline and Price Structure

ADA still trades below a longer descending trendline drawn from the 2025 high. A move above this line would improve the outlook on higher timeframes. Several Fibonacci extension levels, including $1.47, $1.79, and $2.47, are marked as potential future targets if bullish momentum continues.

Analysts are also watching the lower timeframes for a five-wave advance to confirm a trend reversal. So far, that structure has not appeared. Until then, ADA remains inside a wide support zone, with a short-term breakout in place but larger resistance levels still ahead.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |