Dogecoin Nears Apex of Symmetrical Triangle with $0.35 Target in Sight

Key Insights:

- Symmetrical triangle signals a potential Dogecoin breakout, with $0.35 as a target.

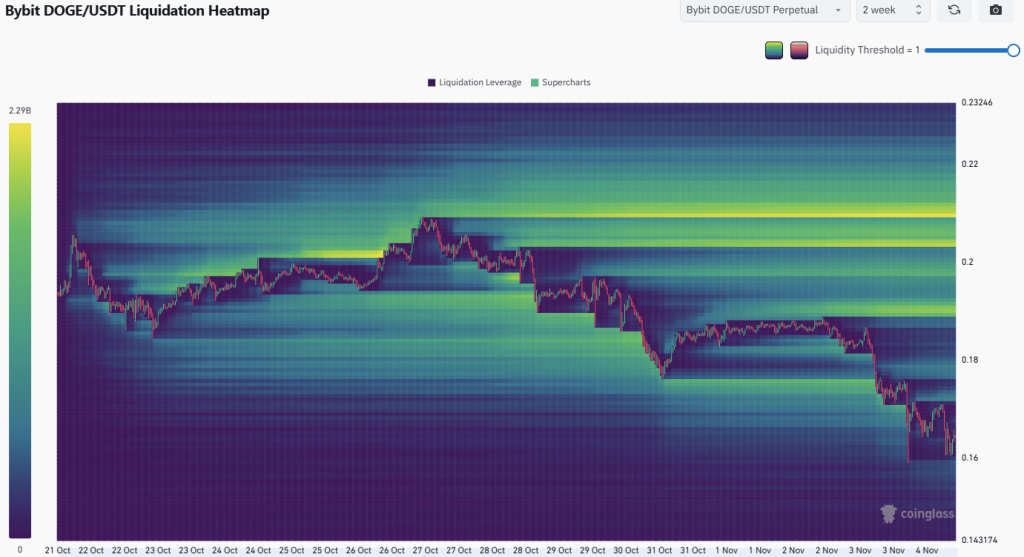

- Liquidity accumulation at $0.17 suggests a possible correction before any bullish momentum.

- Monitoring support zones at $0.15 and $0.13 crucial for traders seeking entry points.

Dogecoin ($DOGE) is nearing a critical moment in its price action. The cryptocurrency is forming a symmetrical triangle on the 1-week chart, with its apex fast approaching. This technical setup signals that Dogecoin may soon experience a significant price movement.

Symmetrical Triangle Indicates Potential Price Breakout

A symmetrical triangle pattern occurs when the price action is constrained by converging trendlines. Dogecoin’s current pattern shows the price squeezing between these boundaries, signaling an upcoming breakout.

If the price breaks above the upper trendline, Dogecoin could rise to $0.35 or higher, starting a new upward trend. This pattern indicates significant volatility ahead, pointing to the potential for large price movements once the breakout occurs.

The formation of the triangle suggests a period of consolidation before a sharp price move. Investors are closely monitoring this pattern for signs of a breakout or breakdown. With the apex of the triangle nearing, Dogecoin could experience a shift in momentum that could push its price higher or lead to a correction.

Bearish Signals and Liquidity Accumulation Near $0.17

Despite the optimistic outlook for a price breakout, there are bearish signals on Dogecoin’s chart that traders should not overlook. Recent price action shows Dogecoin dropping by 5.2% within 24 hours, raising concerns among some market participants. Analysts are pointing to the accumulation of liquidity around the $0.17 level, which could result in a short-term correction if broken.

Liquidity accumulation near $0.17 may trigger a significant correction. If the price falls below this level, support levels at $0.15 and $0.13 are in focus. These areas could act as technical support points where the price may find stability before any further movements.

A decline to this level would represent a roughly 20% drop from recent highs. Market activity and technical indicators suggest that a corrective phase could occur before Dogecoin makes another attempt at a bullish rally. Monitoring liquidity and support zones is essential for identifying optimal entry points.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |