Federal Reserve Chair Signals Inflation Risks Amid Policy Adjustments

- Powell highlights inflation risks and policy shifts at Federal Reserve.

- Inflation risks tilt upward, affecting financial strategies.

- Policy adjustments create uncertainty in financial markets.

Federal Reserve Chairman Jerome Powell stressed inflation risks favor upward movement during a recent address, impacting financial market dynamics.

Economic policy concerns arise amid shifting risk assessments, influencing investor sentiment and market volatility.

Powell’s Inflation Warning Influences Financial Markets

Federal Reserve Chair Jerome Powell recently highlighted that inflation risk is skewed to the upside with no risk-free path for policy. These remarks were reportedly conveyed in a BlockBeats News article dated December 11, citing Xinhua News Agency.

With the focus on managing inflation, the risk balance has shifted, indicating potential adjustments in monetary policy. This shift alters previous understandings of economic stability, as officials weigh options.

The statement from Powell led to mixed reactions across financial markets, with some observers expressing concern over potential volatility. Market analysts suggest a cautious approach amid possible changes in interest rate strategies.

Regulatory Landscape Shifts with Fed’s Policy Adjustments

Did you know? Federal Reserve’s acknowledgment of upward inflation risks marks an important departure from previous policy stances, highlighting increasing emphasis on adaptive monetary strategies.

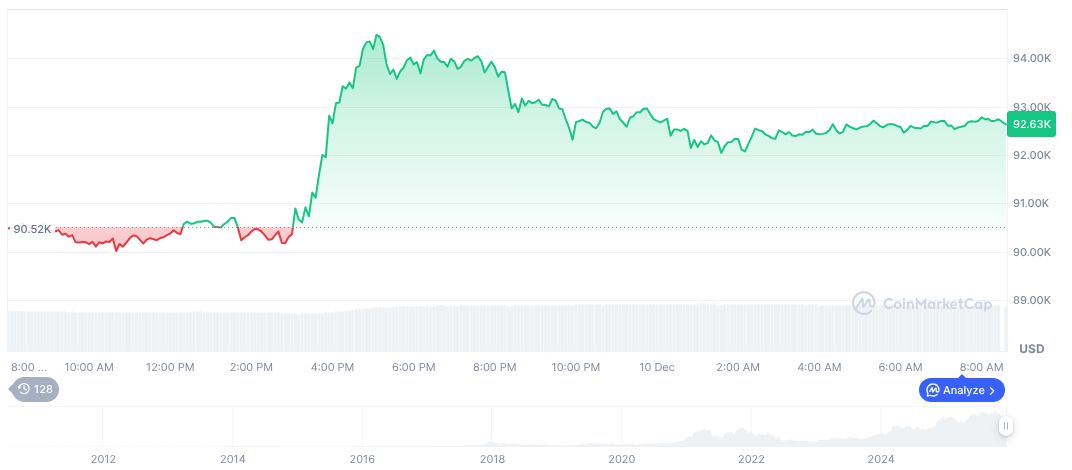

As of December 10, 2025, Bitcoin (BTC) trades at $92,866.28 with a market cap of $1.85 trillion, according to CoinMarketCap. Despite a 0.93% decrease in the past 24 hours, it retains a 58.35% market dominance.

“Adaptive policy measures are vital in the current economic climate,” noted a leading economist, underscoring the impact on regulatory landscapes as the Federal Reserve evolves its stance.

Financial analysts from Coincu highlight potential shifts in regulatory landscapes affecting cryptocurrency valuations, driven by the Federal Reserve’s evolving stance. Adaptive policy measures are anticipated to impact economic stability and technological investments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |