Bitcoin Rejected at $116K and Eyes $110K-$111K Support for Potential Bounce

Key Insights:

- Bitcoin rejected at $116K, traders now focus on the $110K-$111K support zone for direction.

- Over $2 billion in ETF inflows show strong investor confidence despite short-term Bitcoin price weakness.

- Elon Musk links Bitcoin’s value to energy, reinforcing its foundation as a unique digital asset.

Bitcoin (BTC) price has recently faced rejection at the $116,000 zone, with the leading cryptocurrency now showing signs of weakness. The following critical support levels for Bitcoin are between $110,000 and $111,000, which also align with an active CME gap. The market is closely monitoring these levels, as they could signal a potential rebound.

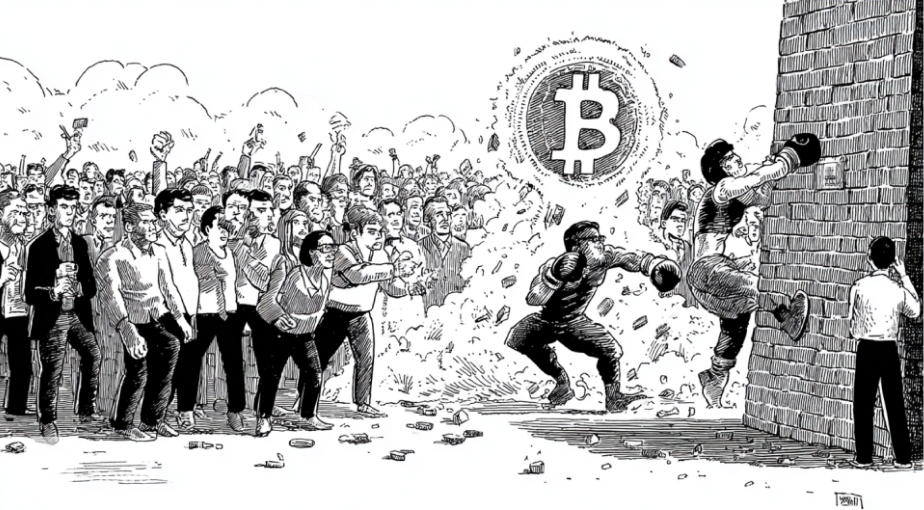

Bitcoin’s Struggle at $116K Resistance

After reaching the $116,000 mark, Bitcoin failed to break through, resulting in a slight pullback. This rejection has led many traders to speculate whether Bitcoin can maintain its position or continue to fall further. Based on Ted, a market analyst, the support zone between $110,000 and $111,000 is now crucial for the asset’s future movement.

If Bitcoin holds these levels, a potential bounce back could follow. If the support fails, Bitcoin may test lower levels, potentially reaching $107,000 before a reversal occurs. This level aligns with a gap in the CME futures market, which often serves as a strong price indicator. If Bitcoin manages to maintain its footing within this range, there could be a chance for a price recovery.

Bitcoin Long-Term Performance and ETF Inflows

Despite the recent rejection at $116,000, Bitcoin has made significant strides over the past decade. Richard Seiler stated, “Zoom out and appreciate how far Bitcoin has come in 10 years.” He noted that Bitcoin is still trading above $100,000, even after the bear market on October 10. Bitcoin has seen over $2 billion in ETF inflows recently, indicating strong long-term investor interest.

Bitcoin’s journey remains noteworthy, and the ongoing ETF inflows suggest that investors continue to see potential in the cryptocurrency, despite short-term volatility. As of the time of writing, Bitcoin was trading at $112,164 with a 24-hour trading volume of $76.227. Bitcoin has decreased by 2.81% in the last 24 hours.

Musk’s Remarks on Bitcoin and Energy

Meanwhile, Elon Musk has also recently commented on Bitcoin’s foundation, emphasizing the role of energy in its value. Bitcoin is based on energy because you can issue fake fiat currency, and every government in history has done so, but it is impossible to fake energy,” Musk said.

His statement highlights Bitcoin’s unique quality of being tied to energy production, which many consider a fundamental strength of the cryptocurrency. The underlying narrative surrounding its value continues to gain traction in both the financial and technological spheres.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |