In Brief

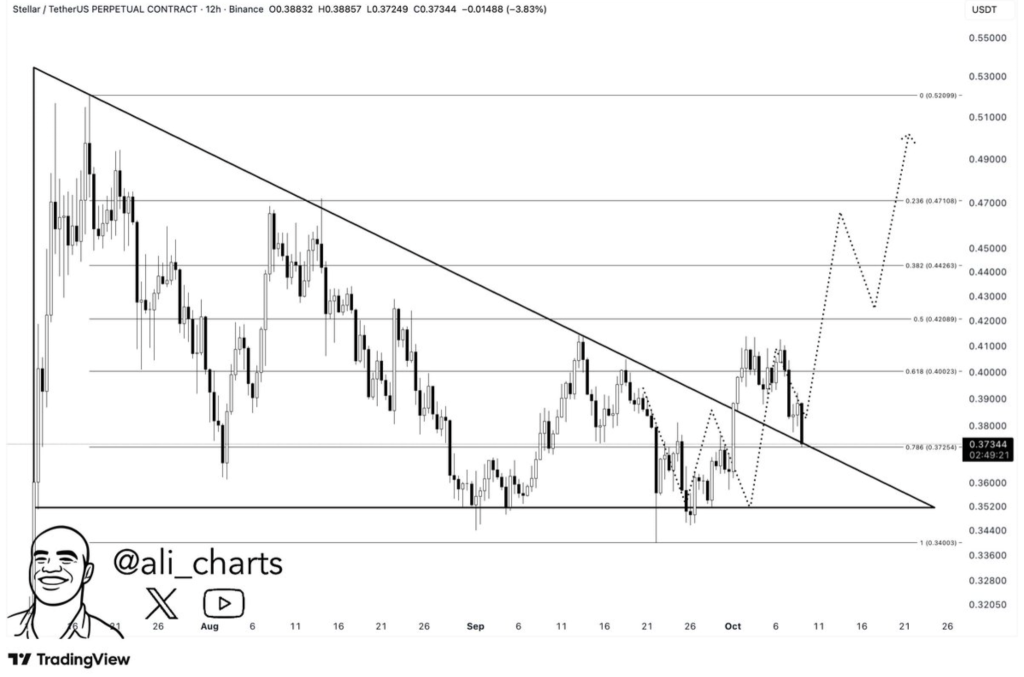

- XLM tests $0.37 support; holding this level may trigger rally toward $0.42–$0.50 range.

- Descending channel breakout above $0.39 could confirm bullish trend reversal.

- Derivatives show buyer strength, with rising volume and bullish long/short ratios.

Stellar (XLM) is testing the $0.37 level, which aligns with both horizontal support and the 0.786 Fibonacci retracement. This area now acts as a critical pivot, as confirmed by analysis from Ali, a well-followed crypto analyst on X (formerly Twitter). The outcome at this price zone could set the tone for the asset’s next major move.

The daily chart shows XLM hovering around $0.373, with both diagonal and horizontal support currently intact. Ali noted that a rebound from this zone could open the path toward $0.42, $0.47, and possibly $0.50. However, a confirmed break below $0.37 could shift sentiment and pressure prices toward the $0.35–$0.34 range.

Meanwhile, the MACD Pulse indicator by Market Spotter highlighted key momentum shifts earlier this week. The tool first captured a 19.5% rally from $0.34 to $0.41, followed by a 10% correction. This divergence suggests weakening upward momentum, and any recovery will likely require a firm move above $0.39.

Descending Channel and Derivatives Data Point to a Potential Reversal

On the 8-hour chart, Stellar trades within a descending channel while hovering below the 50-period moving average. A breakout above $0.38–$0.39 could confirm a reversal, with potential targets at $0.41, $0.47, and $0.54. If buying strength continues, a move toward $0.62 remains on the table.

Support appears stable above $0.27, forming a strong base for a bullish continuation if momentum returns. However, staying below the moving average could delay any upward breakout attempts. Traders will be watching for volume confirmation to support any move beyond $0.39.

Derivatives data reflects cautious optimism, according to data from Binance and OKX. Trading volume rose 6.55% to $369.41 million, while open interest dropped 2.43% to $306.79 million. Long/short ratios remain bullish, but recent liquidations show increased volatility in the short term.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |