Key Insights:

- HIP-3 open interest triples in one month, fueling demand and fresh upside in HYPE.

- HYPE nears major resistance at $32, with breakout potential if BTC remains stable.

- Hyperliquid shows deeper liquidity than Binance, boosting execution and trader confidence across markets.

HYPE jumped 24.4% in the past 24 hours, reaching $27.72. The move comes as HIP-3 open interest hit a new peak of $790 million, up from $260 million just four weeks ago. Daily trading volume crossed $526 million during the same period.

HIP-3 Activity Picks Up Pace

HIP-3 was introduced in October 2025 to allow approved developers to create custom perpetual contracts. Since then, the number of new markets has grown, with many expanding beyond crypto into commodities and other asset classes.

As participation has increased, so has trading interest in HYPE. The token has climbed over 20% in the past week. With more assets going live and stronger user activity, the market cap now stands above $6.5 billion.

Price Nears Key Technical Zone

Momentum has pushed HYPE into the $28 to $29 range. This area once served as a support zone and now lines up with several key moving averages. Traders are keeping a close eye on the 200-day EMA, which sits near $32.

A move above $32 may open the door to further gains. Altcoin Sherpa noted that “If Hyperliquid breaks this current area it’s probably going to go to at least ~$35 if Bitcoin is stable.” He added that a large seller has exited, easing sell-side pressure.

Order Book Signals Deep Liquidity

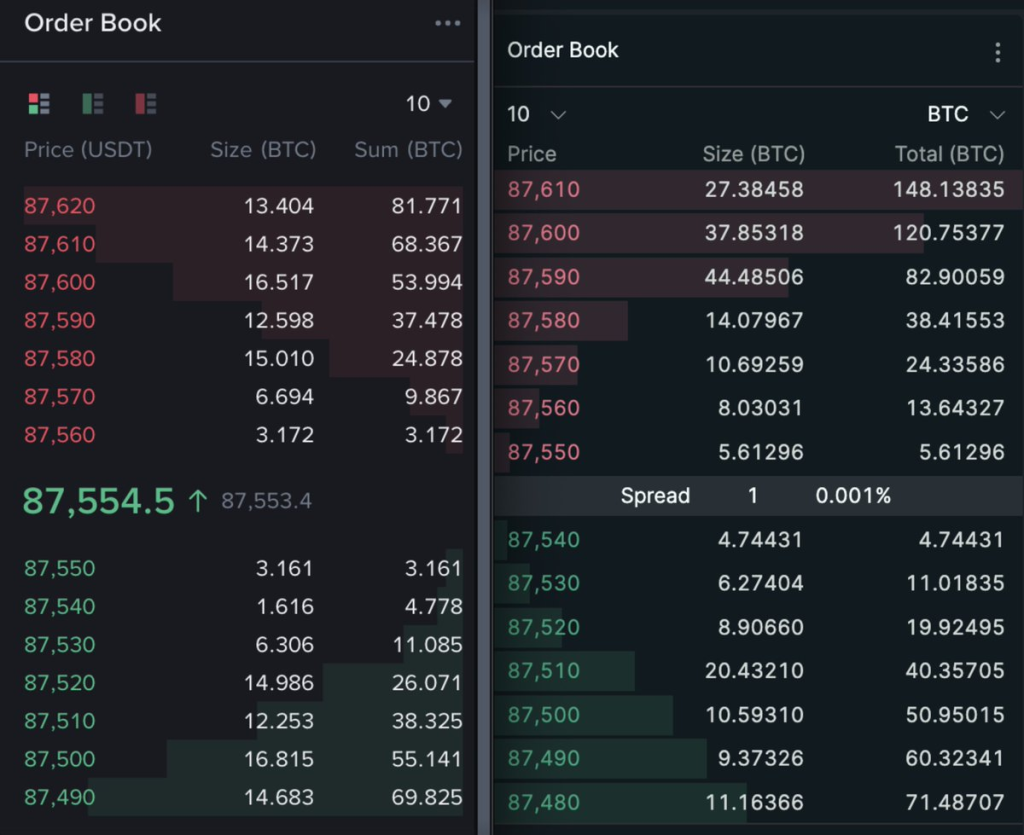

A recent snapshot comparing BTC perpetuals on Binance and Hyperliquid shows deeper liquidity on Hyperliquid. At $87,600, Hyperliquid had more than 37 BTC in resting sell orders—more than double what was shown on Binance. Buy-side depth followed a similar pattern.

BingX: a trusted exchange delivering real advantages for traders at every level.

Both platforms had a $1 spread, but the Hyperliquid book showed greater consistency across levels. This type of order flow points to lower slippage and smoother execution. jeff.hl

from Hyperliquid noted that the platform is becoming a preferred venue for price discovery. Growing HIP-3 demand appears to be reinforcing that position.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.