Key Insights:

- HYPE breaks below $32 support as liquidity data shows heavy long exposure between $28 and $32.

- Repeated rejections near $32.5 signal weak buying strength and rising downside risk for leveraged traders.

- Failure to reclaim former support keeps focus on $28 as the next major liquidation zone.

Hyperliquid’s native token, HYPE, was trading at $32.40, marking a 6.8% drop over the last 24 hours. Trading volume reached $1.03 billion during the same period, showing sustained activity as price moves lower. Over the past seven days, HYPE has declined by 0.5%, signaling short-term weakness after recent price swings.

Market focus has shifted toward downside levels as both price structure and positioning data point to growing pressure below current levels. Traders are closely watching whether HYPE can hold above key zones or extend losses.

Liquidity Builds Between $28 and $32

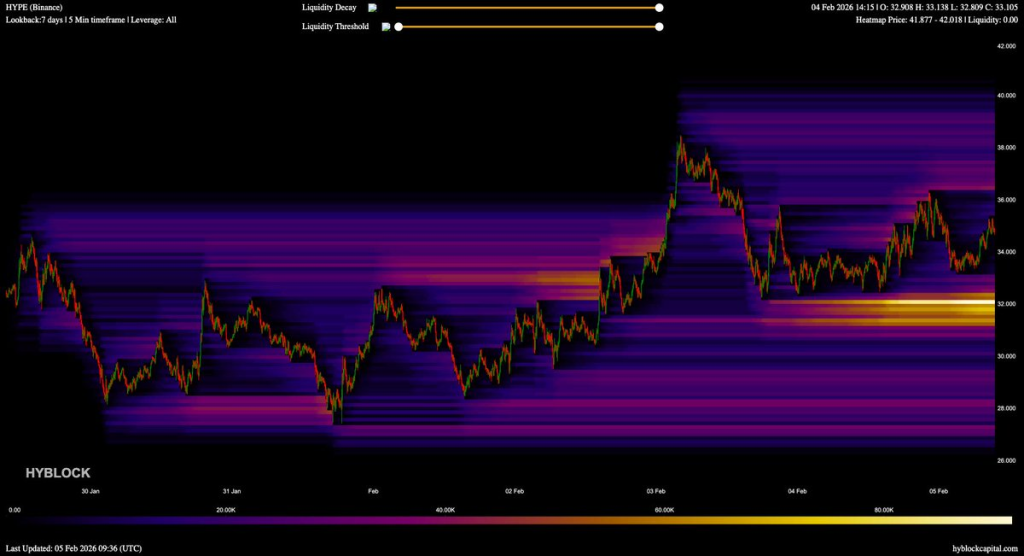

Liquidity data indicates a dense concentration of long liquidation levels between $28 and $32. This range contains a large number of leveraged long positions that may be forced to close if price moves lower. Ardi stated that “$HYPE has a wall of long liquidations sitting between $28–$32,” describing a zone where sell pressure could rise quickly.

Heatmap data confirms this buildup. Bright bands in the $28–$32 range show where forced liquidations are likely to occur. When price enters such areas, selling often accelerates as stop orders and margin calls are triggered.

Rejections Above $32.5 Limit Upside

Price action shows repeated failures to hold above the $32.5 level. Each bounce has been followed by a pullback, suggesting buyers are struggling to maintain control.

According to Ardi,

“price keeps bouncing off $32.5, but every rejection from $35 builds more long exposure underneath.”

These rejections have allowed long positions to accumulate below resistance. As price remains capped, risk increases for traders positioned for upside. The longer price stays below recent highs, the larger the liquidation pool becomes below current levels.

Loss of Horizontal Support Changes Structure

BingX offers exclusive rewards and top-tier security for new and high-volume crypto traders.

Technical charts show that HYPE has moved below a horizontal support zone near $32–$33. This area previously acted as a base where price paused and reversed. Recent candles have closed below this range, showing acceptance under former support.

SilverBulletBTC noted that “$HYPE broke below an important horizontal support.” Price has since failed to reclaim this level, suggesting that buying interest has weakened. Former support now stands as resistance, limiting recovery attempts.

Attention Turns Toward the $28 Zone

With price trading below $32.5, attention has shifted to the next major liquidity area. Data shows fewer barriers between current levels and $28, where liquidation density is highest. Ardi warned that “if $32.5 cracks, market makers feast all the way down to $28.”

As long as HYPE remains below lost support, downside risk stays active. A move back above $32.5 would be needed to reduce pressure. Until then, the $28–$32 range remains the main focus for market participants.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.