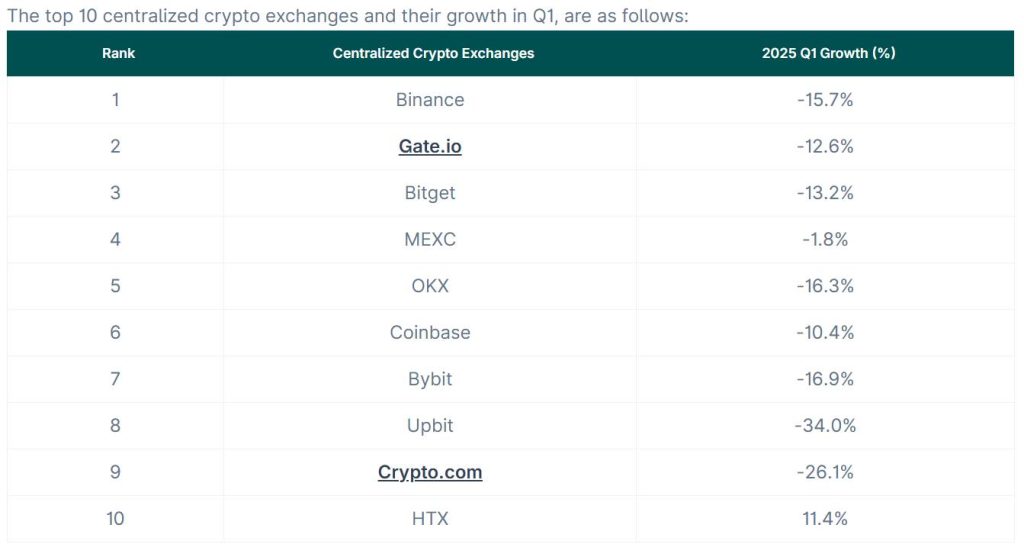

| Key Points: – Market share of centralized crypto exchanges reveals Binance dominance with 38% in April 2025, despite a drop in volume. – Gate.io surged to second place, the only CEX with double-digit growth. – Bitget continued its steady rise, while most major CEXs saw double-digit volume declines. – Regulatory pressure and internal crises drove major losses for Upbit, Crypto.com, and Bybit. |

Market share of centralized crypto exchanges shows a major shake-up in Q1 2025, with Binance retaining the lead and Gate.io making a surprising leap.

The centralized crypto exchange (CEX) landscape is undergoing major changes in early 2025. While Binance continues to dominate in market share, new contenders like Gate.io and Bitget are reshaping the competitive field. Meanwhile, regulatory crackdowns and internal security issues have caused steep losses for several established players. This article analyzes the Q1 2025 market share breakdown, highlights key shifts in volume, and explores what these trends mean for the future of centralized crypto trading.

Market Share of Centralized Crypto Exchanges Dominated by Binance

The latest CoinGecko report underscores that Binance continues to lead the centralized exchange (CEX) landscape. In April 2025, Binance held a 38.0% market share in spot trading, nearly as much as all other top 9 exchanges combined.

However, its trading volume declined by 18% month-over-month, falling to $482.6 billion, its lowest since October 2024. Despite this dip, Binance closed Q1/2025 with a 37.5% share of the top 10 CEX market, processing $2.0 trillion out of a collective $5.4 trillion trading volume.

Gate.io and Bitget Gain Ground Amid Shifting Market Dynamics

Gate.io stunned the market by claiming second place in April 2025, capturing a 9.0% market share with $113.7 billion in spot volume — a +14.4% increase from March. It was the only CEX to record double-digit growth for the month, surpassing competitors like Crypto.com, which has been in steady decline since February.

Bitget secured the third spot in April with 7.2% market share and $92.0 billion in volume. Its consistent month-over-month growth from 4.6% at the start of the year signals a strong trajectory.

Regulatory & Security Issues Drive Volume Drops in Most Exchanges

Despite recording strong growth in April 2025, Gate.io and Bitget saw a decline on a quarterly basis. Gate.io still saw a -12.6% drop in Q1 trading volumes compared to Q4/2024, totaling $361.3 billion. Bitget was only ninth overall with $279.6 billion and a -13.2% decline.

Meanwhile, the broader picture was grim — 8 of the top 10 exchanges experienced double-digit drops in trading volume during Q1.

- Upbit saw the steepest fall at -34%, driven by a three-month suspension imposed by South Korea’s financial regulator due to anti-money laundering and KYC violations.

- Crypto.com dropped -26.1%, likely linked to prolonged uncertainty over a U.S. SEC investigation, which was closed without penalties in March.

- Bybit lost -16.9% of volume following a major $1.4 billion hack.

- HTX (formerly Huobi) stood out as the only exchange to post growth in Q1, up 11.4%, potentially driven by internal trading activity linked to Justin Sun.

A More Fragmented Future for Centralized Crypto Exchanges

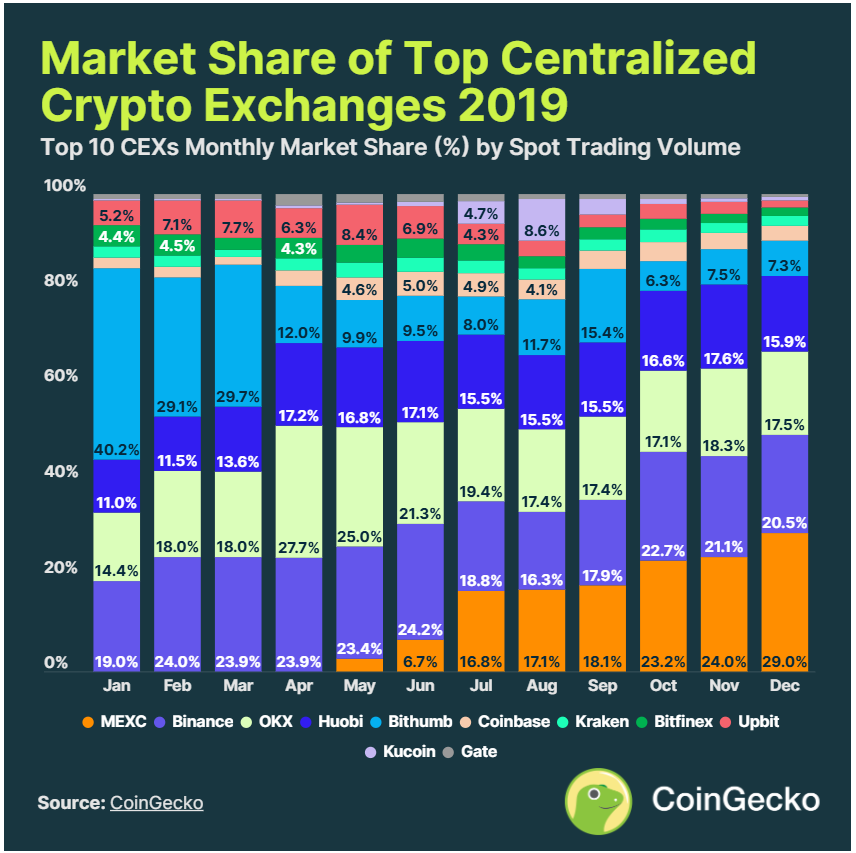

CoinGecko’s five-year historical data (2019–2024) reinforces Binance’s longstanding dominance among centralized crypto exchanges. While Coinbase, OKX, Upbit, and Crypto.com have rotated positions due to shifting user activity and volume, none have managed to dislodge Binance from the top.

That said, the competition has intensified. Newer challengers like Bitget, MEXC, and Gate.io are carving out larger pieces of the pie. As of April 2025, the market share among exchanges ranked 2 through 10 ranges narrowly from 5% to 9%, signaling an ongoing market fragmentation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |