ARB Forms Bullish Falling Wedge Pattern Indicating Potential Breakout Toward $2.00+

Key Insights:

- Arbitrum’s $ARB forms a bullish falling wedge, potentially targeting $2.00+ on breakout.

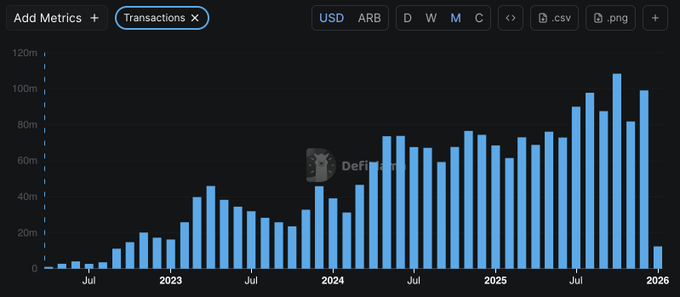

- USDC transfer volume on Arbitrum surged 80% year-over-year, showing real capital movement.

- December saw record transaction volume for Arbitrum, signaling increasing DeFi adoption in 2026.

Arbitrum ($ARB) has formed a falling wedge pattern on its weekly chart, which could signal a potential price breakout. At the time of writing, ARB is priced at $0.22, reflecting a 3.91% increase in the last 24 hours.

Arbitrum Forms Bullish Falling Wedge

The recent price action on Arbitrum suggests that the asset is forming a textbook falling wedge pattern. According to Bitcoinsensus, this technical setup has historically been seen as bullish, especially when the price breaks through the upper resistance level. The current pattern on Arbitrum has multiple bounces from the support level, hinting at increased buying pressure.

The falling wedge is often seen as a bullish setup. If Arbitrum manages to break through the upper resistance level, the price could see an upward move, possibly reaching $2.00 or higher. Traders are waiting to see if strong volume accompanies the breakout, as it would confirm the strength of the move.

Increased USDC Activity on Arbitrum

However, Arbitrum’s ecosystem is also experiencing growing activity. USDC transfer volume on the network has surged 80% year-over-year. This increase points to real capital movement, not just speculative trading.

“The rise in USDC activity on Arbitrum reflects the network’s growing role in stablecoin transactions,” reports say.

As Arbitrum continues to develop its position in the DeFi space, this surge in stablecoin transfers highlights its potential to handle more on-chain settlement. The platform’s increased usage could further support the bullish outlook for $ARB, especially as more stablecoin flows move through its layer-2 solution.

Arbitrum’s Rising Transaction Volume

Meanwhile, based on DeFi Warhol, December marked the second-best month for Arbitrum in terms of transaction volume. The network continues to see growth as more decentralized applications (dApps) adopt it. Experts predict that this growth will continue into 2026, driven by increased adoption of real-world assets (RWA) in decentralized finance (DeFi).

The current momentum, paired with a solid technical setup, positions Arbitrum for potential price gains. As the network scales and stablecoin transactions increase, the demand for $ARB could push the price higher, aligning with the possible breakout from the falling wedge pattern.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |