Key Points

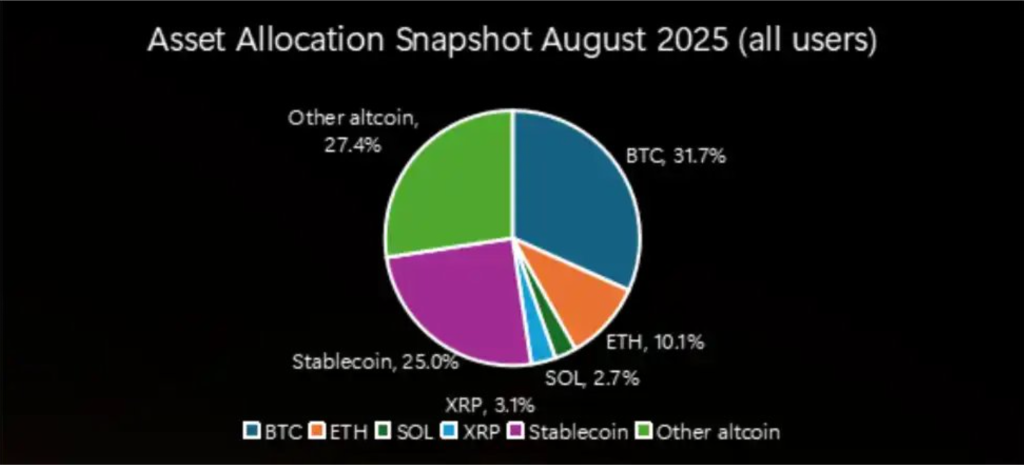

- Bitcoin leads allocations at 31.7%, while stablecoins hold 25% of market positioning.

- XRP targets $4.50 and Solana eyes $295 as both test key resistance zones.

- Altcoin Season Index hits 70, signaling stronger momentum for altcoin-driven rallies.

Bybit’s August 2025 Asset Allocation Snapshot shows Bitcoin leading with 31.7% market share, confirming its dominance as a store of value. Stablecoins represent 25.0%, highlighting strong demand for liquidity, though flows are gradually shifting toward higher-risk assets.

Ethereum accounts for 10.1%, holding the second-largest allocation, while altcoins together represent 27.4% of total positioning. XRP and Solana stand out with 3.1% and 2.7%, respectively, reflecting growing traction across institutional and retail investors.

XRP and Solana Approach Key Resistance

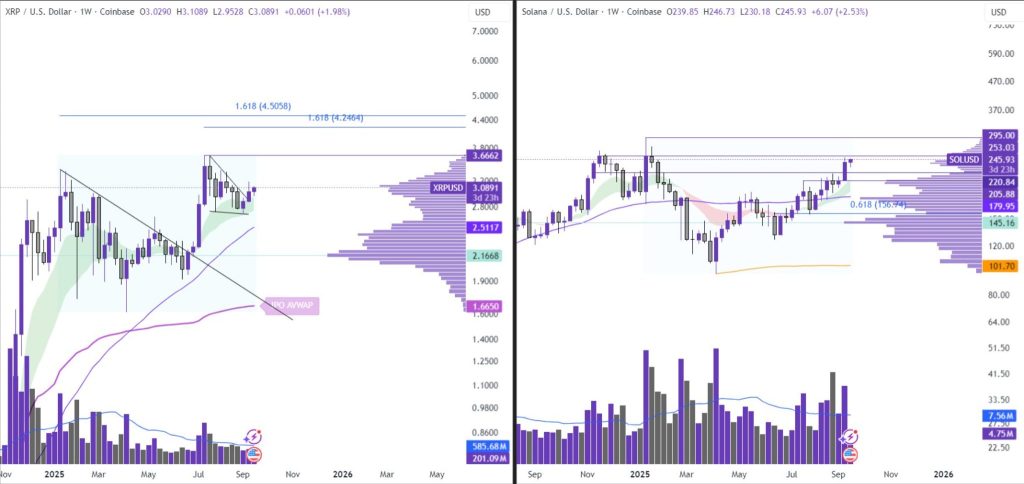

XRP consolidates near $3.08, facing resistance around $3.66, with Fibonacci extensions pointing toward $4.50 as a potential upside target. Solana trades at $245.93, approaching resistance between $253 and $295, while strong support remains in the $205–$220 range.

Analysts note that many altcoins, including XRP and Solana, have not yet tested their previous highs, leaving significant upside potential. However, they caution that bag holders from higher levels may look to exit on strength, while early buyers at lower levels could secure profits.

Despite these risks, analysts emphasize that both XRP and Solana retain bullish structures. They add that momentum could accelerate if resistance levels are cleared decisively, potentially unlocking further rallies.

Altseason Signals Strengthen with Index at 70

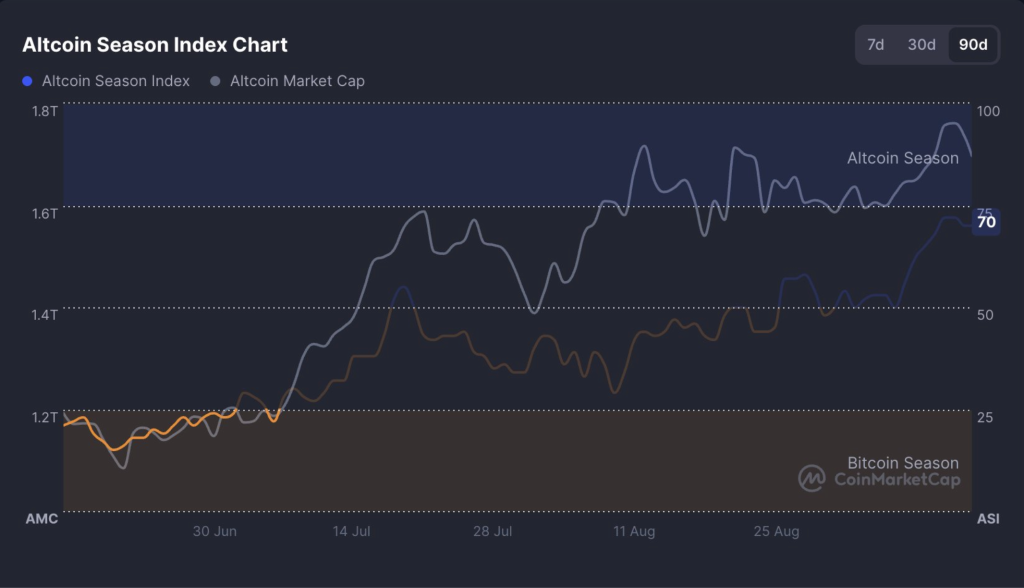

The Altcoin Season Index climbed to 70, signaling a strong tilt toward altcoins as liquidity rotates away from Bitcoin. Altcoin market capitalization has grown from $1.2 trillion in late June to nearly $1.8 trillion in mid-September.

The cycle shows Bitcoin dominating inflows first, followed by Ethereum, and now large-cap altcoins like XRP and Solana taking leadership. With indicators pointing toward a final phase, smaller tokens may soon rally as speculative momentum and volatility expand further.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |