Bitcoin’s Four-Year Cycle Influenced by Political Factors, Reports Markus Thielen

- Markus Thielen of 10x Research outlines political factors reshaping Bitcoin cycles.

- Liquidity and elections now drive Bitcoin trends, not halvings.

- Bitcoin maintains consolidation amid cautious institutional trading.

Markus Thielen of 10x Research noted Bitcoin’s cycle persists, driven by political factors and liquidity, as stated at a recent Cointelegraph event.

Institutional investors affect Bitcoin’s momentum amid tightening liquidity, challenging traditional cycle dynamics and leading to a potential shift in market behavior.

Bitcoin Cycles Shift to Political and Liquidity Influences

The diminishing effect of halvings signifies a shift in Bitcoin’s price trigger markers. Political events and market liquidity are the new forces impacting Bitcoin’s growth trajectory, challenging historical norms. Such changes forecast a sustained consolidation phase until liquidity conditions see notable enhancements. Institutional investors remain vigilant, contributing to the range-bound trend. Key figures, like Changpeng Zhao, founder of Binance, suggest that institutional and sovereign interests could lead to a “super cycle.”

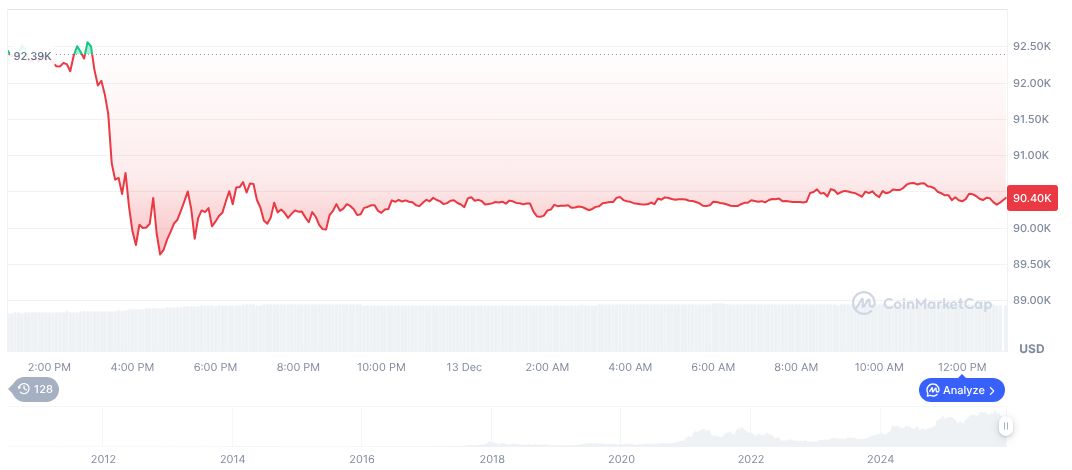

Bitcoin’s market data, sourced from CoinMarketCap, reveals the cryptocurrency’s current status following the influence of evolving market forces. As of December 14, 2025, Bitcoin (BTC) stands at $89,760.14, commanding a market cap of $1.79 trillion and a dominant 58.61% market share. Despite 24-hour volume reaching nearly $68.5 billion, latest trends highlight a notable 16.05% decrease. During this period, the coin’s price moved by -0.92% in 24 hours and -7.18% over 30 days, with an ongoing declining trajectory over 90 days. With a cap of 21 million coins, BTC’s circulation nears 20 million.

CoinCu’s research data emphasizes that political dynamics’ profound impact mirrors growing institutional dominance over supply factors. Historical trends where elections aligned with liquidity boosts should instead focus on larger global policy shifts. The evolving cycle diverges from conventional paradigms, introducing a complex interplay between markets and non-traditional factors.

Bitcoin Price Influenced by Evolving Political and Market Dynamics

Did you know? In 2013, 2017, and 2021, Bitcoin peaked and maintained momentum through cyclical events like halvings and elections. Now, the dynamics include political factors, possibly indicating a paradigm shift.

Bitcoin’s market data, sourced from CoinMarketCap, reveals the cryptocurrency’s current status following the influence of evolving market forces. As of December 14, 2025, Bitcoin (BTC) stands at $89,760.14, commanding a market cap of $1.79 trillion and a dominant 58.61% market share. Despite 24-hour volume reaching nearly $68.5 billion, latest trends highlight a notable 16.05% decrease. During this period, the coin’s price moved by -0.92% in 24 hours and -7.18% over 30 days, with an ongoing declining trajectory over 90 days. With a cap of 21 million coins, BTC’s circulation nears 20 million.

CoinCu’s research data emphasizes that political dynamics’ profound impact mirrors growing institutional dominance over supply factors. Historical trends where elections aligned with liquidity boosts should instead focus on larger global policy shifts. The evolving cycle diverges from conventional paradigms, introducing a complex interplay between markets and non-traditional factors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |