ZEC Surges Toward $480 Resistance, Is a $520 Breakout Next?

Key Insights:

- ZEC hits breakout level as buyers push toward $480 resistance after a strong 27% weekly move.

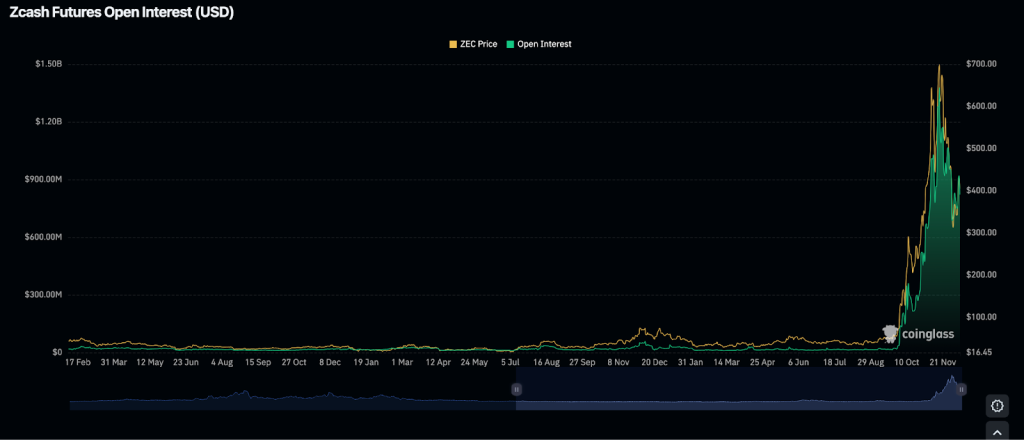

- Futures open interest jumps to $821M, signaling heavy positioning and potential high volatility ahead.

- Analysts split: one sees $520 breakout, another warns of bearish divergence and rejection at resistance.

Zcash (ZEC) was trading near $446.85 after a 4% gain in the last 24 hours. Over the past seven days, it has risen 27.3%. The move follows a clear breakout from recent consolidation, with price now heading toward the $460–$480 zone. This area has previously acted as strong resistance.

According to trader Kamran Asghar,

“ZEC is breaking out of structure, heading toward major resistance at $460–$480.”

He added that if this zone holds as new support, prices may continue to $520 or higher. The move above recent range highs has opened space for further upside, but price now faces a key decision area.

Mixed Views From Traders

Not all analysts agree on the direction. A short setup shared by Dirk Crypto Diggy shows a different view. His chart presents a case for downside, based on a rejection at the 50-week moving average. The trade plan includes an entry near $447, stop at $464, and a target at $333.

Dirk also pointed to bearish divergence on lower time frames. These are signals where price makes higher highs, but momentum indicators like RSI do not follow. This often reflects weakening strength behind a move. “50wMA bearish retest, ltf bear divs… short $ZEC send it lower,” he posted on social media.

Futures Market Shows Heavy Positioning

Data from Coinglass reports ZEC futures open interest at $821.82 million. This is much higher than previous levels, which stayed below $100 million for most of the past year. The rise in open interest started in October, alongside the price rally.

This shows many active positions are still open. If price begins to fall, the chance of liquidations increases. That could lead to fast moves as traders exit. On the other hand, continued buying pressure could push price through resistance. The high open interest adds pressure to both sides of the market.

Trendline and Structure Still Intact

On the short-term chart, ZEC has formed a series of higher lows. A rising trendline is visible below the current price. As long as this structure holds, it may offer support for further attempts to move higher.

Kamran’s chart outlines a path toward $520 if ZEC can stay above the breakout level and absorb selling between $460 and $480. If not, the move may fade. This resistance area remains the key level to watch in the coming sessions.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.