Key Insights:

- Bitcoin trades tightly between $87K–$90K, with resistance strong and support beginning to weaken.

- $BTC faces a key test as charts project potential to slide toward $84K if $87K breaks.

- Traders eye $90K breakout or $87K failure to confirm the next move for Bitcoin.

Bitcoin continues to trade within a narrow range, holding between $87,000 and $90,000. At the time of writing , the price stands at $87,809.63. Over the past 24 hours, it has gained 0.3%, with a 0.4% rise recorded in the past seven days.

On the short-term chart, buyers have stepped in near $87,000, keeping the price from slipping lower. However, every attempt to move beyond $90,000 has failed. This area has acted as strong resistance in recent sessions.

$87K Support at Risk, Analysts Caution

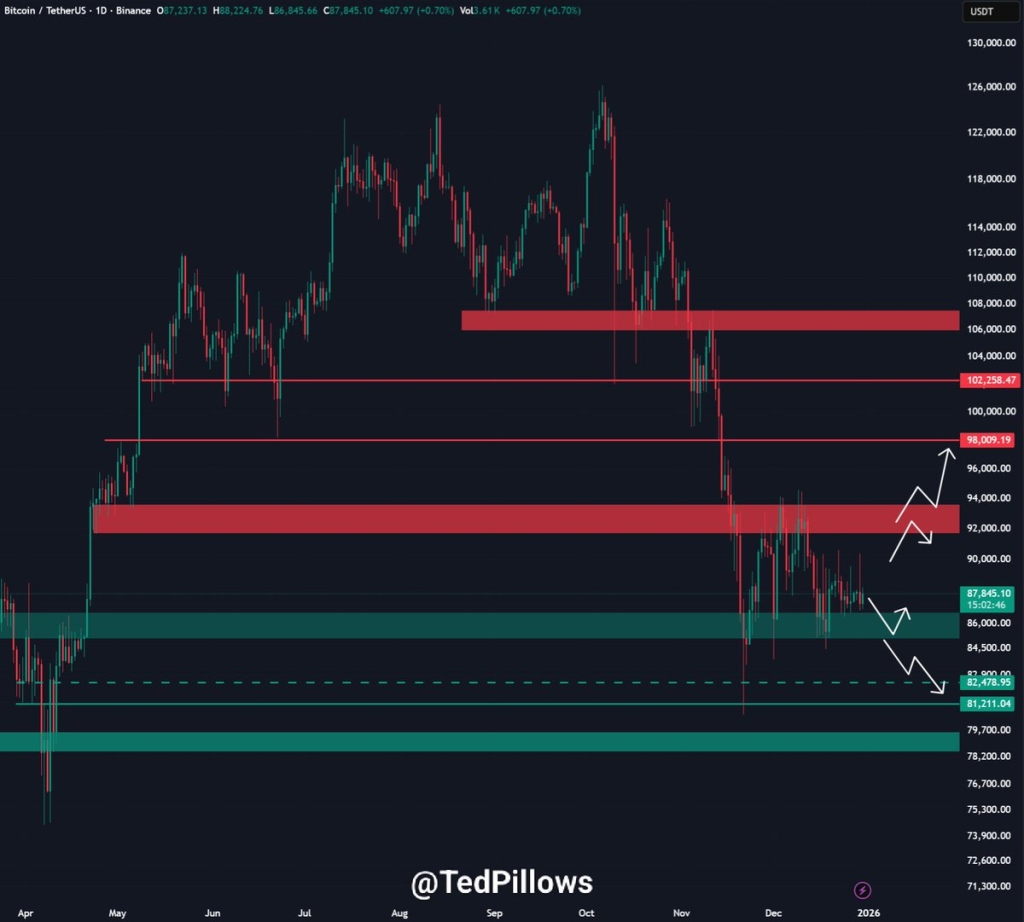

Market analysts are now turning their attention to the lower boundary of this range. Ted shared earlier, “Bitcoin is still stuck in the $87,000–$90,000 range.” He pointed out that upside momentum may remain weak unless BTC clears $90,000. He also added,

“In case BTC loses the $87,000 zone, a revisit of the $84,000–$85,000 level is highly likely.”

Charts on the 4-hour timeframe confirm this view. BTC is trading near support, and price action has remained heavy since the rejection from the upper range. If the current support fails, the next logical area to watch is around $84,000, which has previously acted as a price floor.

Kamran Asghar also noted,

“$BTC rejected at resistance and is hovering on support.”

He suggested that if the support breaks, Bitcoin could move toward the $84K area, while a bounce from here may offer limited upside.

Larger Pattern Signals Pressure Below

On the higher timeframe, Bitcoin appears to be forming a bearish pennant. Crypto Patel charted this on the 10-hour view, showing a consolidation structure following a sharp -21.84% drop. He wrote, “$BTC must break $90,000 to unlock the $107,000 upside,” but warned that failure at this level could lead to a much deeper fall. He added,

“If $90K fails → downside opens to $70K–$65K.”

His chart outlines a projected breakdown target near $70,000. The pennant has now tightened, and price is nearing the end of this formation. Based on this setup, the market is preparing for a larger move either above resistance or below support.

Key Price Levels to Watch Ahead

Bitcoin remains inside a defined structure. Resistance at $90,000 is still holding, and support at $87,000 is being tested again. Volume has remained steady, with no shift in direction confirmed.

While short bounces are still possible, most traders are watching for either a clean break above $90,000 or a close below $87,000 to confirm the next move. The setup shows that BTC is at a decision point, and the next few days could decide whether the market moves back toward the $84K area or aims for a recovery.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.