Litecoin Could Break Out of 9 Year Consolidation With $1,000 Target in Sight

Key Insights:

- Litecoin’s $1,000 price target builds on a 9-year consolidation pattern signaling a possible breakout.

- Litecoin 91% of the supply is mined, with the remaining coins released over the next century.

- Declining TVL and volatile fees reflect mixed network activity despite brief surges.

Litecoin could be nearing a major turning point after years of sideways movement. Market watchers point to a long consolidation pattern that may set the stage for a breakout. Some analysts now track a possible $1,000 price target if momentum builds.

Litecoin Price Pattern Signals Long-Term Breakout Setup

Crypto analysts note that Litecoin has traded within a broad range for nearly nine years. A chart shared by Bitcoinsensus describes a massive 9-year consolidation channel in the making.

The analyst added that “the breakout could be monumental whenever it happens.”

The analyst believes the cryptocurrency could experience a significant breakout, potentially reaching $1,000 per coin. Litecoin is currently trading at $55.18, with a trading volume record of $310,056,097 in the last 24 hours. The asset has gained 2.35% in the last 24 hours.

Technical traders often watch long consolidation phases. These patterns can precede strong price moves when resistance levels break. Litecoin investors now monitor key price zones for confirmation.

On-Chain Data Shows 91% of Litecoin Supply Mined

Meanwhile, as of February 2026, Litecoin has reached an important milestone in its supply chain. Approximately 91% of the total supply has already been mined, according to BSCNews. The network’s total supply is capped at 84 million coins, and this large portion of the supply has already been reached.

As mentioned by BSCN, the remaining supply will take over 100 years to fully mine. This milestone could influence Litecoin’s value, as scarcity tends to drive up demand. The relatively low amount of coins left to mine might result in increased volatility in future supply and demand.

While the fixed supply is seen as a positive factor in the long-term outlook for LTC, the current market conditions still suggest cautious optimism. Litecoin’s miners have faced difficulties as they continue to work through the remaining coins.

Declining TVL and Network Fees Reflect Mixed Activity

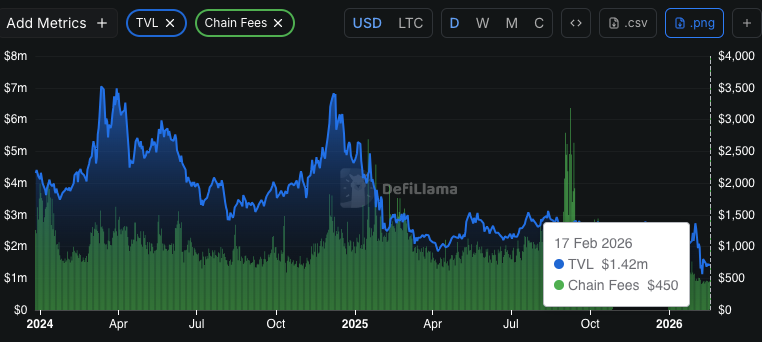

Furthermore, Litecoin’s total value locked stands at $1.42 million as of Feb. 17, 2026. This marks a drop from nearly $7 million recorded in 2024. The data shows a steady decline through 2025.

While the coin’s daily chain fees remain at $450, volatility has continued to affect the network’s long-term liquidity. Brief fee spikes appeared in early and late 2025. These spikes suggest short bursts of network activity.

Despite intermittent usage increases, locked capital has not recovered. The combination of reduced TVL and limited fee growth shows uneven engagement. Traders watch whether renewed activity aligns with the long-term breakout pattern.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |