- Tom Lee’s bullish Bitcoin outlook contrasts with Fundstrat’s cautious strategy due to market volatility.

- Debate highlights internal consensus on crypto risk management.

- Community questions alignments until clarified by key figures.

Fundstrat’s Tom Lee maintains a bullish stance on Bitcoin, contrasting with bearish projections from his colleague Sean Farrell, sparking debate among analysts and clients online.

This clash highlights diverse strategic insights within Fundstrat, influencing investor sentiment and emphasizing the need for nuanced understanding in volatile crypto markets.

Divergent Bitcoin Perspectives: Analysis of Fundstrat’s Strategic Debate

Tom Lee’s bullish stance on Bitcoin contrasts with a more cautious approach by some Fundstrat analysts, triggering a debate over interpretations of internal strategy. Tom Lee is known for his long-term bullish outlook, predicting Bitcoin could hit $150,000 by the end of 2025. Sean Farrell, head of digital asset strategy, focuses on short-term risk management, advocating for portfolio adjustments when Bitcoin prices fluctuate, particularly if they retreat to $60,000-$65,000. Concurrently, Mark Newton, a technical analyst at Fundstrat, anticipates recovery post-initial setbacks, seeing potential for growth by year-end. Cassian, a Fundstrat client, emphasized understanding the different roles within the firm to properly interpret their strategies, helping dispel misconceptions about contradictions. Community response initially centered on perceived inconsistencies within Fundstrat’s outlook, until Cassian’s clarification provided a consistent view on Bitcoin’s macro outlook and risk strategies, gaining an endorsement from Tom Lee.

Community response initially centered on perceived inconsistencies within Fundstrat’s outlook, until Cassian’s clarification provided a consistent view on Bitcoin’s macro outlook and risk strategies, gaining an endorsement from Tom Lee.

“The three core figures at Fundstrat have clearly defined roles: Tom Lee… macro and liquidity… long-term bullish; Sean Farrell… short-term defense… 50% to cash at $60K-$65K; Mark Newton… technical repair post-rebound.” — Cassian

Bitcoin’s Market Dynamics and Historical Comparisons

Did you know? In past market trends, Bitcoin’s dramatic swings often sparked debates similar to Fundstrat’s internal discussions, underscoring how differing strategies within organizations reflect layers of analysis with varied risk horizons.

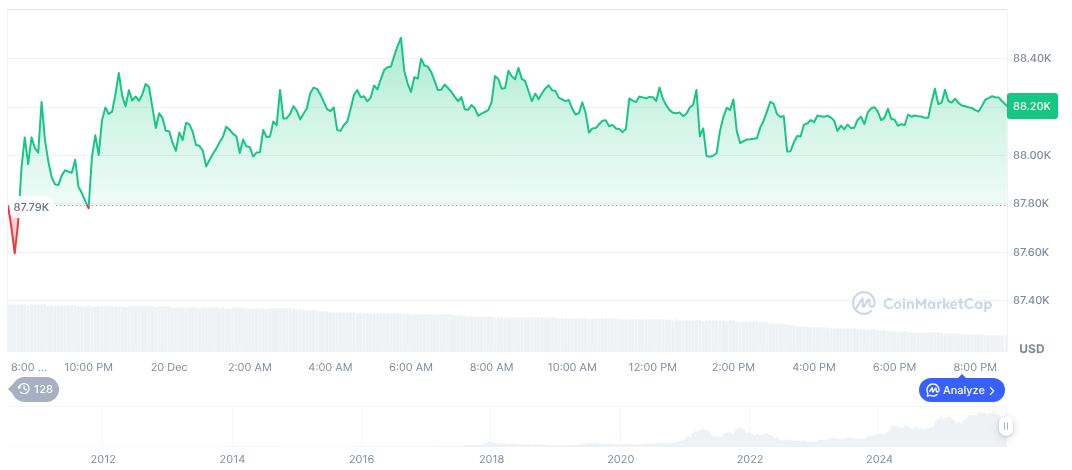

Bitcoin (BTC)’s current value stands at $88,037.80 with a market cap of $1.76 trillion and a dominance of 59.02%, according to CoinMarketCap. Recent data indicates a 24-hour trading volume of $18.07 billion, reflecting a pared-down activity, while the price witnessed slight decreases across short and medium-term durations. Historical price shifts emphasize the digital currency’s volatile nature, showing a 30-day increase of 6.26%, amid broader market corrections over the 90-day period. The Coincu research team highlights that amidst fundamental and macroeconomic uncertainties, regulatory changes and technological advancements will significantly influence cryptocurrencies’ market directions, with key stakeholders carefully monitoring adaptations needed for sustained growth.

Recent data indicates a 24-hour trading volume of $18.07 billion, reflecting a pared-down activity, while the price witnessed slight decreases across short and medium-term durations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |