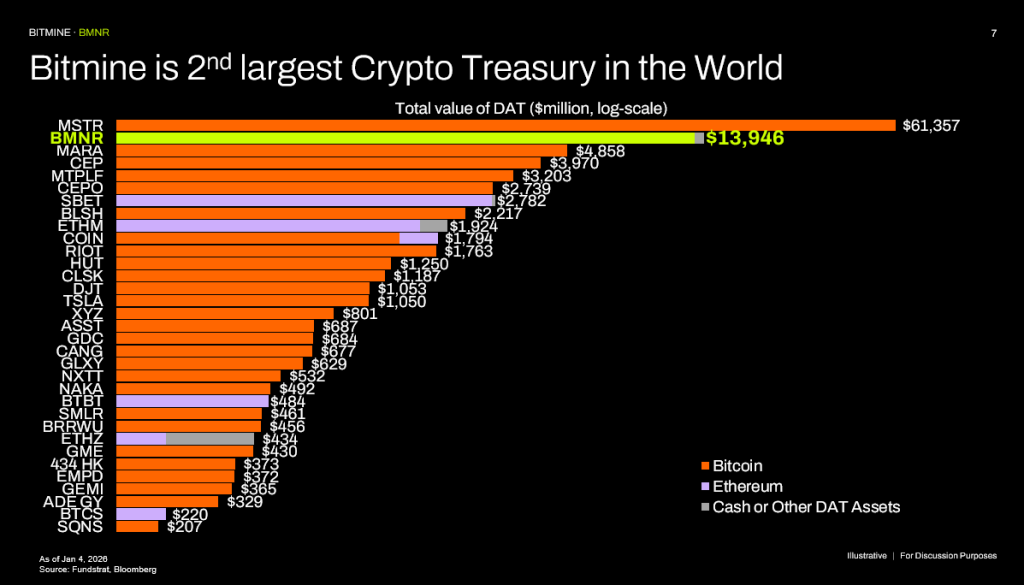

Bitmine Immersion Technologies (BMNR) Reports Bitmine Ethereum Holdings of 4.144 Million Token

Key Points

- Bitmine ethereum holdings rose above 4.144 million ETH, representing roughly 3.43% of total circulating supply.

- Total crypto, cash and early-stage investments reached $14.2 billion as of January 4, 2026.

- Analysts point to bitmine ethereum holdings, treasury-driven flows and staking yield as growing structural forces in Ethereum markets.

Bitmine Immersion Technologies (BMNR) reported a significant expansion of its bitmine ethereum holdings, lifting total Ethereum owned to more than 4.144 million tokens. The update drew attention to the growing role of corporate balance sheets in shaping crypto market flows.

In a disclosure dated January 5, 2026, Bitmine said the combined value of its digital assets, cash reserves and early-stage investments stood at about $14.2 billion as of January 4.

The portfolio includes 4,143,502 ETH, 192 bitcoin, a $25 million investment in Eightco Holdings, and roughly $915 million in cash. The company’s Ethereum position now accounts for approximately 3.43% of the network’s circulating supply, estimated near 120.7 million tokens.

In the final week of 2025, Bitmine acquired 32,977 ETH, reinforcing bitmine ethereum holdings as one of the largest sources of fresh institutional demand for Ethereum globally.

Large treasury positions reshape ETH supply dynamics

Bitmine’s strategy of accumulation is not just a balance sheet holding of tokens; instead, it’s about affecting the liquid supply dynamics of Ethereum. With over 4.14 million ETH effectively withdrawn from active trading, a meaningful portion of supply is no longer available to exchanges or short-term traders.

This reduced circulating float can tighten up market conditions over time, even if the effect does not immediately materialize into sharp price action. Large treasury holders usually build up ETH holdings over longer periods, stake a portion, and keep large reserves that reduce reactive selling during market stress.

This kind of behavior introduces slower, structurally supportive flows into Ethereum markets, contrasted with the faster, sentiment-driven retail liquidity cycles.

Staking, yield, and the economics of Bitmine holdings

Bitmine’s disclosures also highlight the growing importance of staking yield within its Ethereum strategy. As of early January 2026, the company had approximately 659,219 ETH staked, valued at around $2.1 billion based on prevailing prices.

The company plans to launch its proprietary Made in America Validator Network (MAVAN) in early 2026, positioning the initiative as a secure, domestically operated staking infrastructure.

At current composite Ethereum staking rates of roughly 2.8%, full deployment of Bitmine’s ETH holdings into staking could generate around $374 million in annual yield, equivalent to more than $1 million per day.

This introduces a recurring, protocol-native revenue stream that differentiates Bitmine’s approach from passive holding strategies and adds a yield-driven flow component to its treasury model.

Institutional support and broader liquidity context

Bitmine’s Ethereum move is occurring in the context of overall institutional participation that has been robust. Bitmine has been one of the most actively traded companies in the U.S. based on dollar volume.

The company is led by an impressive list of institutional and cryptonative investors, further cementing the idea that Bitmine is a hybrid vehicle that seeks to bridge traditional capital markets and on-chain investments. The emergence of this entity further fuels industry whispers that Ethereum is an increasingly institutional space.

Supply, flows, and price action

Despite the scale of Bitmine’s accumulation, Ethereum prices did not experience an immediate breakout, suggesting that the market has absorbed the buying pressure without significant dislocation. Analysts view this as a sign of deeper liquidity and a more mature market structure compared with earlier cycles.

Over the longer term, the implications of large corporate ETH treasuries may include reduced ETH balances on exchanges, persistent institutional demand, and yield-generating treasury strategies that alter traditional risk and return profiles.

These dynamics position bitmine ethereum holdings as a structural rather than speculative force in Ethereum markets.

Conclusion

Bitmine increasing its Ethereum treasury above 4.14 million ETH, essentially more than 3.4% of total circulating supply, accentuates how corporate treasury behavior is reshaping Ethereum’s market structure. While these moves are not catalysts for short-term price spikes, such long-term allocations reduce available supply and deepen institutional influence across the ecosystem.

For market participants, the signal lies less in immediate price reactions and more in the trend of continued balance-sheet accumulation and yield optimization, which may be quietly underpinning Ethereum’s narrative in the months ahead.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |