Key Insights:

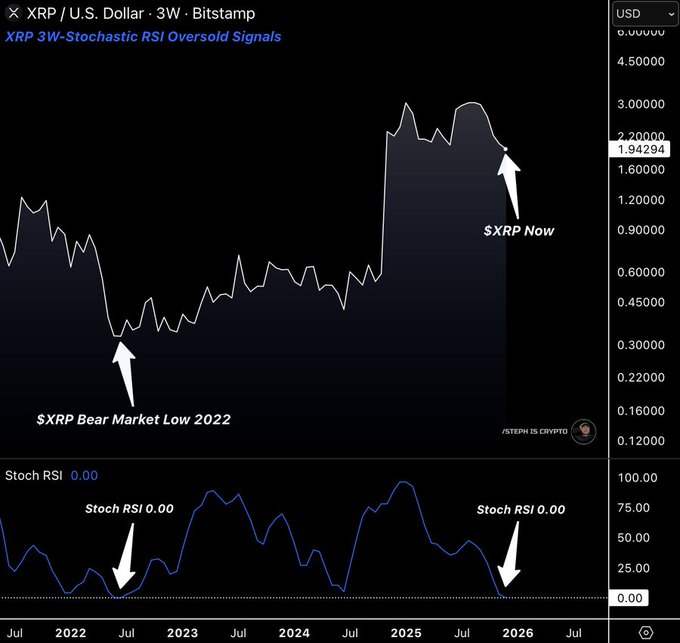

- XRP’s 3-week Stochastic RSI hits 0.00, repeating a pattern seen at the 2022 market low.

- Liquidity above $1.87 suggests price may climb as short liquidations fuel upside movement.

- Thin liquidity below current levels signals limited selling pressure in the near-term price range.

XRP was trading at $1.87, with a 24-hour trading volume of $1.97 billion. Over the past day, the price has moved up by 0.8%, while the 7-day change shows a smaller rise of 0.4%. During this period, market data from Coinglass displays a clear concentration of liquidity above current levels. These liquidity zones appear between $1.88 and $2.00, and are mostly tied to short positions that could be liquidated if prices increase.

This setup can influence short-term price direction. When liquidity pools are positioned above market price, any upward movement can trigger liquidations. These liquidations often result in a stronger push upward, as stop-loss levels are reached. This process may lead to a rapid move toward the $2.00 level, especially if buying momentum continues.

Limited Liquidity Below Current Range

In contrast, the same chart shows less liquidity positioned below the current price. This means there are fewer open positions or stop orders in the lower range. As a result, the incentive for prices to drop is reduced. Lower liquidity below can also signal that fewer traders are placing downside bets in the immediate term.

With more activity seen above the current level and lower exposure below, price pressure may favor an upward move. Although markets can change quickly, the current structure suggests that the $2.00 area may come into focus if current momentum is maintained.

Momentum Indicator at Historical Low

Alongside the liquidity data, a separate chart shows that XRP’s Stochastic RSI on the 3-week timeframe has fallen to 0.00. This condition is rare and was last recorded during the 2022 bear market low. At that time, XRP remained stable in a long consolidation period before starting a new upward trend.

The Stochastic RSI reaching zero reflects a complete lack of downward momentum. According to analysts reviewing the data, this value tends to appear only when sellers have fully exited or slowed their activity.

One analyst noted,

“This indicator only reaches zero when selling pressure is fully exhausted.”

However, this does not suggest immediate price movement. Instead, it signals that downward movement may be limited from this point forward.

Accumulation Behavior and Long-Term Holders

Following the last occurrence of a 0.00 Stochastic RSI reading, XRP did not see a sharp price recovery right away. Instead, the market entered an accumulation phase, during which long-term holders gradually increased their positions. This type of price behavior may be repeating now.

Recent commentary points out that “seeing it again suggests downside risk is structurally limited.” The same chart shows no signs of wide-scale distribution, meaning long-term holders may be retaining their positions rather than selling into the market. If this continues, it may support price stability as the market transitions into a new phase.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.