Here Is Solana Price as Galaxy Digital Facilitates $1.65B Deal

Key Points

- Solana price stands at $226.30 following major institutional acquisition.

- Galaxy Digital manages $1.65B SOL deal for Forward Industries.

- $326M in SOL moved off exchanges, signaling large-scale accumulation.

Galaxy Digital facilitated Forward Industries’ acquisition of $1.65 billion worth of Solana (SOL) through a private placement. On-chain data confirmed $326 million in SOL was withdrawn from exchanges within the last 14 hours.

These movements included large-scale capital transfers, mainly in USDC and USDT, across Binance and Bybit. The structured inflows reflect coordinated institutional buying and immediate deployment into Solana positions.

Exchange Withdrawals Signal Strategic Accumulation Phase

Galaxy Digital withdrew 1,452,392 SOL from exchanges, signaling aggressive buying activity through OTC and spot channels. Binance saw inflows of 60M, 58M, 52M, 50M, and 49M USDC, suggesting staggered execution.

Additional OTC activity included a $319.43M USDC transfer, while Bybit received 32M and 30M USDT in quick succession. Forward Industries still holds over $1.3 billion in reserves for further SOL purchases.

Market Sentiment Shifts as Solana Breaks Technical Barriers

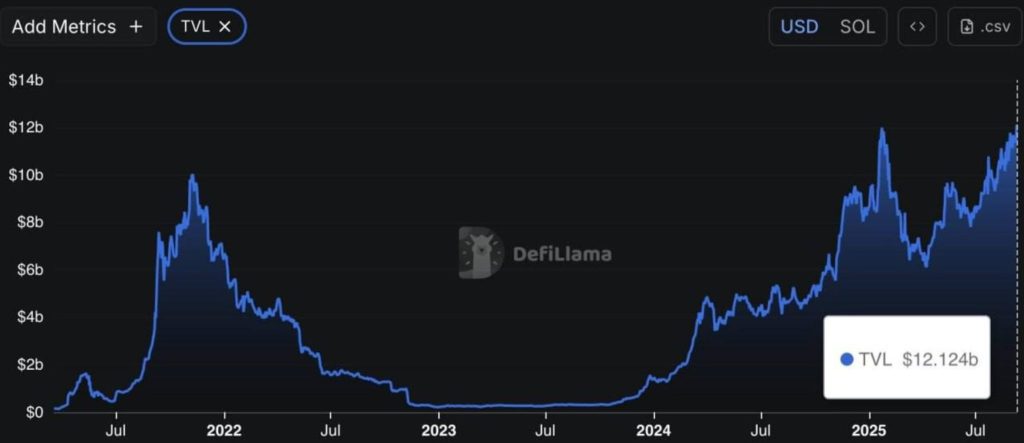

Solana’s total value locked (TVL) surpassed $12.124 billion, marking a record high and reflecting revived confidence in its DeFi ecosystem. The growth highlights a strong recovery from 2022 lows, when TVL fell below $1 billion.

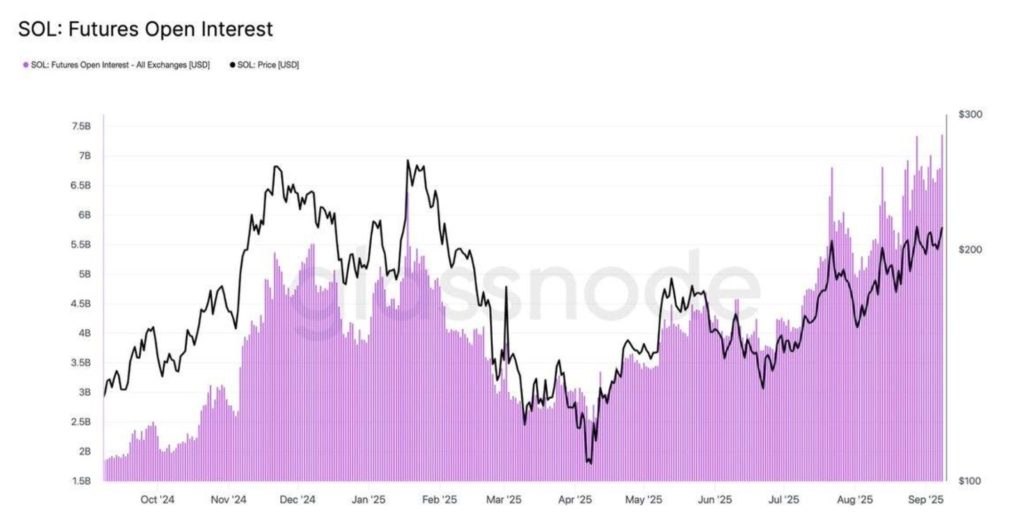

Moreover, Glassnode reported Solana’s futures open interest surged to $7.5 billion, indicating high leverage and growing speculative interest. The price climbed steadily above $200 and currently trades at $226.30.

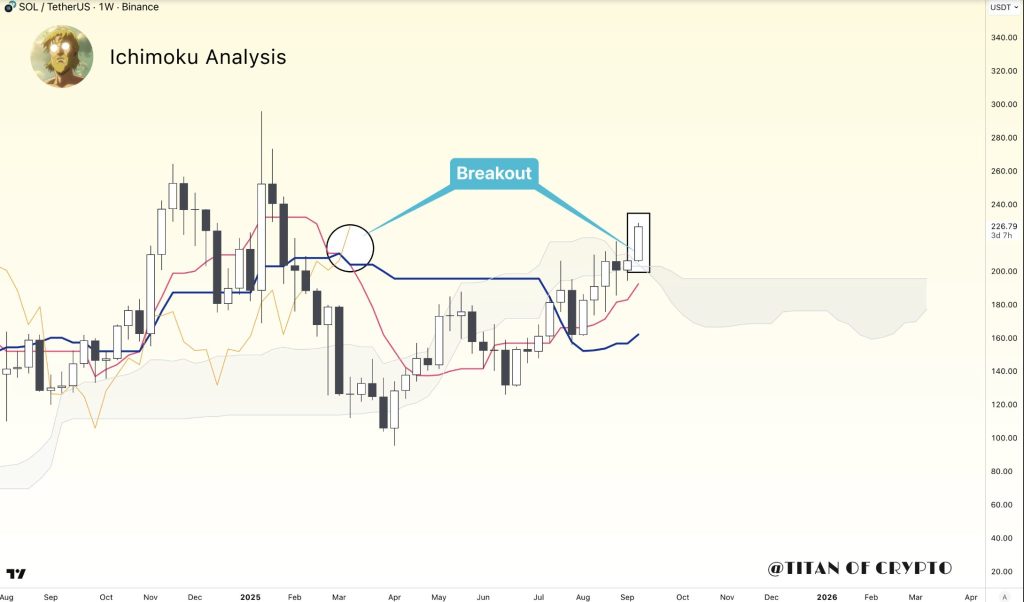

Looking at price, Ichimoku indicators on the weekly chart confirmed a bullish breakout above the cloud in the $200–$210 range. Titan of Crypto identified this as a momentum continuation setup toward higher resistance zones between $250 and $300.

Derivatives activity and spot demand continue to support the rally, adding strength to the ongoing institutional accumulation. With technical momentum in place, Solana remains positioned for short-term upside potential.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |