Key Insights:

- XRP’s breakdown mirrors past cycles that led to multi-year sideways or bearish price action.

- Short liquidations stack above $2.20, hinting at squeeze potential if price rebounds strongly.

- Without a breakout above $2.25, XRP may remain under pressure or trend lower near term.

XRP has broken below its 3-day Gaussian Channel, a trend-following indicator that changes color based on market direction. In past cycles, this breakdown has often led to extended bearish or sideways price movement. The same pattern occurred in 2014, 2016, 2019, and 2022, each followed by long periods of low or declining price action.

Historical data shows that the 2019 breakdown lasted for around 778 days, while the one in 2016 extended for about 749 days. Both instances resulted in prolonged periods without upward price movement. This historical behavior may be repeating, as the current chart presents a similar structure. Traders have often used these past events to assess market conditions after a breakdown from this channel.

Price Action Stalls Under Resistance

XRP was trading around $2.07, following a small bounce from the support area just above $2.00. However, the 4-hour chart shows the price struggling to move past the nearest resistance zone between $2.10 and $2.25. Further resistance is noted near $2.60 to $2.70, with $2.63 being a target mentioned by some traders on social media.

Despite a 3.7% increase over the last 24 hours, XRP has declined 4.3% over the past week. The current structure shows lower highs and lower lows, indicating a downward trend. Unless XRP moves above $2.25 with strong buying volume, the probability of reaching higher targets remains low. At present, trading volume does not suggest the presence of strong momentum required for a breakout.

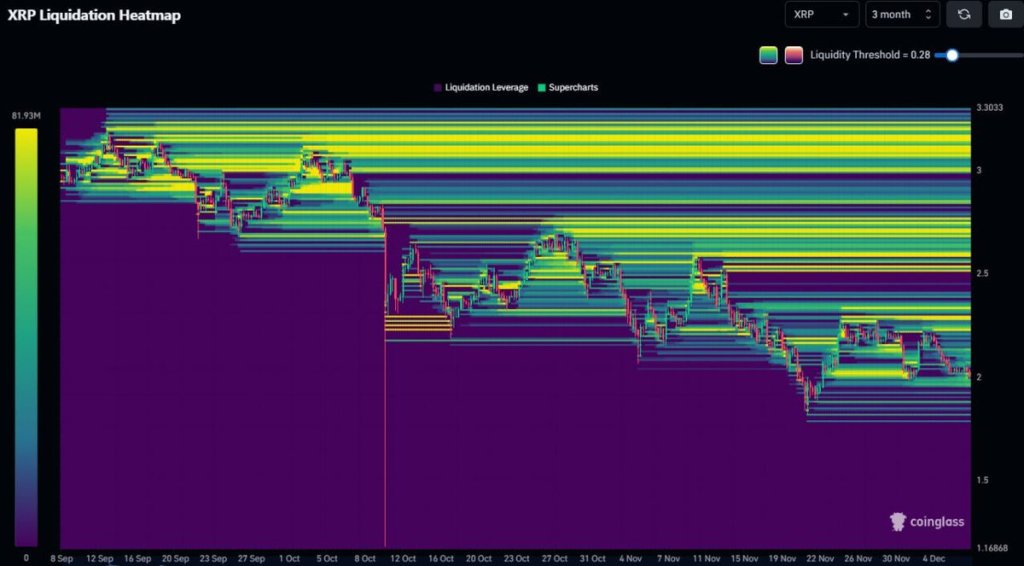

Liquidation Heatmap Shows Upside Liquidity

A recent liquidation heatmap reveals large clusters of liquidity above the current price. This is concentrated between $2.20 and $3.00, with the highest levels appearing around the $2.50 to $2.70 range. These areas reflect where short traders have placed their stop-loss or liquidation levels.

Retail traders appear to be holding short positions in large numbers. “Too much liquidity is sitting on the upside, which will be taken out,” according to a post by Niels. The chart indicates potential for a short squeeze if upward pressure increases. However, no trigger for that move has been observed yet.

Market Conditions Remain Unstable

While some sources mention rising ETF inflows, the broader crypto market remains unstable. XRP’s current price movement does not show signs of recovery. The trend remains bearish unless major resistance levels are broken.

Traders are watching closely for a shift in momentum. Until then, XRP may continue to consolidate or fall further. “Retail is shorting one of the strongest large-caps of this cycle,” but the chart does not confirm a reversal at this time.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |