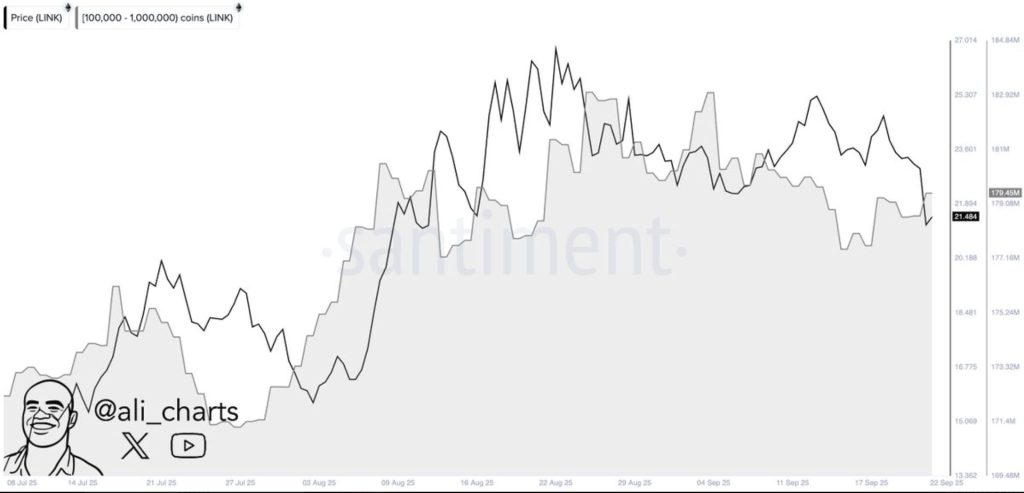

Key Points

- Whales accumulated 800K LINK, pushing total holdings to 179.45 million tokens

- LINK trades near $21.8, with key resistance at $21.95 and $22.47 levels

- Binance and OKX data show strong long bias despite weekly price declines

Chainlink whales have accumulated more than 800,000 LINK during the recent downturn, signaling strategic positioning in uncertain market conditions. Their holdings now stand at 179.45 million LINK, showing clear confidence despite short-term volatility.

This trend coincides with LINK current consolidation, where whale demand has historically supported price stabilization. If accumulation continues, it could strengthen support between $20 and $22 while reducing downside risks in the near term.

Technical Structure and Market Activity Point to Key Resistance Levels

On the technical side, LINK trades near $21.81 and appears locked in a corrective wave (4) formation. Fibonacci levels show resistance at $21.95 and $22.47, with a decisive breakout above $22.5 needed to confirm bullish continuation.

However, failure to sustain momentum could trigger downside targets around $19.46, with deeper corrections possible toward $17.42 and $15.61.

Derivatives Data Shows Long Bias Despite Weekly Losses

At press time, LINK is priced at $21.78, marking a 2.08% gain in the past 24 hours. However, the token remains down 7.66% weekly and has dropped 17.12% over the last 30 days.

Despite these declines, LINK shows strong long-term performance, gaining 95.62% year-over-year and highlighting resilience in broader market cycles.

Chainlink’s market capitalization is $14.8 billion with futures open interest at $1.3 billion, showing robust trader participation. Binance traders hold a strong long/short ratio of 2.69, while top traders show an even higher 2.92 ratio.

This positioning aligns with a moderate long bias on OKX, which records a ratio of 1.45. Together, these metrics indicate optimism among derivatives traders even as price faces short-term corrective pressure.

The combination of whale accumulation, technical resistance levels, and strong derivatives positioning suggests LINK may find support before a potential rebound. Yet, confirmation requires a sustained move above $22.5 to shift market sentiment toward renewed bullish momentum.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |