Will LINK $47 Level Be Next as Chainlink Adds 1,963 Addresses?

Key Points

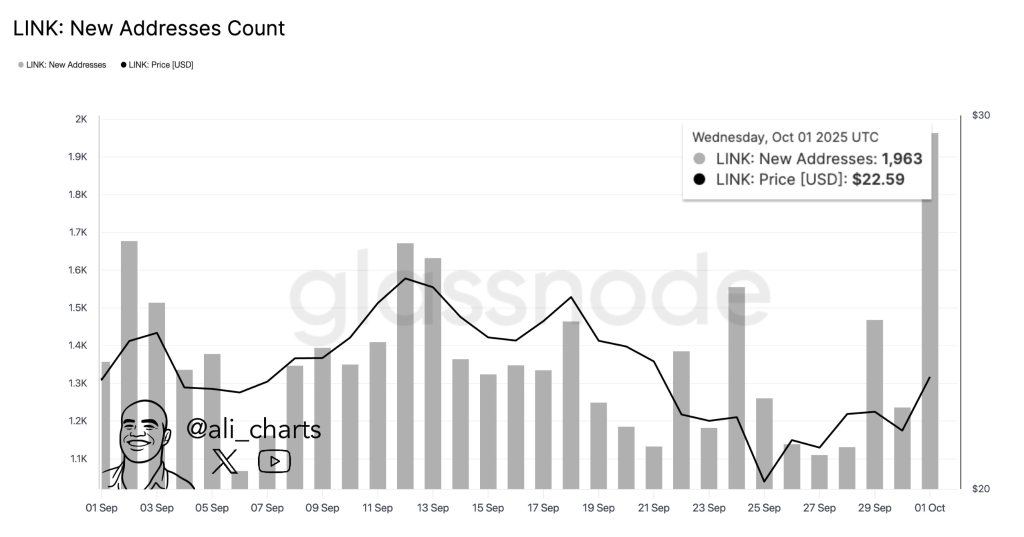

- Chainlink added 1,963 new addresses, showing a strong spike in user network growth.

- LINK price consolidates near $22 as exchange outflows signal investor accumulation.

- Technicals suggest bullish momentum with mid-term targets set between $35 and $47.

Chainlink added 1,963 new addresses on October 1, 2025, marking one of its strongest daily upticks in weeks. This rise signals growing network adoption and came as LINK held near $22.59 following recent market swings.

The increase in new wallets suggests expanding user engagement, which often supports long-term price strength. LINK remains above the $20 support, reinforcing investor confidence despite recent price softness.

On-Chain Data Shows Mixed Signals but Bullish Momentum Holds

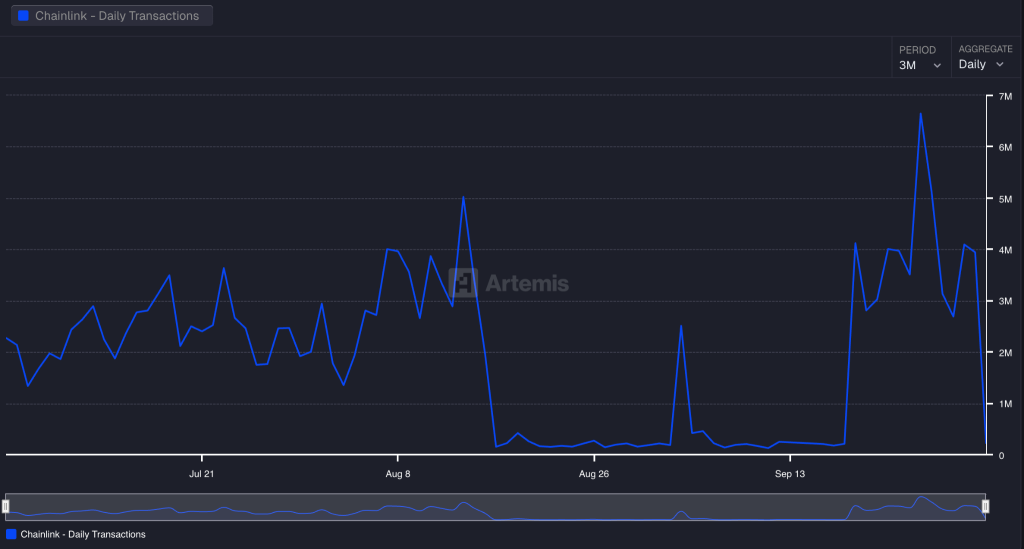

Despite the address surge, daily transactions dropped sharply to 224.1K, falling 90.1% from the September peak above 6 million. This decline indicates cooling network activity, though fundamentals still point toward accumulation.

Chainlink’s netflows continue showing outflows of $10M to $20M, reflecting consistent withdrawal of tokens from exchanges. This trend reduces sell-side pressure and supports a bullish sentiment as LINK consolidates near $22.

On August 25, LINK recorded a $50M outflow, which coincided with a price move above $25 shortly after. Since then, exchange activity slowed but remained skewed toward accumulation, supporting a broader uptrend.

LINK trades at $22.18 with a 1.8% daily drop, though it is still up over 7% in the past week. Long/short ratios on Binance, especially among top traders, remain firmly bullish despite near-term price weakness.

LINK has gained 69.7% in 90 days and 109.6% over the past year, showing strong long-term momentum. Although its 30-day performance is down 4.83%, the trend suggests a temporary cooling phase.

Technical indicators show support around $20, aligning with the 0.786 Fibonacci level and a bullish price channel. Immediate resistance lies near $28.98, with potential to reach $35–$39 if current momentum holds.

Analysts see a realistic breakout toward $46.3 to $47 if LINK stays above $18.5 and builds on recent gains. However, failure to hold above key levels could trigger a retest of lower supports near $15 or $12.2.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |