Bitcoin ETF inflows jump to 3-month high as BlackRock attracts $372M

Key Points

- Bitcoin ETF inflows surged to a 3-month high, led by $372M into BlackRock’s IBIT, signaling renewed institutional demand.

- Spot Bitcoin ETF flows were broad-based, with most issuers posting gains and no GBTC outflows, pointing to a more stable Bitcoin ETF market.

- Institutions diversified beyond Bitcoin, with ETH, SOL, and XRP ETFs also seeing net inflows.

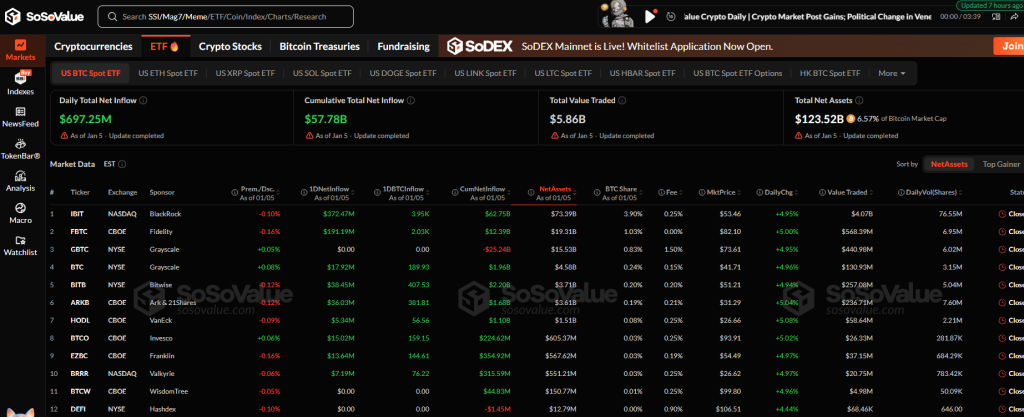

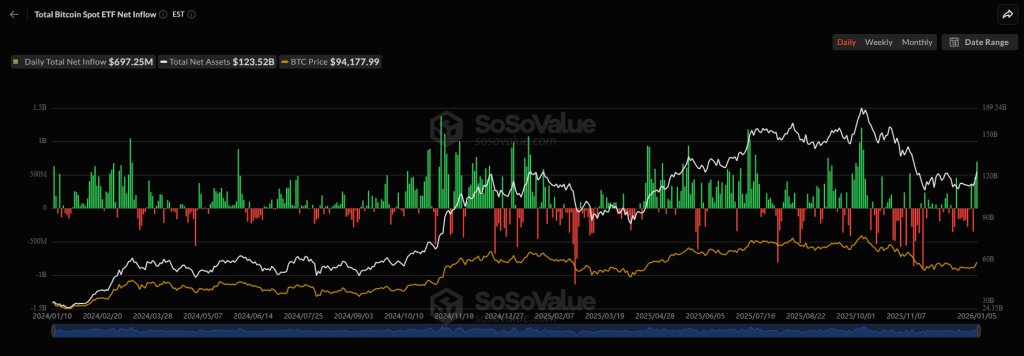

U.S. spot Bitcoin ETFs recorded their strongest single-day inflows in three months on Jan. 5 (ET), signaling a sharp rebound in institutional demand at the start of 2026. According to SoSoValue data, total net inflows across U.S. spot Bitcoin ETFs reached $697 million, marking the highest daily figure since October.

BlackRock’s iShares Bitcoin Trust (IBIT) led the surge, attracting $371.9 million in net inflows. Fidelity’s FBTC followed with $191.2 million, while Bitwise, Ark, Invesco, Franklin Templeton, Valkyrie, and VanEck all posted positive net flows. The broad participation suggests a coordinated institutional allocation rather than a one-off trade.

BlackRock’s IBIT dominates institutional Bitcoin ETF flows

Flow data shows that institutional buying was distributed across nearly all major issuers, a notable shift from earlier periods when inflows were concentrated in only one or two funds. The pattern points to a more mature and diversified ETF market.

Notably, Grayscale’s legacy GBTC recorded zero outflows on the day. This marks a meaningful change following more than $25 billion in cumulative withdrawals since GBTC’s conversion to an ETF structure, signaling that selling pressure from legacy products may be stabilizing.

ETF inflows point to portfolio rebalancing, not speculation

The surge in ETF inflows coincided with a rebound in trading activity after a quieter December. Bitcoin held above the $93,000 level throughout the session, indicating that inflows reflected portfolio rebalancing rather than speculative momentum chasing.

Such behavior aligns with institutional allocation patterns, where capital is deployed gradually through regulated ETF vehicles instead of direct spot market speculation. ETF flows therefore provide a clearer signal of longer-term positioning rather than short-term trading activity.

Institutional appetite on Jan. 5 (ET) was not limited to Bitcoin. Spot Ethereum ETFs recorded $168.13 million in net inflows, while data from Crypto Rover showed BlackRock clients purchasing 31,737 ETH, worth approximately $100.2 million, on the same day.

Flows were also positive across other crypto ETF categories. Solana spot ETFs attracted $16.24 million, while XRP spot ETFs recorded $46.10 million in net inflows. The diversified demand suggests that large allocators are building exposure across multiple digital assets, rather than focusing solely on Bitcoin.

ETF approvals signal institutional validation

According to BlackRock, the rapid approval and adoption of crypto ETFs represent institutional validation, not regulatory curiosity. Digital assets, including spot Bitcoin ETFs, are increasingly being embedded into standard portfolio construction frameworks used by global capital allocators.

The breadth of Bitcoin ETF inflows, combined with the absence of renewed GBTC outflows, suggests a maturing Bitcoin ETF market where institutions are allocating capital deliberately and with longer-term conviction. As regulated access expands, Bitcoin ETFs appear to be moving closer to the core of institutional investment strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |