XLM 2026 Forecast: Can Stellar Lumens Break Out of 8-Year Consolidation?

Key Insights:

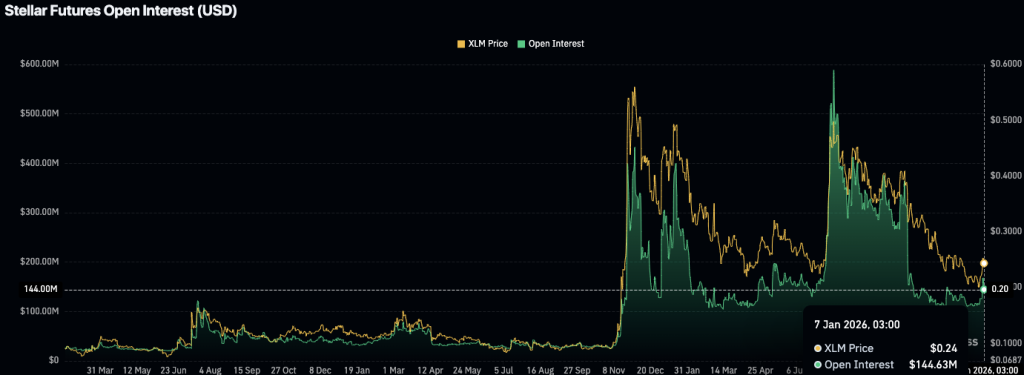

- XLM’s price fluctuated sharply, peaking at $0.50 in December 2025 before falling to $0.24.

- Open interest in XLM futures dropped from $600M to $144.63M, signaling market uncertainty.

- Stellar ranks second in the RWA market, with a market cap of $7.72 billion, behind Chainlink.

Stellar Lumens (XLM) has been in a prolonged phase of price consolidation for nearly eight years. As we moved into 2026, questions arose about whether cryptocurrency can break free from the trend and achieve significant growth. Stellar’s price was trading at $0.238 with a 24-hour trading volume of $261M. Stellar is down 4.35% in the last 24 hours.

Price Fluctuations and Open Interest Decline

Over the past year, Stellar has experienced notable price fluctuations. According to Cryptollica, the price peaked at $0.50 in early December 2025 but has since declined sharply. This pattern of volatility has been consistent throughout 2025, leading to varying investor sentiment.

Despite these ups and downs, the Open interest in XLM futures also tells a story of market uncertainty. The open interest peaked at nearly $600 million but has since fallen to $144.63 million.

This sharp decrease in open interest suggests a reduction in market activity and a possible shift in investor confidence. The market now appears to be in a cautious phase, with traders waiting for a clearer direction before making significant moves.

Stellar’s Position in the Real-World Asset Market

However, Stellar maintains a strong presence in the Real World Asset (RWA) market. Based on Charged Ventures data from CoinMarketCap, it now ranks as the second-largest RWA coin by market capitalization, standing at $7.72 billion.

This positions XLM just behind Chainlink (LINK), which leads the sector with a market cap of $9.66 billion. Stellar’s use case in facilitating cross-border payments and tokenizing real-world assets continues to make it an attractive option for various industries.

The stability of XLM in the RWA market reflects its broader use case in blockchain technology. While it has faced price fluctuations in the general market, its position in the RWA sector provides a level of resilience. As the demand for blockchain solutions grows, XLM may benefit from the expansion of tokenized real-world assets.

Can Stellar Break Out in 2026?

Looking ahead to 2026, the key question is whether XLM can break free from its eight-year consolidation phase. While its price remains relatively low, the development of its underlying technology and its role in the RWA market may help propel the coin forward.

The stability of the RWA market, combined with future advancements in blockchain adoption, could lead to increased demand for Stellar’s services. However, doubts remain about whether XLM can maintain upward momentum in the face of market volatility.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |