- US CPI data may prompt stock futures rally, affecting Federal Reserve policy.

- Expectations of a 50 bps rate cut influence crypto markets.

- BTC and ETH prices may rise if CPI is below forecasts.

Anticipation builds as investors await a potentially pivotal U.S. Consumer Price Index report on September 10, 2025, which could heavily influence Federal Reserve’s monetary policy decisions.

A softer-than-expected CPI could trigger significant market rallies, especially in crypto assets, and increase pressure for a Federal Reserve rate cut.

US CPI Data: Economic Implications and Market Speculations

The upcoming US Consumer Price Index report is sparking speculation among financial analysts and institutions. Morgan Stanley projects a slight increase in core CPI of 0.26% for September, ahead of the consensus estimate of 0.2%. Expectations are high, with the looming report adding pressure on market players monitoring potential impacts.

An unexpected CPI outcome could prompt changes in market sentiment. A lower-than-expected CPI would increase the odds of a 50 basis point rate reduction by the Federal Reserve, potentially benefiting risk assets like stocks and cryptocurrencies. Analysts note heightened anticipation across sectors ready for potential shifts.

Market reactions to the anticipated CPI report are mixed. The US stock index futures might rally in favor of a dovish monetary policy, encouraging investment in risk assets. Financial commentators highlight the influence lower inflation data could have on crypto markets, especially on Bitcoin (BTC) and Ethereum (ETH).

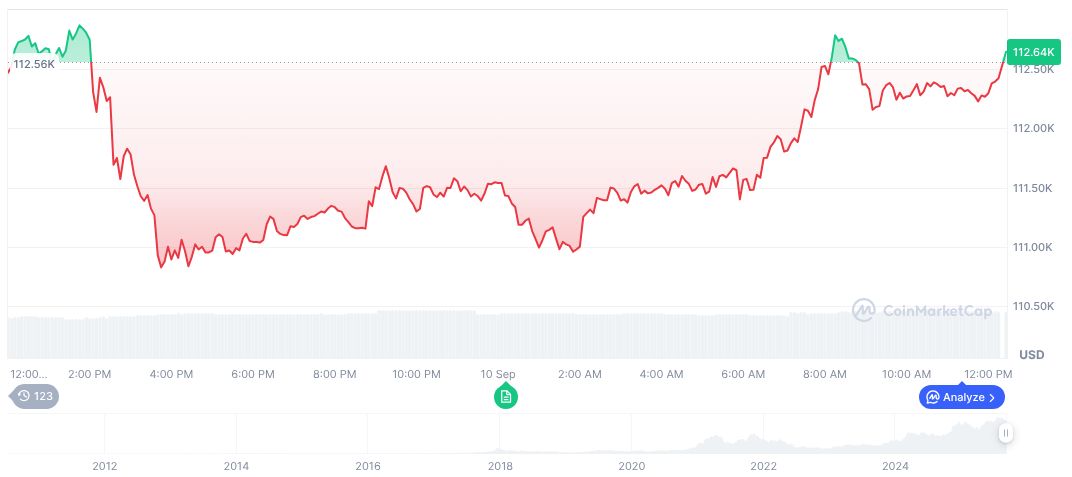

Bitcoin Stands at $113k Amid Fed Rate Speculations

Did you know? The July 2023 CPI miss led to a 4% rise in Bitcoin’s price within 24 hours, showcasing how sensitive crypto assets can be to inflationary data surprises.

According to CoinMarketCap, Bitcoin (BTC) stands at $113,182.20, with a market cap of $2.25 trillion. BTC’s 24-hour trading volume reached $51.34 billion, gaining 0.49% in a day despite a 5.38% drop over 30 days. The cryptocurrency’s market dominance grew to 57.40%.

Expert insights from the Coincu research team highlight potential regulatory and financial outcomes stemming from this report. A softer CPI might spur increased investment in risk assets, while investors could gravitate toward DeFi and innovative financial solutions. Historical trends suggest a sharp focus on US equities and cryptocurrencies should such a financial scenario unfold.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |