Bitcoin RSI Forms Ascending Triangle Amid Pullback: What’s Next for BTC?

Key Insights:

- RSI forms an ascending triangle, signaling potential breakout for Bitcoin’s price.

- Short squeeze near $89K and $95K boosts upward momentum in Bitcoin.

- Rising Binance ratio points to increased buying power and liquidity entering Bitcoin.

Bitcoin (BTC) has recently shown signs of a potential upward movement despite experiencing a pullback. Key indicators suggest a positive shift in these technical patterns, which signals that Bitcoin is preparing for a price increase.

Bitcoin’s Price Action and Technical Indicators

From the point of view of Trader Tardigrade, the Relative Strength Index RSI has been steadily rising, forming an ascending triangle at the base of the ongoing pullback in Bitcoin’s price. Traders closely watch the RSI as it can provide valuable insights into potential market trends. This ascending triangle pattern typically indicates that buyers are gaining strength, as the price reaches higher lows while facing resistance at a consistent level.

As Bitcoin forms this pattern, many market participants expect a potential breakout when the price surpasses the resistance zone. Another development that could influence Bitcoin’s future price action is the ongoing short squeeze.

Based on Bitcoinsensus, Bitcoin’s price has been rising through key liquidation zones, with significant short liquidations occurring around the $89K and $95K levels. As more short positions are forced to close due to price movements, buying pressure increases, further driving the price higher. This surge in liquidations could lead to an accelerated rally as market dynamics shift, adding to the positive momentum building for Bitcoin.

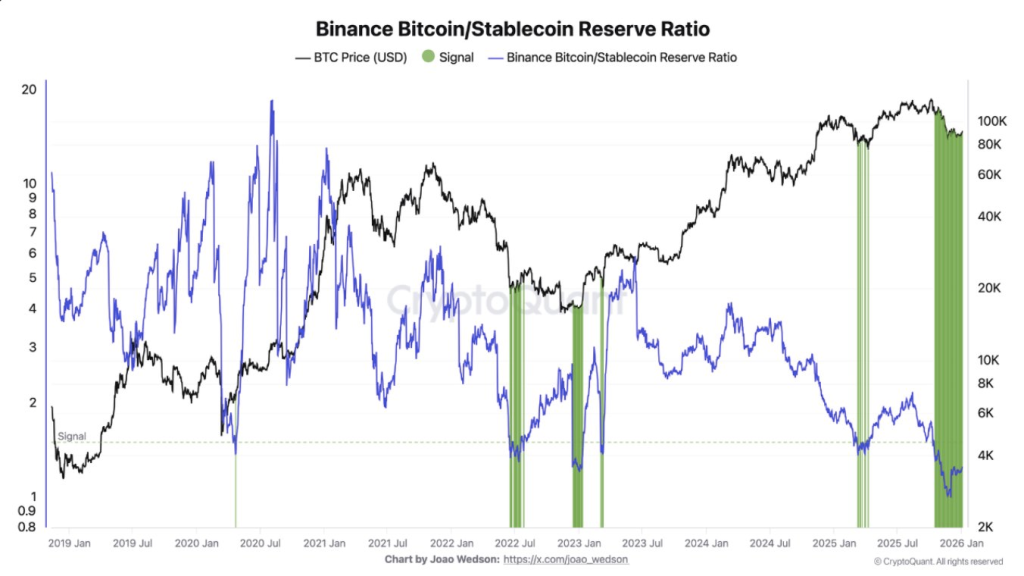

Binance Ratio Signals Rising Buying Power

Meanwhile, On-chain data from CryptoQuant shows a positive trend for Bitcoin. The Binance Bitcoin/Stablecoin ratio has started to rise, indicating that more capital is being deployed into Bitcoin from stablecoins. This suggests that sidelined liquidity may be entering the market, which could further fuel Bitcoin’s upward momentum.

According to CryptoQuant, “This shift could mark the early stages of a gradual deployment of sidelined liquidity, which would represent a very positive signal for the market.” This could mean more buying pressure for Bitcoin, potentially leading to higher prices in the coming days.

Bitcoin’s price recently reached $94,391.72, marking a 1.78% increase in the past 24 hours. All eyes are now on whether the cryptocurrency will continue its upward movement or face resistance in the short term.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |