- Standard Chartered analysts discuss Federal Reserve’s projected rate cuts.

- US dollar and bond yields may rise.

- Market expectations may adjust based on economic momentum.

Standard Chartered Bank analysts predict ongoing Federal Reserve rate cuts through 2025, potentially ceasing in 2026 if U.S. economic strength persists, affecting dollar and bond yields.

This scenario may lead to rising U.S. dollar and bond yields, impacting the allocation of riskier assets, including cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Standard Chartered’s Forecast for Federal Reserve Rate Cuts

Nicholas Chia and Steve Englander have highlighted in their report that while rate cuts by the Federal Reserve are expected to continue through 2025, the momentum may decrease in 2026 if the U.S. economy remains strong. The analysts suggest that this ongoing scenario could drive up the U.S. dollar and bond yields.

This analysis points to a significant shift in monetary policy expectations, with a possible gradual removal of the market’s projected 63 basis point rate cut if U.S. growth and productivity exceed forecasts. Such changes may lead investors to reconsider asset allocations amidst higher yields.

Reactions from the market are keenly observed following this report. Statements from Jerome Powell and other FOMC members indicate a balanced strategy that considers various economic factors. The broader market’s response will depend on forthcoming economic data and official monetary policies.

“Risk management cut” as the median policy rate projections suggest more cuts but also upgraded growth and inflation expectations. — Jerome Powell, Chair, Federal Reserve

Analysis: Effects of Rate Cuts on Crypto Markets

Did you know? Interest rate changes have historically impacted cryptocurrency markets. For example, in previous cycles where the Fed eased rates, Bitcoin and Ethereum saw significant price increases due to favorable risk conditions.

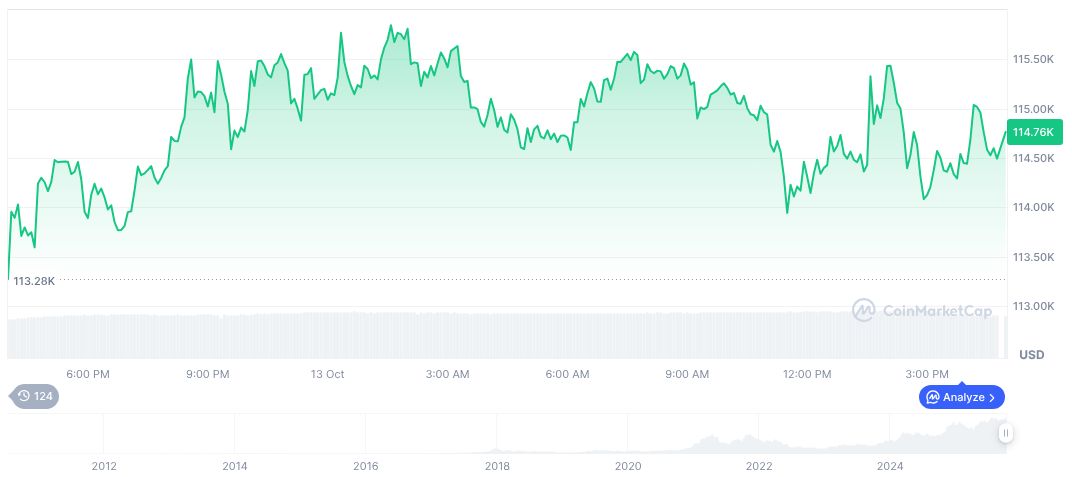

Bitcoin is currently valued at $115,357.50, holding a market cap of approximately 2.29 trillion and a dominance of 58.64%. In the past 24 hours, its trading volume reached 81.88 billion, dropping by 8.27%. CoinMarketCap data shows a price hike of 1.15% over the same period.

Coincu experts analyze potential outcomes and suggest that while historical trends indicate supportive effects on cryptocurrencies from rate cuts, this may not hold if the U.S. dollar strengthens. Caution and strategic investment remain pivotal as markets navigate these shifting projections.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |