Solana Breaks Downtrend Consolidating To $127: Is This the Start of a Major Breakout?

Key Insights:

- Solana defends support at $127 with growing buyer activity and rising daily trading volume above $3.1B.

- RWA ecosystem on Solana reaches $873M, including U.S. Treasuries, equity, and institutional debt assets.

- Solana generates $38 of every $100 in application revenue, doubling Ethereum’s share in December activity.

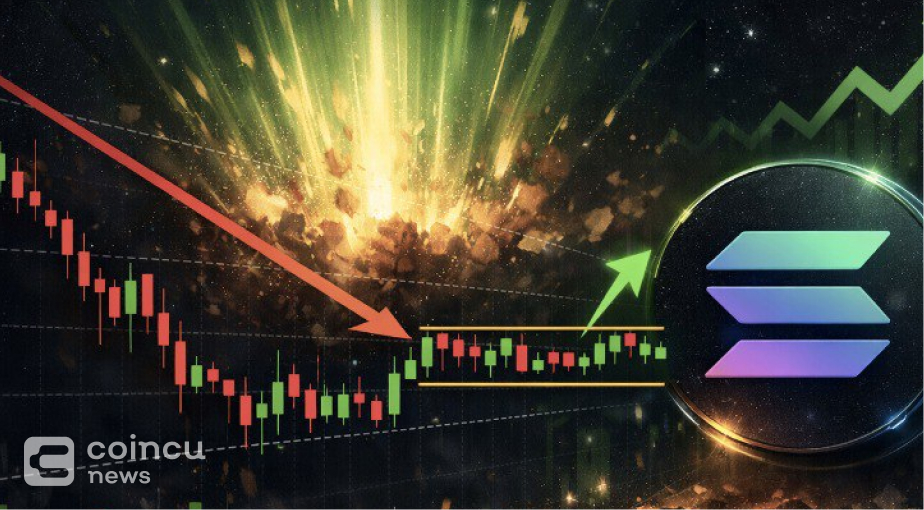

Solana (SOL) is trading near the $127 level after breaking out of a prolonged downtrend. The asset has entered a consolidation phase, and market activity is showing signs that buyers are returning. With renewed interest in real-world assets (RWAs) and increasing application revenue, Solana has started the new year on a steady path.

Buyers Step In as Solana Holds the Lower Range

According to BitGuru, Solana is coming out of a prolonged downtrend and is now trading in a consolidation phase around the $127 level. This suggests that selling pressure has weakened, and buyers are starting to take control. The asset’s ability to hold support near this level indicates that market participants are watching for a possible breakout.

Market charts show increased buying interest near the $120 level. Traders continue to monitor the asset’s movement, as a push above the $130 resistance level could bring further momentum.

Solana has managed to defend its lower support levels and is now trading around $127. The price rose 2.43% over the last 24 hours, with a trading volume of over $3.1 billion. Analysts say the current phase of price stability may signal the start of a new market trend.

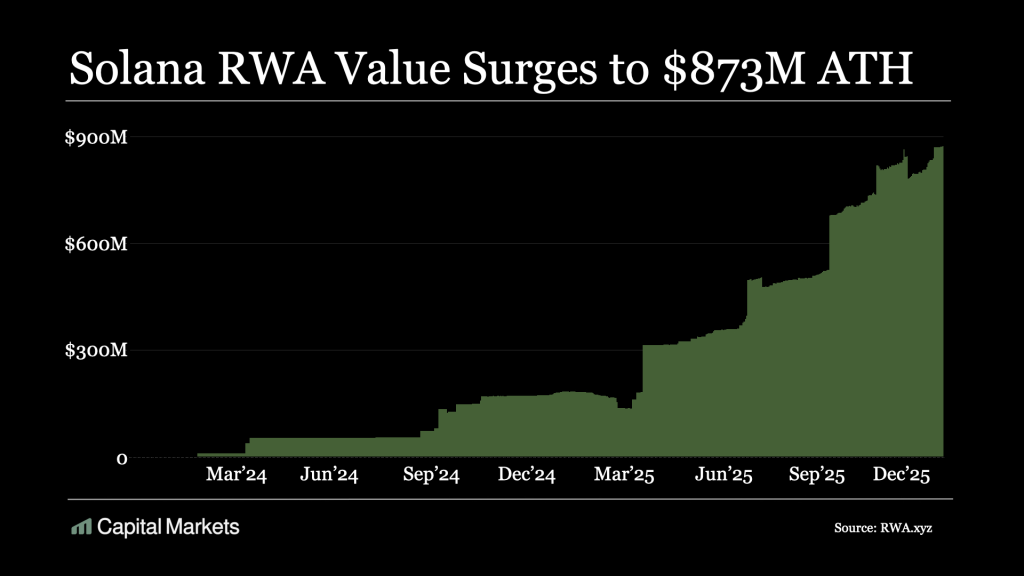

Solana’s RWA Ecosystem Reaches New All-Time High

Meanwhile, Solana’s real-world asset (RWA) ecosystem reached $873 million in value. This new record includes tokenized U.S. Treasury debt, public equity, institutional funds, and non-U.S. government debt. This growth comes as more regulated and yield-bearing assets move onto the blockchain.

The expansion of RWAs has added utility to the Solana network. Investors now use the platform for more than decentralized applications or NFT trading. Instead, they are turning to Solana for real-world financial products that offer yield and transparency.

The rise in on-chain value is also seen as a sign of growing trust in Solana’s network stability and low transaction costs. As traditional finance and blockchain continue to merge, the chain’s infrastructure is being used for new kinds of assets.

Application Revenue Surges as Solana Outpaces Competitors

Data shared by gum 0xGumshoe shows that Solana led all blockchains in application revenue during December. For every $100 in revenue, $38 came from Solana, which is more than double Ethereum’s performance. This suggests that applications built on Solana are seeing higher user engagement and transaction activity.

Developers have continued to build on Solana due to its fast speeds and low fees. These conditions support a strong environment for dApps, gaming, and DeFi tools. More usage on the network has led to increased demand for SOL tokens.

As application activity continues to grow and the network processes more value, Solana is positioned to remain active in the blockchain sector. Traders are watching closely to see whether the current price consolidation turns into a breakout in the coming weeks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |