Key Points

- XRP tests $3.10 resistance with RSI signaling strong buying pressure and bullish momentum.

- Analysts set upside targets at $3.30–$4.17 if breakout above $3.20 confirms trend.

- Support zones at $3.03, $2.85, and $2.70 remain critical if bullish move fails.

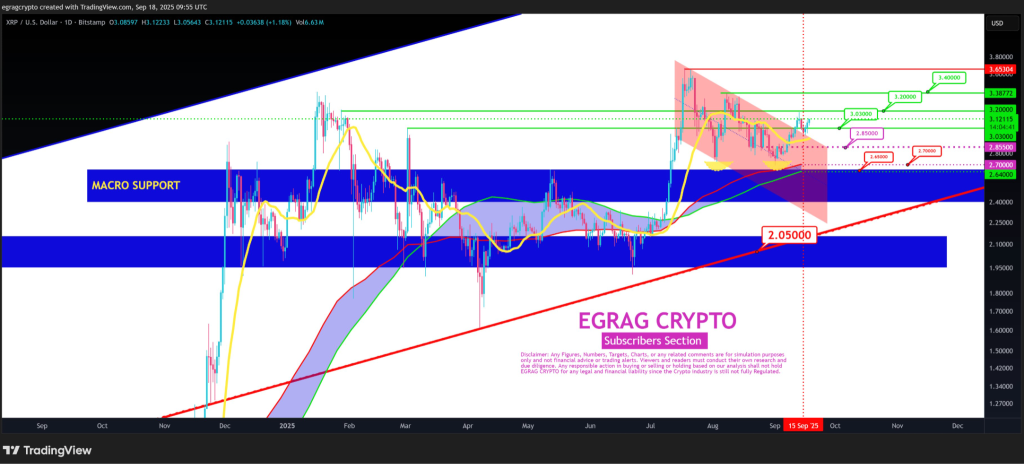

XRP is pressing against resistance at $3.10, with momentum strengthening as the Relative Strength Index moves higher. Dark Defender notes that this descending resistance trendline has weakened after multiple tests, raising the likelihood of a decisive breakout.

If XRP clears the $3.10 level, the analyst projects a rally toward the 261.80% Fibonacci extension at $4.1711. However, if the move fails, immediate support stands near $2.8057, which may provide a cushion against downside pressure.

Furthermore, EGRAG CRYPTO identifies $3.03 as the critical support zone, which held during a recent retest on September 15. The analyst adds that a break below this level could expose supports at $2.85 and deeper levels at $2.70–$2.65.

On the upside, a daily close above $3.20 would confirm bullish continuation, with near-term targets set at $3.30 and $3.40–$3.65. Therefore, the range between $3.03 and $3.20 remains decisive, as consolidation narrows before a larger directional move.

Market Data Supports Growing Bullish Sentiment

According to Coinglass, XRP trades at $3.1131, up 3.49% in 24 hours, with spot volume at $1.81 billion. Futures volume reached $9.07 billion, while market cap stood at $185.98 billion with circulating supply of 59.78 billion XRP.

Performance metrics reveal gains across multiple timeframes, including a 49.67% rise year-to-date and a 432.66% surge over the past year. Derivatives sentiment also supports strength, as Binance’s long/short ratio is 3.0193 and OKX shows a bullish lean at 1.7.

Overall, XRP’s technical structure, analyst outlooks, and derivatives positioning indicate growing probability of a breakout if key resistance levels are reclaimed. Focus remains on the $3.20 level for confirmation, while supports at $3.03 and $2.85 help guard against deeper pullbacks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |