Key Insights:

- Ethereum dropped 3.59% in 24 hours, triggering over $296 million in trader liquidations.

- Whale wallets reduced holdings below 75% for the first time in seven months.

- Smaller ETH wallets now hold a record 2.3% of supply, driven by rising staking activity.

Ethereum’s sharp price decline to $1,945 triggered a major wave of liquidations. In the last 24 hours, 105,052 traders were liquidated, with the total value erased hitting $296.54 million, according to CW . The single largest liquidation took place on Bitget, where an $8.2 million ETH position was closed.

The price drop came with heavy volume, and the sharp move down pushed overleveraged positions out of the market. Ethereum has fallen 3.59% in the last 24 hours and is down 14.39% over the past week.

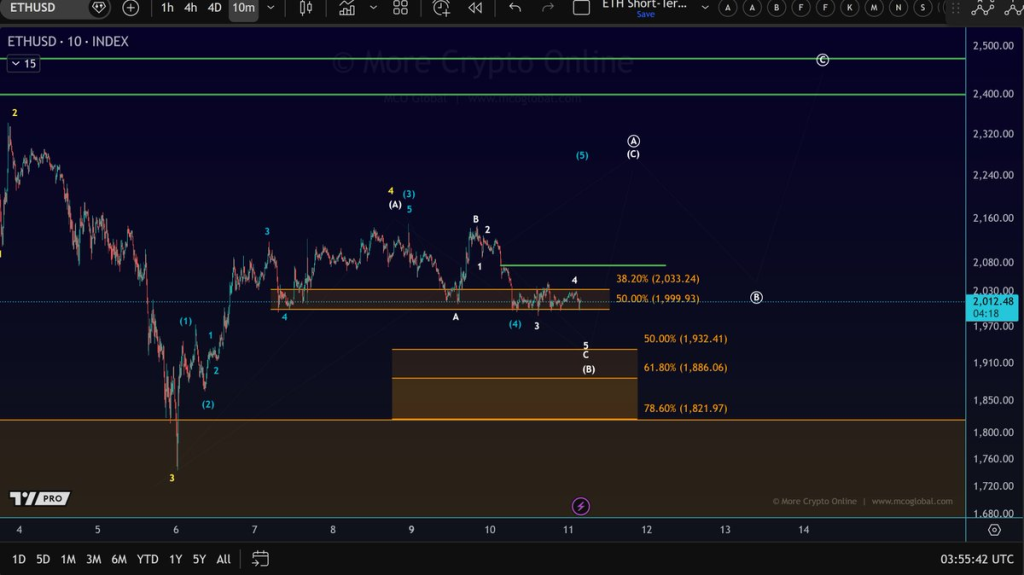

Analysts Track Key Support as ETH Retests $2,000 Zone

Ethereum’s price is now sitting near a key short-term support zone. Chart data from More Crypto Online shows the asset hovering around the 50% Fibonacci retracement at $1,999.93 and 38.2% at $2,033.24. The price has revisited this zone several times without showing a strong bounce.

More Crypto Online noted,

“The white scenario currently appears to be the more probable pathway, as price has not shown a meaningful upside reaction from the upper micro support zone and is testing it again.”

However, If Ethereum continues lower, the next major support area sits between $1,821 and $1,932, which includes deeper retracement levels where some buying interest may return.

BingX offers exclusive rewards and top-tier security for new and high-volume crypto traders.

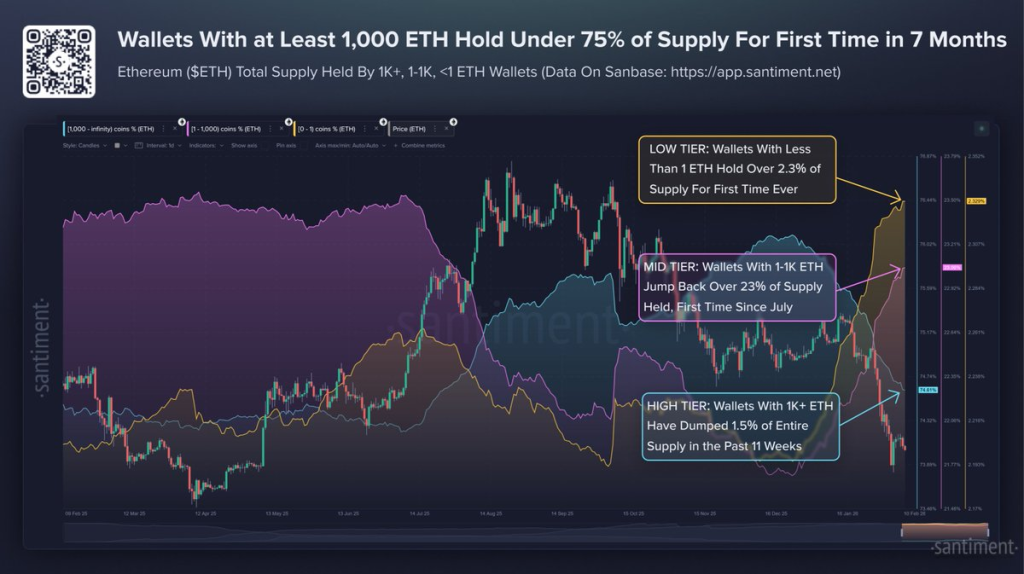

Whale Wallets Cut Holdings for First Time in Months

Large Ethereum wallets are reducing their positions. According to Santiment, addresses holding over 1,000 ETH now control less than 75% of the total supply. This shift marks the first time in seven months that these large holders have dropped below that level. Roughly 1.5% of Ethereum’s supply has been sold by these wallets since late December.

Santiment stated,

“Wallets with at least 1,000 Ethereum are collectively holding less than 75% of the coin’s supply after dumping ~1.5% of the supply since Christmas.”

This change signals a clear move out of large hands during recent market pressure.

Small Holders Gain More Control of Supply

At the same time, smaller Ethereum wallets are gaining a bigger share of the supply. Wallets holding between 1 and 1,000 ETH have now moved back above 23% of total supply, a level not seen since July. Meanwhile, wallets with less than 1 ETH now hold 2.3% of all ETH — the highest level recorded to date.

Santiment added, “Small wallets are likely growing due to staking, as those with <1 $ETH now hold their highest percentage of supply (2.3%) ever.” This shift shows how ETH is becoming more distributed across smaller holders.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.