Key Insights:

- Solana’s price holds at $218, signaling possible short-term base formation for upward movement.

- Institutional interest in Solana rises with $4.15B in SOL holdings, bolstering long-term support.

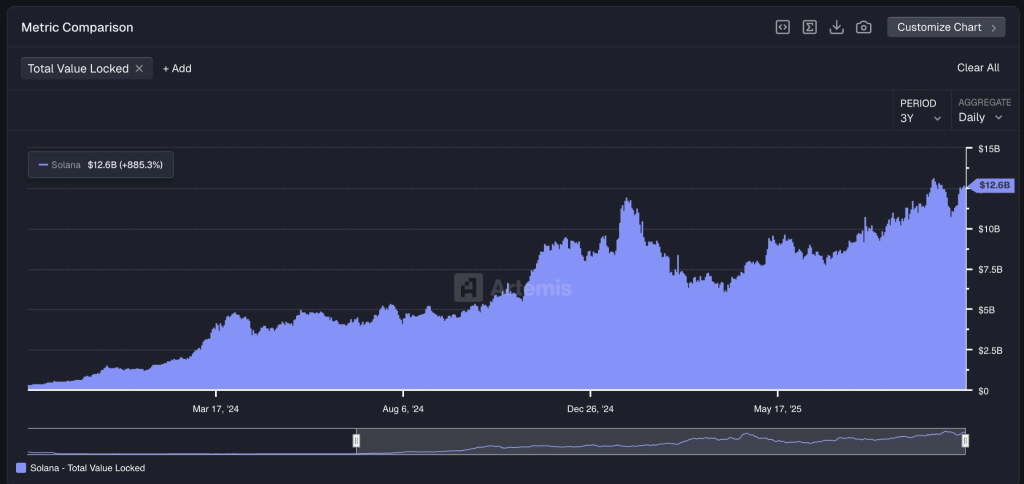

- Solana’s ecosystem expands with TVL surpassing $12B, proving strong fundamentals despite recent price drop.

Solana (SOL) is showing resilience after a short-term decline, holding steady near key support levels. Despite a 3.67% drop in the last 24 hours, traders are watching closely as buying momentum builds around the $216.5–$219.3 range.

Buyers Defend Key Support Zone

According to trader Degen Sing, Solana is trying to stabilize around $218.8 after a clean drop, with buyers actively defending the support area near $216.5–$219.3. The setup shows a possible short-term base formation, suggesting the asset may be preparing for another upward move.

The 15-minute Stochastic indicator shows an oversold condition, while the RSI is neutral but turning upward. If SOL manages to reclaim $222, a potential breakout toward $226–$229 could occur. However, a drop below $216.5 might expose lower levels, according to analysts.

At the time of writing, Solana was priced at $210.29, reflecting a 3.67% decline in the past 24 hours. Its 24-hour trading volume stands at $8.31 billion, showing active participation from traders.

Institutional Buying Fuels Confidence

However, Market interest in Solana continues to grow as institutional players expand their exposure. Treasury companies have already accumulated $4.15 billion worth of SOL, adding that VisionSys AI recently partnered with Marinade Finance to launch a $2 billion digital treasury.

The partnership marks one of the largest treasury developments on the Solana network, with the first $500 million expected to be staked within six months. Such activity may provide long-term buying support for SOL, as corporate treasuries and staking programs expand across the ecosystem.

Strong Fundamentals and Network Growth

Beyond short-term price action, Solana’s broader ecosystem continues to expand. Commenting on this, crypto_rand noted that while many chase trending tokens, coins like $SOL are the real deal, noting the blockchain’s growing total value locked (TVL), which recently surpassed $12 billion.

Despite the current decline, Solana maintains a strong on-chain foundation and active developer base. As market participants await updates on the ETF approval, price consolidation near $218 suggests cautious optimism.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |