XLM Bullish Outlook Grows as Price Maintains Trendline Support Levels

Key Insights:

- XLM maintains trendline support, showing bullish potential as price tests higher lows.

- A break above $0.2317 could signal a strong bullish trend continuation for Stellar.

- Futures open interest surges with price movements, indicating heavy speculative participation and leverage effects.

The Stellar (XLM) price is currently holding steady above key trendline support levels, indicating potential for a bullish continuation. The asset is currently trading at $0.2358, with a 24-hour trading volume of $72.85 million. In the last 24 hours, the cryptocurrency has experienced a slight decline of 1.65%.

Price Holding Trendline Support

XLM has been testing trendline support over the past few weeks. Based on X_Four_iv, the cryptocurrency has formed higher lows, which suggests the market sentiment may be turning more bullish. It is holding above key support levels, with price oscillating around $0.23.

If this trend continues, the coin could see further upward movement as it approaches resistance zones. Experts suggest that a break above resistance could trigger a stronger bullish trend.

According to Finora, “the price is showing a slight bullish undertone while remaining within a range.” Also noted that the support at $0.2169 will be crucial for potential long entries if it holds.

Resistance Level To Watch for Bullish Breakout

While the asset’s current price action remains within a range, it faces resistance around the $0.2317 level. A breakout above this price point could potentially signal the beginning of a new bullish cycle.

Traders are closely watching how XLM interacts with this level, as a failure to break above it could lead to a pullback. According to Finora, if XLM successfully reclaims the price after a dip and the bullish structure holds, the targets could move toward $0.2317 and beyond.

However, should the price fail to surpass this resistance level, a deeper pullback may occur. This highlights the importance of monitoring these key price levels for any signs of a breakout or reversal.

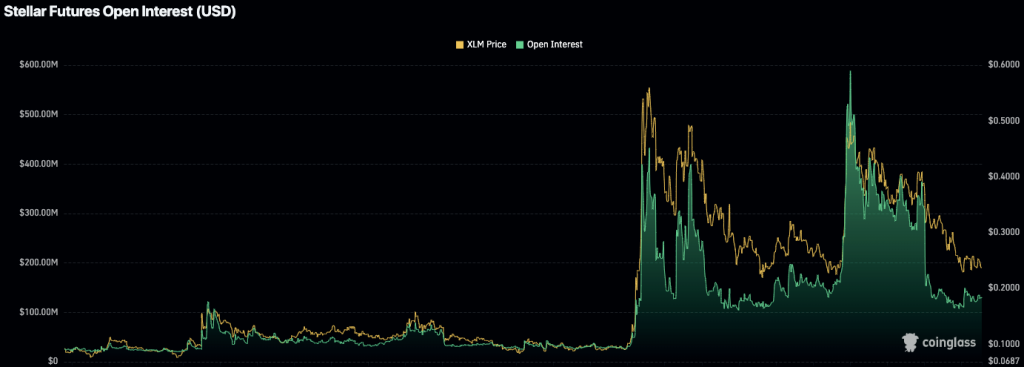

Futures Open Interest Shows Speculative Participation

The futures open interest in the cryptocurrency has surged and unwound sharply during recent price swings. This shows heavy speculative participation in the market. Analysts have observed that as the price rallies, the open interest climbs, reaching peak levels in line with price spikes.

However, as prices cool, open interest also declines, signaling aggressive deleveraging. These shifts in futures open interest reflect the role of leverage in driving price movements.

As the asset continues to fluctuate, the market’s reliance on leveraged positions may contribute to both upward momentum and sharp pullbacks. This ongoing dynamic suggests that speculators play a central role in the movements on its recent price.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |