Bitcoin Price Trades Near $70,000 as Key Level Comes Into Focus

Key Insights:

- Bitcoin trades near $70K as resistance and Saylor’s level converge overhead.

- NUPL drops to 0.18, signaling thinner profit margins across the network.

- Rejection at $70K–$72K may send BTC back toward $64K support zone.

Bitcoin (BTC) traded at $69,648.15, recording a 4.5% gain over the past 24 hours. Over the last seven days, the asset rose 2.3%. Daily trading volume stood at $40.33 billion, showing steady activity as price moved closer to the $70,000 mark.

On the one-hour chart, BTC is testing the upper boundary of a descending channel. The pattern formed after a prior drop and reflects a series of lower highs and lower lows. Price is now pressing against resistance near the $69,000–$70,000 range. One trader wrote that price is “pressing firmly on LTF descending channel diagonal resistance” and said “the breakout will be glorious.”

$70K–$72K Zone Aligns With Saylor Level

On the two-day chart, BTC recently reclaimed $69,000 after bouncing from the $64,000–$66,000 area. That zone acted as support during the latest pullback. Price is now approaching the $70,000–$72,000 range, which previously served as support before turning into resistance.

Traders are watching this level closely because it sits near what many refer to as

“Saylor’s average price.” A market participant stated that “a reclaim of $70,000–$72,000 level will push BTC above Saylor’s average price.” The same trader warned that “a rejection means BTC will likely retest the $64,000–$66,000 zone again.”

On-Chain Data Shows Profit Margins Tightening

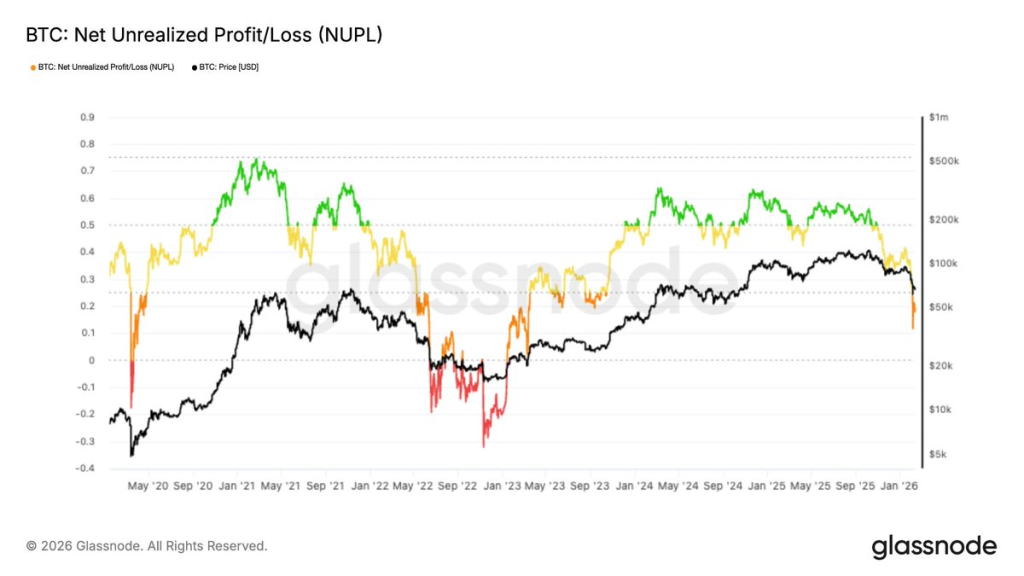

Glassnode data shows Bitcoin’s Net Unrealized Profit/Loss (NUPL) has fallen to 0.18. This places the market in the Hope/Fear range, where average unrealized gains across the network are relatively low.

An analyst noted that “BTC NUPL has dropped back into the Hope/Fear range,” adding that profit cushions are thinning. When unrealized gains narrow, some holders may choose to sell near breakeven levels. If price declines, there is less built-in profit to absorb selling pressure.

Market Focus Remains on Break or Rejection

BTC continues to trade just below $70,000 as traders monitor resistance on lower time frames and the broader $70,000–$72,000 zone. A clear move above this range could shift short-term structure higher and bring $75,000–$76,000 into view.

If price fails to hold current levels, attention may return to support between $64,000 and $66,000. As BTC trades near $70K, both technical resistance and on-chain positioning remain central to near-term price action.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.