ADA Shows Early Rebound Signs with Bullish Divergence and Double-Bottom Targeting $0.50

Key Insights:

- ADA forms a double-bottom near $0.38 while RSI and MACD show early bullish divergence signs.

- Price remains under the 50- and 100-day moving averages as breakout needed for $0.50 target.

- Cardano’s DeFi TVL drops 4.41% in 24h; DEX volume falls to $10.56M amid reduced network activity.

Cardano (ADA) is showing early signs of recovery after recent losses. At the same time, a double-bottom pattern has formed near the $0.38 support level, which traders often view as a reversal signal. As of today, ADA is priced at $0.370770. The 24-hour trading volume stands at $759,457,959. Over the past day, the token has fallen 6.54%, which reflects broader pressure across the crypto market.

Technical Indicators Show Recovery Signals

The RSI and MACD indicators on ADA charts are showing a bullish divergence. This happens when prices move down but momentum indicators begin to turn up. Such setups are often seen as a sign that downward momentum is weakening.

The current price action shows a double-bottom near $0.38. According to Marzell this pattern has previously acted as a strong support level. While this technical structure may suggest price strength, analysts remain cautious until a breakout happens. A bullish divergence in both the RSI and MACD indicators suggests a potential shift in momentum.

ADA is still trading under both its 50-day and 100-day moving averages. Until the price closes above these levels, traders may remain hesitant to enter long positions. A breakout above these averages could be seen as a sign that buyers are gaining control. A confirmed breakout above these averages is needed before any upward move toward the $0.50 mark can be expected.

DeFi Activity and DEX Volume Dropping Amid Broader Volatility

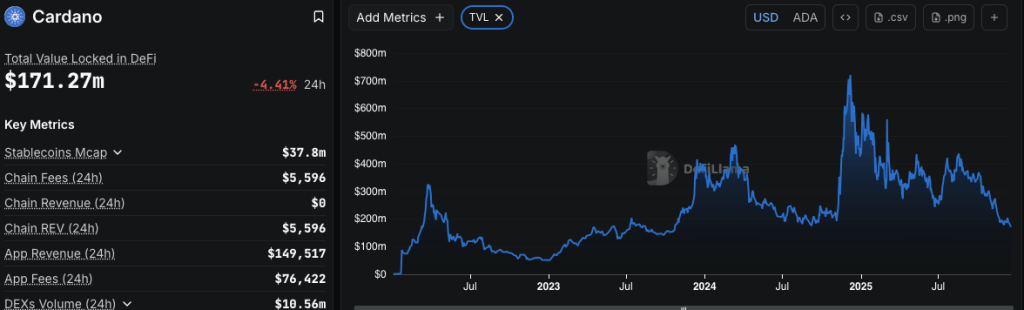

Furthermore, Cardano total value locked (TVL) in DeFi has dropped to $171.27 million, which is down 4.41% in the past 24 hours. This decline is part of a wider trend of reduced activity across Cardano-based platforms through 2024 and into 2025.

Chain fees over the last 24 hours were reported at $5,596, while application revenue stood at $149,517. These figures point to relatively low network usage. Some users have raised concerns over the drop in engagement.

Decentralized exchange (DEX) volume on Cardano has also seen a reduction. Only $10.56 million was traded in the last 24 hours. This figure adds to the recent trend of lower usage across DeFi platforms on the network. The drop in DEX activity may reflect caution from users as they wait for signs of a stronger market recovery.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |