DePIN Tokens Revenue Report The Hidden Revenue Engine Behind Web3 Infrastructure

DePIN tokens revenue proves that Web3 infrastructure is no longer driven by speculation, but by real-world demand and on-chain cash flow. The sector now generates $72M in on-chain revenue in 2025, even as most tokens remain far below their historical highs.

The hidden revenue engine behind Web3 infrastructure is built on real utility rather than token inflation.DePIN Tokens are shifting to sustainable business models, forcing the market to reprice DePIN Tokens around fundamentals.

Why DePIN’s $10B Market Is Overlooked and Tokens Lag Fundamentals

DePIN is overlooked because token prices follow speculative crypto cycles, not the real revenue being generated by physical infrastructure networks.

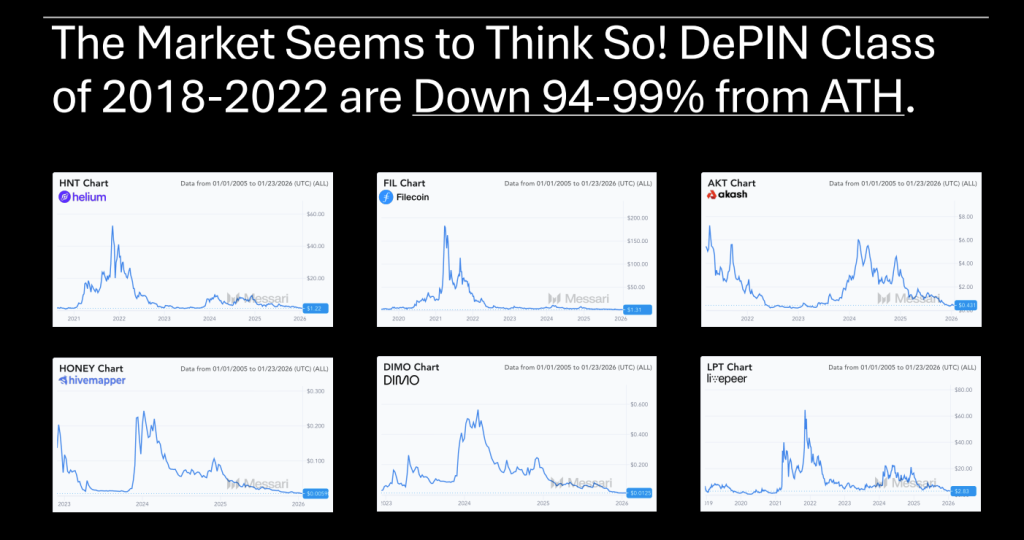

Although most DePIN tokens remain 94–99% below their all-time highs, the sector has quietly grown into a $10B market generating $72M in onchain revenue in 2025. This divergence shows that price action is still driven by sentiment, while fundamentals compound in the background.

The market has shifted from subsidy-driven growth to revenue-backed infrastructure, yet valuations remain anchored in outdated assumptions from the 2021 cycle. That structural mismatch explains why DePIN appears “mispriced” despite improving business metrics.

In 2021, DePINs were pre-revenue, demand-constrained, inflation-heavy, and traded at 1000x+ multiples. In 2025, they are revenue-generating, supply-constrained, and trade at 10–25x revenue multiples. This structural reversal explains why token prices lag real economic value today.

Demand, Macro Liquidity, Yields, Japan, ETF Flows, Adoption Catalysts

DePIN Tokens growth in 2025 is driven by rising real demand combined with institutional liquidity and revenue-first crypto economics.

Enterprise usage for decentralized compute, wireless, energy, and sensor data continues to expand regardless of short-term token volatility. This demand layer is now persistent, not cyclical.

- At the macro level, global liquidity became more accommodative as central banks pivoted. The Fed’s easing path supported risk assets, while investors rotated toward revenue-bearing digital infrastructure.

- The “Japan Factor” further amplified volatility and long-term positioning. Japan raised rates to 0.75% by December 2025, causing temporary crypto liquidity shocks. At the same time, regulators prepared frameworks for spot crypto ETFs, drawing institutional capital into digital assets.

- ETF flows & institutions: Spot Bitcoin ETFs saw $26B–$29B in net inflows in 2025, pushing total crypto ETF AUM above $130B. Corporate treasuries expanded crypto exposure, anchoring long-term demand.

- Adoption catalysts: Market leadership shifted from narratives to verifiable onchain revenue, while stablecoins became the settlement backbone of Web3, reaching $4T+ in annual volume and ~30% of onchain transactions

Where Revenue Accrues: Onchain Revenue, Fees, Utilization, and Emissions

DePIN Tokens derive long-term value from on-chain usage fees and network utilization, not from token emissions.

| Mechanism | Meaning | Impact |

|---|---|---|

| Onchain Revenue / Fees | Payments for compute, storage, bandwidth | Confirms real-world utility |

| Utilization | Higher usage → higher fees | Revenue decouples from token price |

| Emissions | Token rewards for early supply | Unsustainable without fee replacement |

Markets now value DePIN networks on revenue multiples between 10x and 25x, compared with over 1000x during the speculative peak of 2021. This signals a maturing asset class where price increasingly reflects business fundamentals.

Verticals and Leaderboards: Compute, Wireless, Storage, Mobility Utilization and Revenue

Wireless and compute networks currently generate the majority of DePIN revenue, while storage and sensor networks provide high-margin data layers.

Wireless protocols monetize real consumer connectivity, while compute platforms sell processing power for AI training and inference. Storage and sensor networks monetize data usage and spatial intelligence.

DePIN Leaderboard by Annual Revenue (late 2025):

| Project | Vertical | Projected Annual Revenue |

|---|---|---|

| Helium | Wireless | ~$21M |

| io.net | Compute | ~$7.6M |

| GEODNET | Mobility (Sensor) | ~$4.9M |

| Braintrust | Compute | ~$3.0M |

| Hivemapper | Mobility (Mapping) | ~$2.5M |

| Akash | Compute | ~$1.9M |

| Filecoin | Storage | ~$1.4M |

| Render | Compute | ~$1.4M |

Top protocols by demand-side revenue and protocol fees

Helium, io.net, and GEODNET lead DePIN by monetizing real services at scale. Helium dominates wireless revenue through consumer products. io.net and Braintrust monetize decentralized compute for AI workloads. GEODNET and Hivemapper sell sensor and mapping data for robotics and navigation.

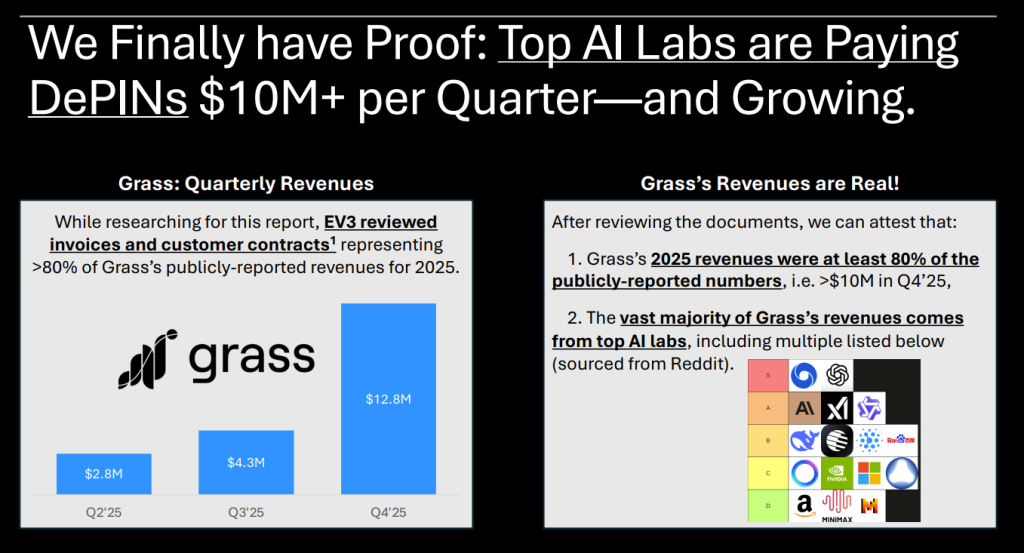

Grass generated more than $10M per quarter and reached $12.8M in Q4, with most invoices verified as real usage. This confirms enterprise-grade demand for decentralized infrastructure.

Supply-side incentives, hardware costs, expected utilization, token value capture

DePIN unit economics depend on how quickly real usage replaces token emissions as the primary reward mechanism. Early stages rely on emissions to incentivize hardware deployment and overcome high upfront costs. This builds supply but creates inflation.

As utilization rises, paid usage covers operating costs and emissions taper. This transition marks the shift from speculative networks to sustainable businesses. Token value capture occurs via burn-and-mint models where fees burn native tokens, directly linking demand to scarcity and long-term price support.

Regulation and Tokenomics: SEC/CFTC Risk, Emissions, and Value Capture

SEC/CFTC implications for tokens, revenue, and network fees

Tokens tied to usage and fees are less likely to be classified as securities than profit-sharing instruments. Utility-based DePIN Tokens function as access tools for connectivity, compute, and storage, resembling commodities rather than investment contracts. Designing around usage-based fees and burns supports a non-security profile and regulatory resilience.

Quick Fact: BingX exchange is offering exclusive perks for new users and VIP traders.

Design levers: protocol fees, sinks versus emissions, balancing risk-off volatility

Sustainable DePIN Tokens tokenomics require shifting from emissions to protocol fees and token sinks.

- Protocol fees capture value from usage.

- Token sinks (burns) counter emissions and create scarcity.

- Emissions bootstrap supply, then taper.

- Stablecoin pricing & fiat-pegged rewards reduce volatility and retain providers.

Three survival paths for DePIN:

- InfraFi: stablecoin holders finance hardware, lowering cost of capital.

- Capex-light models: faster monetization with lower upfront costs.

- Bull-market timing: launching into liquidity cycles for rapid scale

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |