Ethereum Breakdown: Price Falls 10%, Support at Risk Below $1.8K

Key Insights:

- Ethereum broke $2,000 support, plunging fast as traders faced mass liquidations and panic selling.

- Price sits under $2,093 resistance, keeping short-term structure bearish with risks of new lows.

- Ethereum’s active addresses hit record highs, yet price action shows weak buyer follow-through.

Ethereum (ETH) fell below the $2,000 level and quickly lost nearly 10% of its value. The drop followed a period of weak price action and ended with a sharp breakdown. As of now, ETH trades near $1,997 after touching a local low close to $1,820.

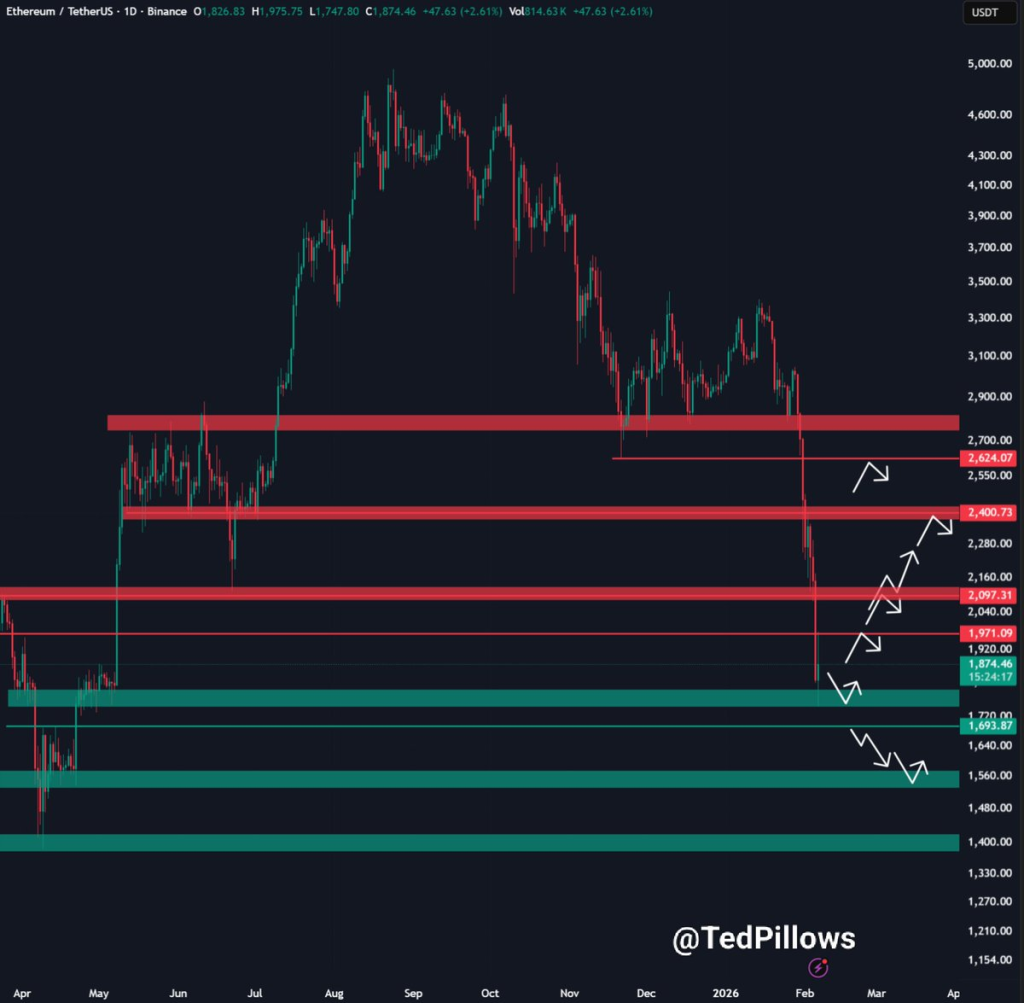

The move came after a clean break of a key support level. Market participants reacted with heavy selling, and several long positions were liquidated in the process. Analyst TedPillows stated, “$ETH lost the $2,000 level and immediately dumped 10%.” He added that the next area of support lines up with ETH’s April 2025 low, where liquidation levels remain active.

Resistance Holds at $2,093

ETH has bounced off $1,820, which aligns with the 78.6% Fibonacci retracement. Despite this bounce, the reaction has been weak. The price remains under $2,093, which is seen as the nearest resistance. This level also matches the 0.618 Fib and former supply zone from recent breakdowns.

Man of Bitcoin commented,

“As long as ETH trades below $2,093, downside risk remains active.”

The market structure still prints lower highs, and buyers have not been able to break above the resistance. Without a clean move above $2,093, the chances of another drop remain high.

Next Support Zones Below

BingX offers exclusive rewards and top-tier security for new and high-volume crypto traders.

If ETH fails to hold the $1,820–$1,780 zone, traders are watching $1,690 and $1,600 as the next key levels. The $1,690 level matches the April 2025 bottom and is closely tracked by traders. It is also the region where remaining Trend Research liquidation levels are said to sit.

A deeper move toward $1,600 would bring ETH back to a previous demand zone. This area also matches the 0.887 Fibonacci level and has shown buying interest in the past. Price action in the coming days will likely center around whether ETH can hold above current support or push through the $2,093 resistance.

Network Activity Grows Despite Drop

While price has been falling, Ethereum network usage is rising. Data from Maartun shows that active addresses on Ethereum have hit a new all-time high. The 30-day average has reached 693,335 addresses, suggesting more user activity on-chain.

So far, the spike in address count hasn’t affected price. ETH remains down 26.71% over the past week. It has gained around 2.6% in the past 24 hours, but overall price structure remains weak while user activity increases.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.