Whales Target ARB for Long-Term Gains with Potential 10x Return to $2.43

Key Insights:

- $ARB bounced back 238% after a 77% drop, showing strong market recovery and long-term growth potential.

- Arbitrum’s TVL is at an all-time high, highlighting its growing adoption and scalability.

- Record $4.5 billion net inflows in a single day show increasing institutional interest in $ARB.

Arbitrum ($ARB), a popular Layer 2 scaling solution, has recently captured the attention of major investors, especially whales. Following a significant sell-off during the recent market crash, the token recovered strongly, leading many to believe it may be a prime candidate for long-term growth. With the potential to reach up to $2.43, analysts are increasingly bullish about its future.

Strong Support Levels and Recovery

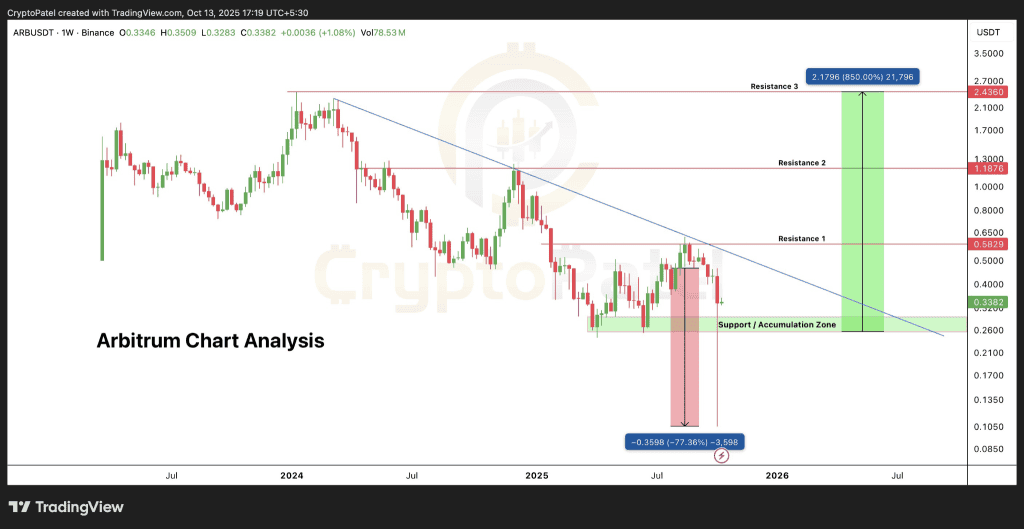

During the recent market downturn, $ARB dropped over 77% within hours, causing concern among investors. The token quickly bounced back by 238% from its low, signaling strong market confidence. This quick recovery has reaffirmed that the support zone at $0.25 remains intact.

The price has not closed below the $0.25 support, which suggests a strong accumulation area. Investors are closely watching this level, as it may serve as a critical point for future gains. The structure of $ARB also exhibits higher highs and higher lows, confirming a bullish trend after it reclaims its demand zone.

With whales accumulating $ARB at current levels, many expect the token to continue its upward momentum. The support at $0.25 remains solid, and the long-term target could see $ARB reach targets of $0.58, $1.18, and even $2.43.

If the broader altcoin market performs well, analysts suggest that $ARB could see returns as high as 10x from its current price range. The live Arbitrum price today is $0.3436, with a 24-hour trading volume of $397.9 million. Arbitrum is up 0.19% in the last 24 hours.

Impressive On-Chain Metrics and Record Net Inflows

However, Arbitrum has shown strong on-chain performance, with metrics indicating growing confidence in the project. One of the standout figures is the total value locked (TVL), which is at an all-time high (ATH). $ARB has been processing a significant amount of stablecoin transfer volume, which is an indication of its scalability.

Lennaert Snyder noted that Arbitrum’s ability to scale efficiently is evident, with TVL at ATHs and a surge in stablecoin transfer volume. These metrics show that Arbitrum is gaining traction as a preferred solution for decentralized applications.

Furthermore, ARB is also witnessing record net inflows, further driving market confidence. According to recent reports, the token saw a massive $4.5 billion in net inflows within just one day.

This surge underscores the increasing interest in $ARB, from both retail investors and institutional players. The strong inflows suggest that investors are seeing potential long-term gains, fueling optimism for the token’s future.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |