Key Insights:

- Whales continue to accumulate ASTER despite sharp retail sell-offs and falling price momentum.

- Price hovers near $0.70 support with bearish signals active across all major timeframes.

- A breakdown below $0.70 may push ASTER toward $0.675–$0.685 critical support zone.

ASTER/USDT was trading around $0.7059 after a consistent period of selling. The chart shows that the token has been unable to stay above the $0.75 level. This zone, marked as local resistance, has rejected multiple attempts at a breakout.

The price was sitting just above $0.70, which is the last visible support before a potential drop into a lower range between $0.675 and $0.685. If this support level fails, ASTER may retest its previous lows. The price action remains weak, with no strong signs of buyer activity in this area.

Bearish Signals Active Across All Timeframes

Technical tools confirm the current bearish structure. The Apollo V2 system displays a short signal across all major timeframes, including the 4-hour and daily charts. Trend strength is rated at 10, the highest possible value on the scale used by the system.

Momentum indicators also show no signs of reversal. The RSI is at 48, which puts it in a neutral state — not oversold, but not bullish either. According to trader Ardi,

“Gonna be nasty if this chart breaks down before reaching oversold.”

This comment reflects the risk of further losses without any oversold signal to attract dip buyers.

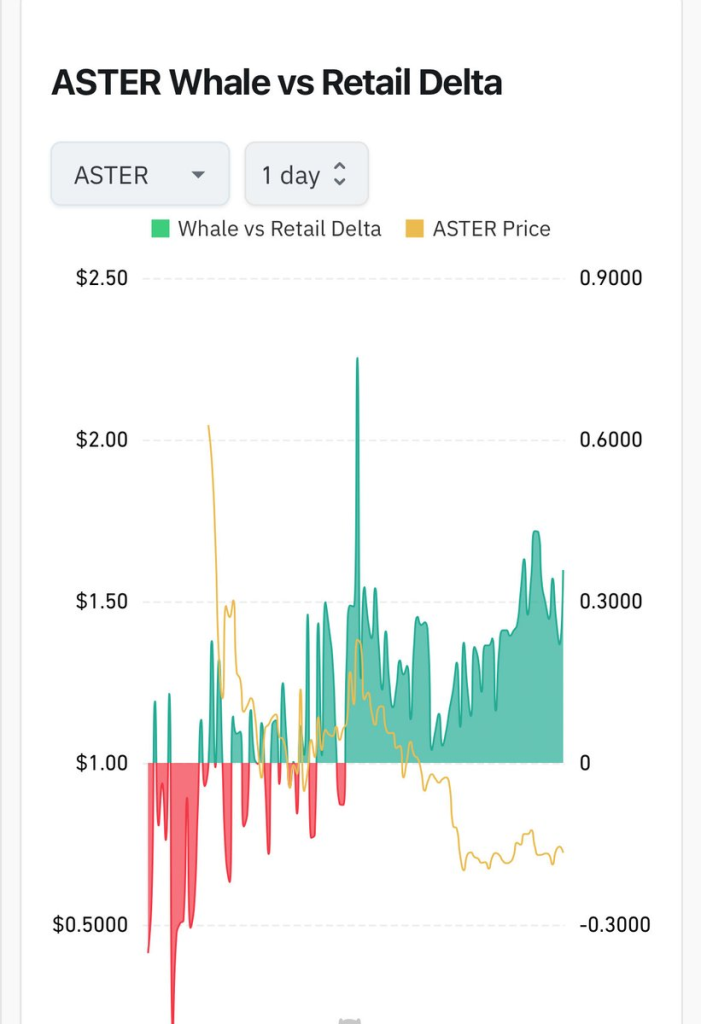

Whale Buying Rises While Retail Selling Continues

Separate data shows a gap between whale and retail behavior. The Whale vs Retail Delta chart indicates a steady increase in whale buying activity, marked in green. Retail traders, on the other hand, have been selling during the decline, shown in red on the same chart.

The yellow price line continues to slide, but large holders are still accumulating. Capibara Trading noted,

“Whales continue to buy up $ASTER while everyday folks are selling scared based on price action.”

This suggests a possible long-term view among whales that is not yet shared by retail investors.

Short-Term Moves Will Depend on $0.70 Reaction

Whether ASTER holds the $0.70 level will decide the short-term direction. A bounce from here and the formation of a higher low could open the way for a retest of $0.75. That said, resistance remains heavy at that level and would likely limit any upside unless volume improves.

If price closes below $0.70, the lower support zone will come into play. That would confirm a breakdown and extend the current downtrend. Traders are now watching closely to see if buyers step in or if the market continues to weaken.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.