Key Insights:

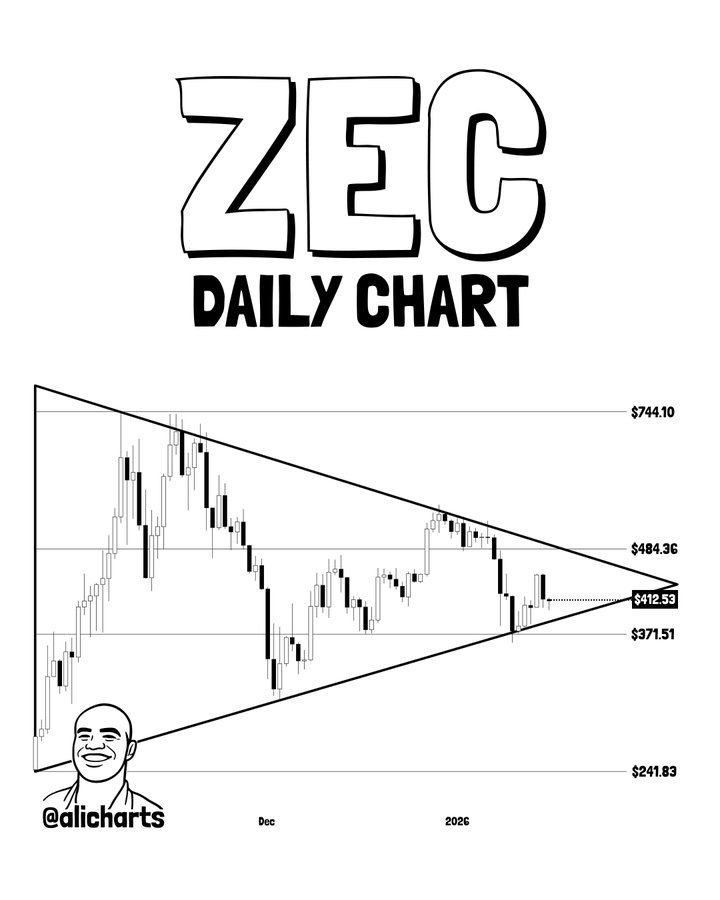

- ZEC is stuck in a triangle pattern, with price squeezing toward a critical breakout point.

- A 40% price swing is expected soon, depending on which side of the triangle breaks first.

- Weekly moving average acts as resistance, while support holds strong around $405 and $371 levels.

Zcash (ZEC) has been trading within a narrowing triangle on the daily chart. The price has formed a series of lower highs and higher lows, showing a loss of momentum in both directions. This pattern now points toward an upcoming breakout as the range continues to tighten.

At the time of reporting, ZEC trades near $407.12. This reflects a 2.6% loss over the past 24 hours and a 4% drop over the last week. Daily volume stands at around $440.86 million. The price is holding between support at $371.51 and resistance at $484.36, where the triangle boundaries sit. This suggests the market is nearing a decision point.

Pattern Structure Hints at Large Price Move

The triangle pattern in play covers a wide price range, and traders often use this range to estimate the next move. In this case, a 40% swing from the current price could follow a confirmed breakout. This would take ZEC either to the $577 area on a break upward or to around $247 on a downward move.

This setup matches recent observations from market analysts. One trader noted,

“The triangle consolidation suggests a large move is near, but direction remains uncertain.”

Meanwhile, Volume and volatility are expected to rise as the price approaches the triangle’s edge.

Traders are watching for a clear close beyond either side of the triangle to confirm the next direction. No confirmation has been seen yet.

Weekly Moving Average Holds Price Below

Over the past 24 hours, ZEC has been testing its weekly moving average, shown as the yellow line on the chart. This level has held as resistance, stopping the price from pushing higher.

So far, the price has not managed to close above this level. If it does, that could add momentum to the bullish case. If it fails again, selling pressure may increase. The zone between $437 and $450 has already proven hard to break. Above that, the $485 level and a long-term trendline remain key areas to watch.

Support Zones Remain Active

If ZEC fails to push higher, it may move down to test lower levels. Support is stacked at $405, $393, and $371. Below that, $360.70 marks a recent low and could act as a strong line of defense.

Momentum tools like RSI and MACD are not showing strong signals in either direction. RSI sits in the middle range. MACD is flat, showing the lack of trend. The market is waiting for confirmation.

Until the breakout happens, ZEC remains trapped within the triangle. A sharp move is expected soon.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.