- Trump faces a 57% impeachment probability in his 2025-2029 term.

- Democrats may control the House after the 2026 midterms, affecting impeachment odds.

- Political events impact both prediction and cryptocurrency markets.

The probability of Donald Trump facing impeachment during his 2025-2029 term reached 54% on the Kalshi platform, linking political shifts to wagering markets.

This reflects heightened political risk perceptions, yet no direct impact on major cryptocurrencies has been observed, as financial exposure remains within Kalshi’s regulated prediction contracts.

Kalshi Signals 57% Impeachment Risk for Trump

Kalshi prediction markets indicate a growing likelihood of Trump’s impeachment during his 2025-2029 presidency, reported at 57%. This increase reflects broader political tensions and market speculation. Trump’s past impeachments play a role in current market dynamics.

Changes in political sentiment influence market pricing, with a predicted Democratic majority after the 2026 midterms significantly impacting impeachment odds. Event contracts highlighting political risk are experiencing high trading volume, reflecting market uncertainty.

“Democrats controlling the House after the 2026 midterms is priced at 72%, and Kalshi explicitly links higher impeachment odds to a higher probability of a Democratic House majority.” — Kalshi Editorial Team, Kalshi.

Government and market reactions focus on Trump’s legal challenges and midterm outcomes. Kalshi’s forecast aligns with aggressive democratic strategies moving forward, and public predictions underscore volatility.

Impeachment Odds Shake Up Predictions for BTC Markets

Did you know? Kalshi’s impeachment odds for Trump have experienced fluctuations driven by anticipated Democratic midterm outcomes, highlighting the market’s sensitivity to political events.

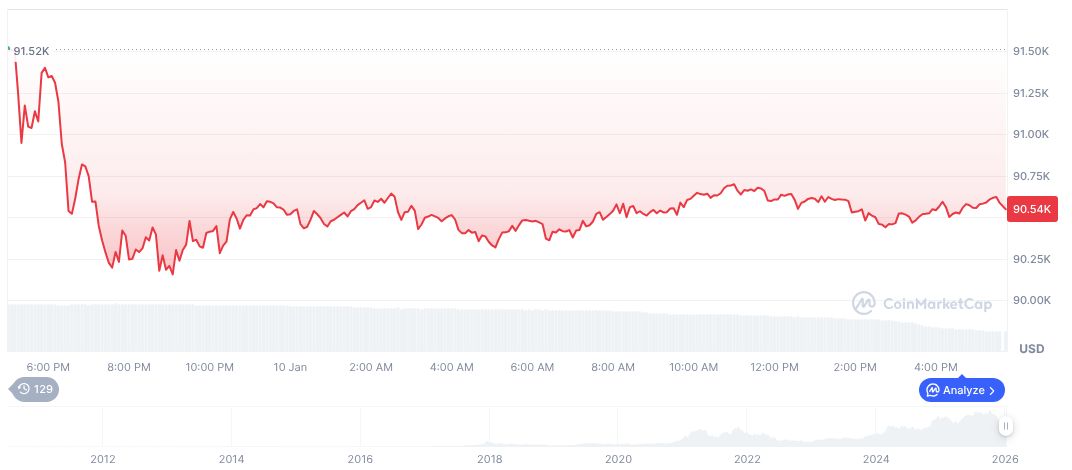

As of January 11, 2026, Bitcoin (BTC) trades at $90,544.99. Its market cap is approximately $1.81 trillion, with 58.45% dominance. Bitcoin’s 24-hour volume is $11.86 billion, reflecting a 64.91% decrease. Recent statistics show a -0.01% daily change, according to CoinMarketCap.

According to Coincu research, political events like Trump’s impeachment odds could influence broader market sentiment. While cryptocurrencies generally react to macro conditions, geo-political developments may cause temporary volatility. The USA’s political landscape remains a persistent factor in prediction market forecasts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |