Key Insights:

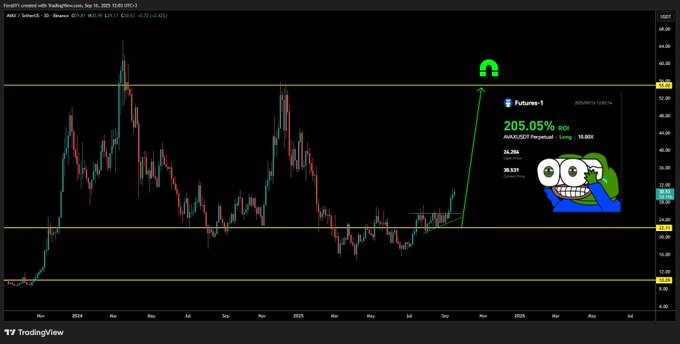

- AVAX breaks above long-term range, turning $30 into support while traders eye $36 as resistance.

- Market strength pushes AVAX higher despite altcoin weakness, with traders setting $50 as the next target.

- Chart projections outline expansion phases, suggesting possible medium-term checkpoints at $45, $55, and $70.

Avalanche (AVAX) was trading at $30.37 with a daily trading volume of $1.27 billion. The token has risen 6% in the past 24 hours and posted a 17% gain over the past week. These moves come as broader altcoin markets show mixed trends, suggesting AVAX is holding relative strength.

Market observers note that AVAX has exited a long period of sideways movement between $20 and $30. The breakout from this accumulation range signals renewed interest from traders. If momentum continues, market participants are monitoring a potential move toward higher resistance levels.

Technical Levels and Resistance Zones

The daily chart shows $30 as the new support level after the breakout. The next resistance zone is identified near $36, described as a “sell wall” by some traders. This level has historically attracted selling pressure, and a move beyond it may decide the short-term direction of price.

If buying pressure sustains, the next resistance range is placed between $40 and $42. Above these levels, technical projections extend toward the $50 zone, which coincides with the target mentioned by several traders. “$50+ is the target” has been noted by analysts monitoring the breakout.

Breakout From Long-Term Downtrend

The AVAX/USDT daily chart also indicates a breakout from a long-term descending resistance line that began earlier this year. Multiple tests of this line failed until recent weeks, when price moved higher with increased volume. The structure now reflects a change in trend from downward to upward.

During the consolidation phase, a bullish support trendline formed. Price tested this support several times before the breakout, suggesting steady accumulation. With the resistance cleared, traders expect expansion phases where the market could pause before moving to the next price zone.

Outlook and Trader Sentiment

Chart projections point to potential medium-term targets at $45, $55, and $70, depending on sustained momentum. These targets are based on past trading patterns and expansion cycles shown on historical charts. While not certain, these levels are being watched as possible checkpoints in the current trend.

Despite uncertainty in the broader market, AVAX has maintained upward momentum. With support established at $30 and resistance marked at $36, the next moves may determine whether AVAX can continue its rally toward the $50 region. Traders remain attentive, with some asking: “Can AVAX push through the $36 wall and set its course toward $50?”

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |