In Brief

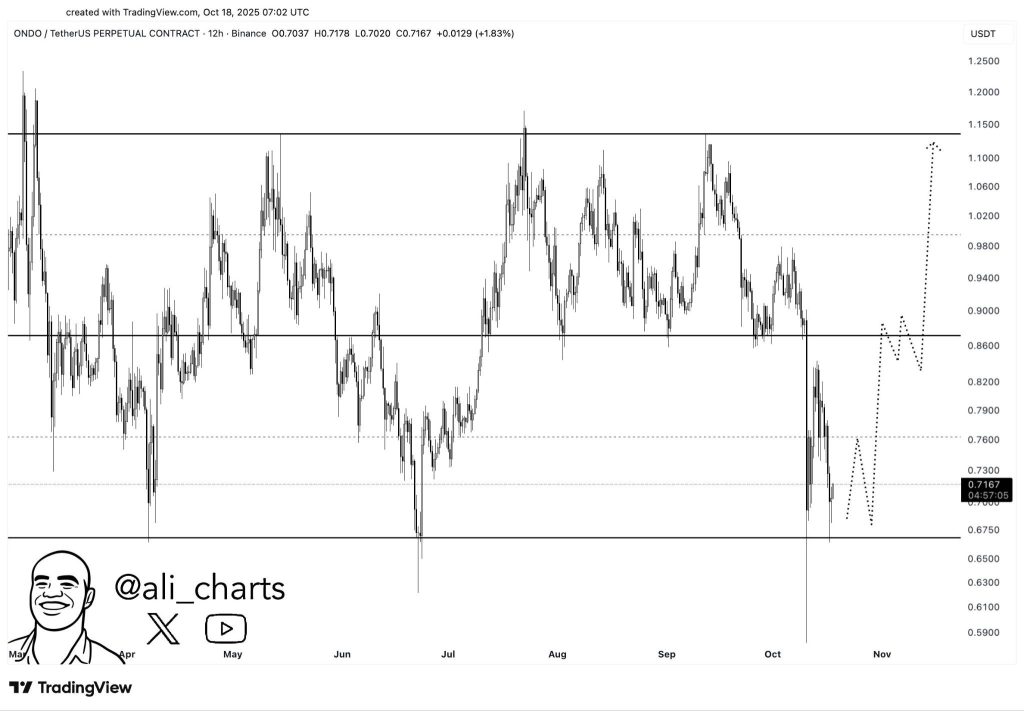

- Ondo trades at $0.718, holding key $0.67 support with targets near $0.86–$1.15.

- TVL surpasses $1.8B with 105 RWA assets and 28K holders, per rwa.xyz.

- Ondo urges SEC to delay Nasdaq’s tokenization plan, citing transparency concerns.

Ondo (ONDO) is showing early signs of a potential rebound while trading at $0.7180, up 4.00% over 24 hours. The token continues to hold above the $0.67 support, which analysts, including ali charts, identify as a key demand zone.

A sustained move above this base could open targets at $0.86 and $1.15, signaling a bullish breakout if momentum builds. However, a close below $0.67 may invalidate this setup, exposing downside risk toward $0.60 in the near term.

Oversold technicals also influence the outlook, with the RSI at 34.6 and the MACD histogram at -0.014, suggesting limited bullish strength. ONDO’s price remains below its 7-day SMA of $0.766, indicating potential consolidation before a clearer trend emerges.

Despite short-term volatility, ONDO rose 0.99% in the past 24 hours, outpacing the broader market’s 0.38% gain. Sector sentiment remains neutral, though ONDO’s proactive regulatory engagement has sparked attention across the tokenisation space.

Regulatory Push and TVL Growth Support Long-Term Strength

Ondo Finance recently urged the SEC to delay Nasdaq’s tokenised securities approval, citing a lack of settlement transparency. The firm argued the plan unfairly favours traditional finance, reinforcing Ondo’s position as a leader in compliant RWA tokenisation.

Meanwhile, according to rwa.xyz, Ondo has surpassed $1.80 billion in total value locked (TVL), up 7.81% month-over-month. The protocol now manages 105 real-world assets with 28,168 holders, reflecting rising adoption and institutional trust.

Monthly active addresses surged 1,930.90% to 42,852, while DeFiLlama confirms the protocol’s TVL rose from under $600 million to $1.78 billion in 2025. This makes Ondo the third-largest RWA issuer behind BitGo and BlackRock.

The divergence between TVL growth and token price suggests long-term capital remains committed, even amid short-term volatility. As key levels hold and fundamentals improve, ONDO’s path toward $1.15 remains in focus.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |