Key Insights:

- Bitcoin’s pattern shows repeated accumulation, manipulation, and expansion cycles that guide long-term market direction.

- A firm breakout above $94K may open a fast move toward higher liquidity between $97K and $98K.

- The $78K support remains the crucial threshold that maintains Bitcoin’s bullish structure on the weekly timeframe.

Bitcoin traded near $90,209 after a daily pullback of about 2%. The market stayed inside a wide range as traders focused on major support levels. Seven-day data showed a slow decline, leaving the market in a cautious phase.

The long-term chart showed a repeating Power-of-3 cycle. The pattern moved through three stages: accumulation, manipulation, and expansion. Each accumulation phase lasted close to 105 days. The manipulation stage lasted 49 days before price shifted into a 98-day expansion period. Recent movement showed the end of another 49-day manipulation phase and the start of a new expansion leg.

One analyst said,

”A weekly close below $78,000 will warn of a long bear market.”

Liquidity Zones and Continued Rejection at $94K

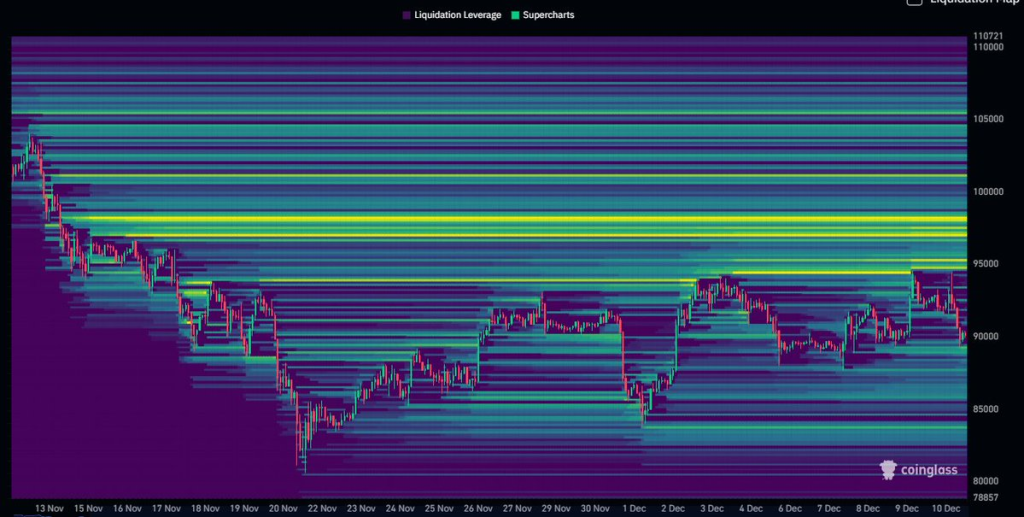

Liquidity data placed the main cluster between $97,000 and $98,000. This remained the key area for traders waiting for the next major reaction. Price action, however, showed repeated rejection at the $94,000 level. Attempts to move above this zone failed for several weeks.

Analysts noted that a firm break above $94,000 may allow price to move toward the upper liquidity band. One market watcher said “once the breakout above $94K holds, the next move will come quickly.” Until then, the market may stay inside a tight range with sharp reversals.

Triangle Formation and Moving Average Pressure

Short-term charts showed Bitcoin inside an ascending triangle. The pattern formed as higher lows developed along a rising support line. The top of the pattern held near $94,000, keeping the market in compression.

Price met resistance at the 4-hour 200MA. Each advance toward the moving average was rejected. The setup remained stable while the rising support line held. This kept the triangle active and left room for a breakout attempt if pressure eased.

Key Support at $78,000 Remains the Deciding Level

Analysts continued to track the $78,000 level. This acted as the structural base of the Power-of-3 pattern. The broader outlook stayed bullish while Bitcoin traded above this support. A weekly close below $78,000 would break the cycle and warn that the market may shift into a longer bearish phase.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.